Express Scripts 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 75

74

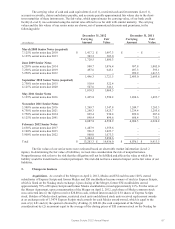

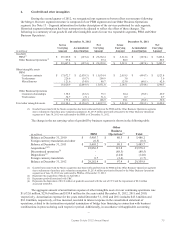

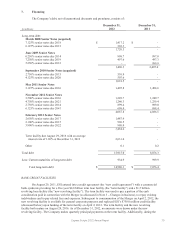

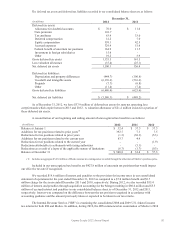

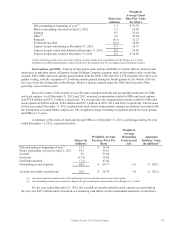

7. Financing

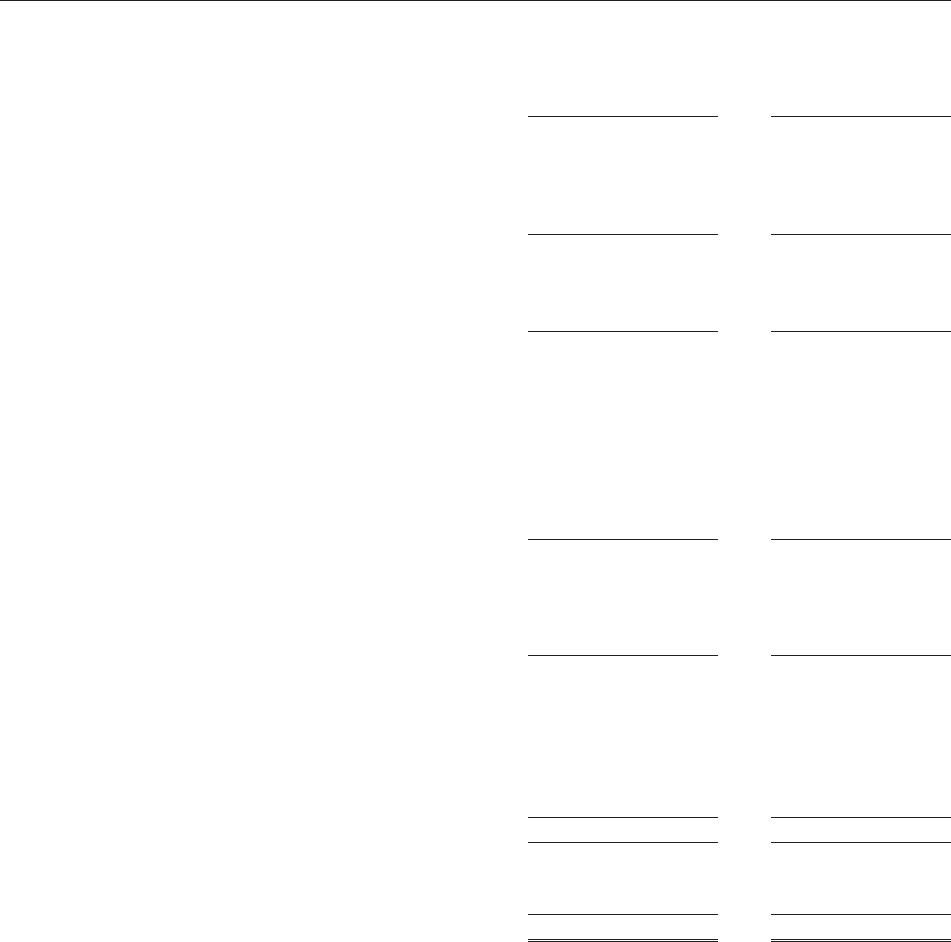

The Company’s debt, net of unamortized discounts and premiums, consists of:

December 31,

December 31,

(in millions)

2012

2011

Long-term debt:

March 2008 Senior Notes (acquired)

7.125% senior notes due 2018

$

1,417.2

$

-

6.125% senior notes due 2013

303.3

-

1,720.5

-

June 2009 Senior Notes

6.250% senior notes due 2014

998.7

997.8

7.250% senior notes due 2019

497.6

497.3

5.250% senior notes due 2012

-

999.9

1,496.3

2,495.0

September 2010 Senior Notes (acquired)

2.750% senior notes due 2015

510.9

-

4.125% senior notes due 2020

507.6

-

1,018.5

-

May 2011 Senior Notes

3.125% senior notes due 2016

1,495.8

1,494.6

November 2011 Senior Notes

3.500% senior notes due 2016

1,249.7

1,249.7

4.750% senior notes due 2021

1,240.3

1,239.4

2.750% senior notes due 2014

899.4

899.0

6.125% senior notes due 2041

698.4

698.4

4,087.8

4,086.5

February 2012 Senior Notes

2.650% senior notes due 2017

1,487.9

-

2.100% senior notes due 2015

996.5

-

3.900% senior notes due 2022

980.0

-

3,464.4

-

Term facility due August 29, 2016 with an average

interest rate of 1.96% at December 31, 2012

2,631.6

-

Other

0.1

0.2

Total debt

15,915.0

8,076.3

Less: Current maturities of long-term debt

934.9

999.9

Total long-term debt

$

14,980.1

$

7,076.4

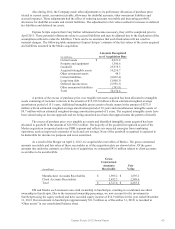

BANK CREDIT FACILITIES

On August 29, 2011, ESI entered into a credit agreement (the “new credit agreement”) with a commercial

bank syndicate providing for a five-year $4.0 billion term loan facility (the “term facility”) and a $1.5 billion

revolving loan facility (the “new revolving facility”). The term facility was used to pay a portion of the cash

consideration paid in connection with the Merger (as discussed in Note 3 – Changes in business), to repay existing

indebtedness and to pay related fees and expenses. Subsequent to consummation of the Merger on April 2, 2012, the

new revolving facility is available for general corporate purposes and replaced ESI’s $750.0 million credit facility

(discussed below) upon funding of the term facility on April 2, 2012. The term facility and the new revolving

facility both mature on August 29, 2016. As of December 31, 2012, no amounts were drawn under the new

revolving facility. The Company makes quarterly principal payments on the term facility. Additionally, during the