Express Scripts 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report90

12. Commitments and contingencies

We have entered into noncancellable agreements to lease certain offices, distribution facilities and

operating equipment with remaining terms from one to ten years. The majority of our lease agreements include

renewal options which would extend the agreements from one to five years. Rental expense under the office and

distribution facilities leases, excluding the discontinued operations of EAV, UBC, Europe and PMG (see Note 4 –

Dispositions), in 2012, 2011 and 2010 was $103.6 million, $30.2 million and $40.3 million, respectively. The future

minimum lease payments due under noncancellable leases, excluding the facilities of the discontinued operations of

our held for sale entities UBC and Europe, are shown below (in millions):

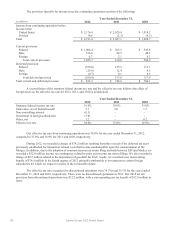

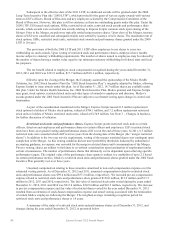

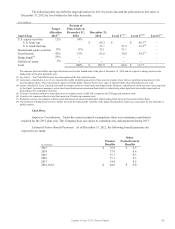

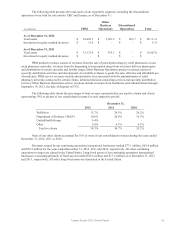

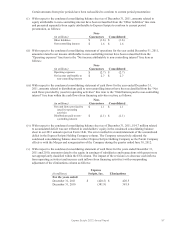

Year Ended December 31,

Minimum Operating

Lease Payments

Minimum Capital

Lease Payments

2013

$ 77.7

$ 13.7

2014

60.7

13.7

2015

40.5

13.6

2016

33.0

13.6

2017

31.3

-

Thereafter

29.1

-

Total

$ 272.3

$ 54.6

In the fourth quarter of 2011, ESI opened a new office facility in St. Louis, Missouri to consolidate our St.

Louis presence onto our Headquarters campus. The annual lease commitments for this facility are approximately

$3.3 million and the term of the lease is ten years.

In November 2012, we entered into a four-year capital lease for equipment to be used in our Fair Lawn,

New Jersey facility. Prior to January 1, 2013, the Company does not have the right to use the asset and has not

received any services that would result in an obligation. Additionally, the equipment has not been placed into service

at December 31, 2012. As such, no asset or liability has been recorded at December 31, 2012. The lease terminates

in December 2016 and contains an option for the Company to purchase the equipment for one dollar at that time.

For the year ended December 31, 2012, approximately 43.7% of our pharmaceutical purchases were

through two wholesalers, 16.8% through Cardinal Health and 26.9% through AmerisourceBergen. In October 2012,

AmerisourceBergen became our primary wholesaler. We believe other alternative sources are readily available.

Except for customer concentration described in Note 13 – Segment information below, we believe no other

concentration risks exist at December 31, 2012.

As of December 31, 2012, we have certain required future purchase commitments for materials, supplies,

services and fixed assets related to the normal course of business. We do not expect potential payments under these

provisions to materially affect results of operations or financial condition based upon reasonably likely outcomes

derived by reference to historical experience and current business plans. These future purchase commitments (in

millions), excluding the facilities of the discontinued operations of our held for sale entities UBC and Europe, are

summarized below:

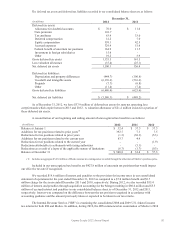

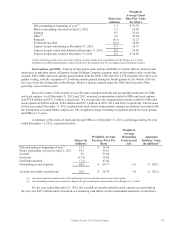

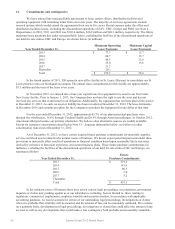

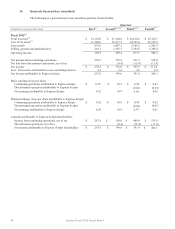

Year Ended December 31,

Future

Purchase Commitments

2013

$ 219.2

2014

141.6

2015

80.5

2016

5.0

2017

5.2

Thereafter

-

Total

$ 451.5

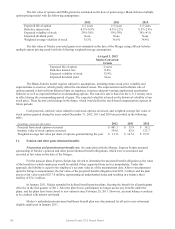

In the ordinary course of business there have arisen various legal proceedings, investigations, government

inquiries or claims now pending against us or our subsidiaries, including, but not limited to, those relating to

regulatory, commercial, employment, employee benefits and securities matters. In accordance with applicable

accounting guidance, we record accruals for certain of our outstanding legal proceedings, investigations or claims

when it is probable that a liability will be incurred and the amount of loss can be reasonably estimated. We evaluate,

on a quarterly basis, developments in legal proceedings, investigations or claims that could affect the amount of any

accrual, as well as any developments that would make a loss contingency both probable and reasonably estimable.