Express Scripts 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 51

2015 2017 ter

515.0 476.8 079.9 207.2 751.1

s 272.3 77.7 101.2 64.3 29.1

54.6 13.7 27.3 13.6 -

451.5 19.2 222.1 10.2 -

293.4 787.4 30.5 295.3 780.2

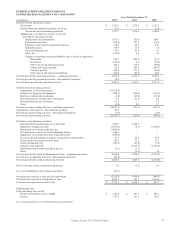

IMPACT OF INFLATION

Changes in prices charged by manufacturers and wholesalers for pharmaceuticals affect our revenues and cost of

revenues. Most of our contracts provide that we bill clients based on a generally recognized price index for pharmaceuticals.

Item 7A — Quantitative and Qualitative Disclosures About Market Risk

We are exposed to market risk from changes in interest rates related to debt outstanding under our credit facility.

Our earnings are subject to change as a result of movements in market interest rates. At December 31, 2012, we had

$2,631.6 million of obligations which were subject to variable rates of interest under our credit agreements. A hypothetical

increase in interest rates of 1% would result in an increase in annual interest expense of approximately $26.3 million (pre-

tax), presuming that obligations subject to variable interest rates remained constant. Note, however, that as of December 31,

2012, cash on hand exceeds our variable rate obligations by $162.3 million.