Express Scripts 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Express Scripts 2012 Annual Report96

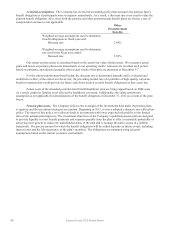

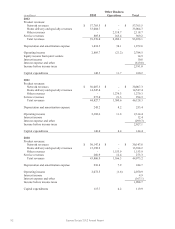

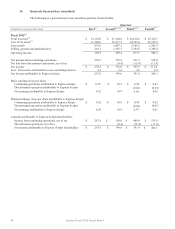

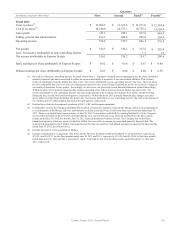

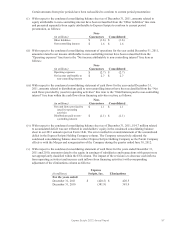

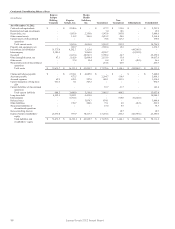

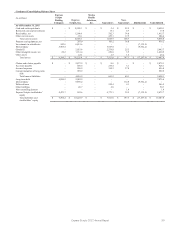

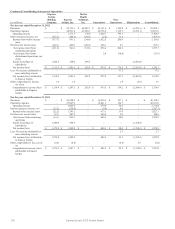

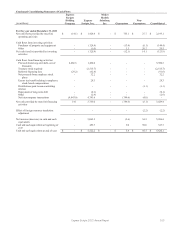

15. Condensed consolidating financial information

The senior notes issued by the Company, ESI and Medco are jointly and severally and fully and

unconditionally (subject to certain customary release provisions, including sale, exchange, transfer or liquidation of

the guarantor subsidiary) guaranteed by our 100% owned domestic subsidiaries, other than certain regulated

subsidiaries, and, with respect to notes issued by ESI and Medco, by us. The following condensed consolidating

financial information has been prepared in accordance with the requirements for presentation of such information.

The condensed consolidating financial information presented below is not indicative of what the financial position,

results of operations or cash flows would have been had each of the entities operated as an independent company

during the period for various reasons, including, but not limited to, intercompany transactions and integration of

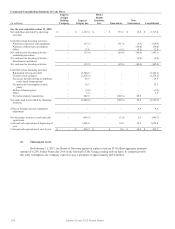

systems. Effective September 17, 2010, PMG was sold, effective December 3, 2012, Liberty was sold, effective

December 4, 2012, EAV was sold and effective during the fourth quarter of 2012 it was determined that our

European operations and portions of UBC would meet the criteria of discontinued operations. The operations of

PMG are included as discontinued operations in those of the non-guarantors for the year ended December 31, 2010.

The operations of Liberty are included as continuing operations in those of the non-guarantors for the year ended

December 31, 2012 (from the date of the Merger). The operations of EAV, Europe and the international operations

of UBC are included as discontinued operations in those of the non-guarantors as of and for the year ended

December 31, 2012 (from the date of the Merger). The domestic operations of UBC classified as discontinued

operations are included in those of the guarantors as of and for the year ended December 31, 2012 (from the date of

the Merger). The following presentation reflects the structure that exists as of the most recent balance sheet date and

also includes certain retrospective immaterial revisions (discussed and presented in further detail below). The

condensed consolidating financial information is presented separately for:

(i) Express Scripts (the Parent Company), the issuer of certain guaranteed obligations;

(ii) ESI, guarantor, and also the issuer of additional guaranteed obligations;

(iii) Medco, guarantor, and also the issuer of additional guaranteed obligations;

(iv) Guarantor subsidiaries, on a combined basis (but excluding ESI and Medco), as specified in the indentures

related to Express Scripts’, ESI’s and Medco’s obligations under the notes;

(v) Non-guarantor subsidiaries, on a combined basis;

(vi) Consolidating entries and eliminations representing adjustments to (a) eliminate intercompany transactions

between or among the Parent Company, ESI, Medco, the guarantor subsidiaries and the non-guarantor

subsidiaries, (b) eliminate the investments in our subsidiaries and (c) record consolidating entries; and

(vii) Express Scripts and subsidiaries on a consolidated basis.

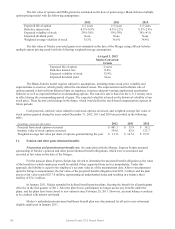

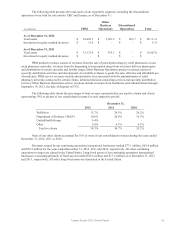

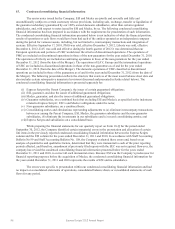

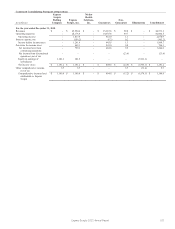

While preparing the financial statements for our quarterly report on Form 10-Q for the period ended

September 30, 2012, the Company identified certain immaterial errors in the presentation and allocation of certain

line items in the previously reported condensed consolidating financial information between the Express Scripts

column and the ESI column for the years ended December 31, 2011 and 2010. In accordance with Staff Accounting

Bulletin No.99 and Staff Accounting Bulletin No. 108, the Company evaluated these errors and, based on an

analysis of quantitative and qualitative factors, determined that they were immaterial to each of the prior reporting

periods affected, and therefore, amendment of previously filed reports with the SEC was not required. However, the

company has revised the condensed consolidating financial information presented below for the years ended

December 31, 2011 and 2010, to correct all such immaterial errors. Because ESI was the Company’s predecessor for

financial reporting purposes before the acquisition of Medco, the condensed consolidating financial information for

the years ended December 31, 2011 and 2010 represents the results of ESI and its subsidiaries.

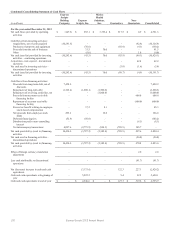

The errors were specific to presentation within our condensed consolidating financial information and had

no impact on consolidated statements of operations, consolidated balance sheets or consolidated statements of cash

flows for any period.