Express Scripts 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report80

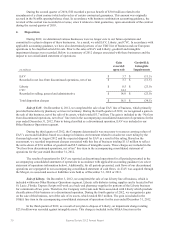

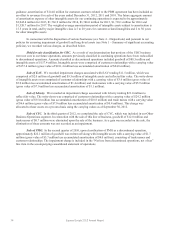

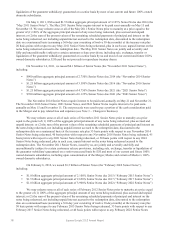

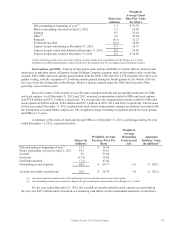

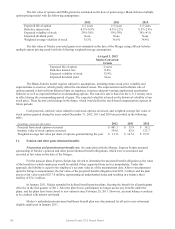

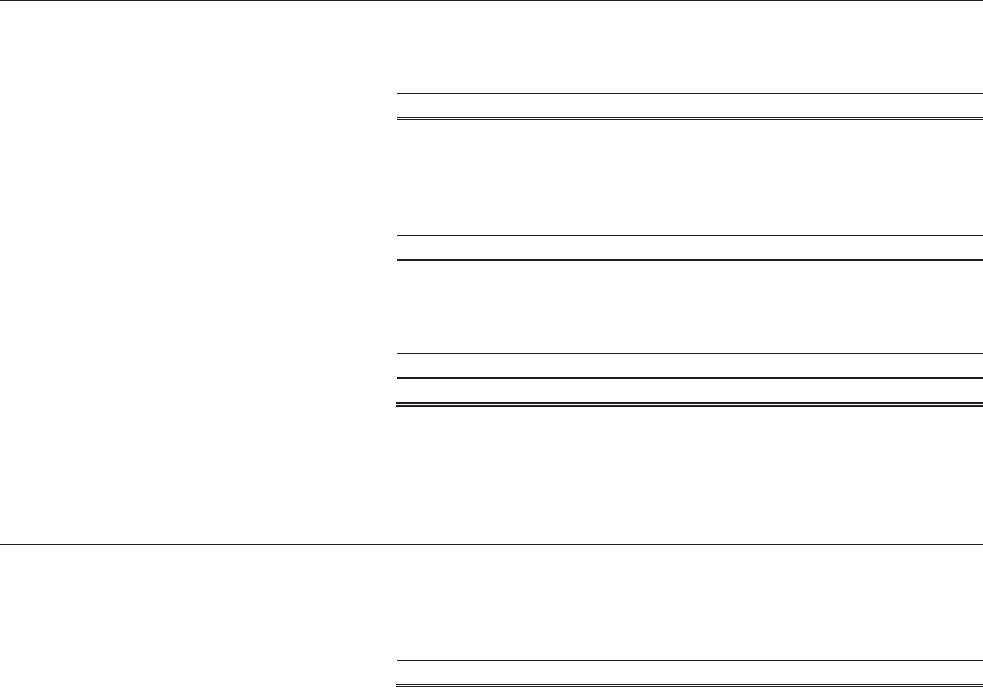

The provision (benefit) for income taxes for continuing operations consists of the following:

Year Ended December 31,

(in millions)

2012

2011

2010

Income from continuing operations before

income taxes:

United States

$ 2,176.4

$ 2,029.4

$ 1,918.2

Foreign

14.6

(2.3)

(9.5)

Total

$ 2,191.0

$ 2,027.1

$ 1,908.7

Current provision:

Federal

$ 1,006.4

$ 565.2

$ 545.8

State

216.6

42.5

40.3

Foreign

0.7

3.1

0.1

Total current provision

1,223.7

610.8

586.2

Deferred provision:

Federal

(359.8)

125.3

113.1

State

(29.9)

12.4

4.5

Foreign

(0.7)

0.1

0.3

Total deferred provision

(390.4)

137.8

117.9

Total current and deferred provision

$ 833.3

$ 748.6

$ 704.1

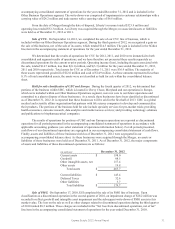

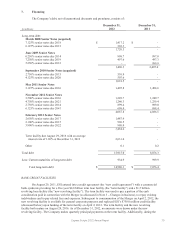

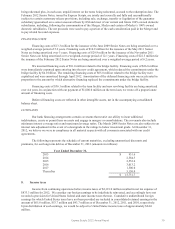

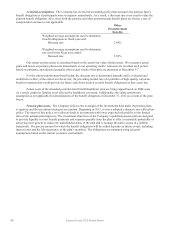

A reconciliation of the statutory federal income tax rate and the effective tax rate follows (the effect of

foreign taxes on the effective tax rate for 2012, 2011, and 2010 is immaterial):

Year Ended December 31,

2012

2011

2010

Statutory federal income tax rate

35.0%

35.0%

35.0%

State taxes, net of federal benefit

5.1

2.0

1.7

Non-controlling interest

(0.3)

-

-

Investment in foreign subsidiaries

(3.0)

-

-

Other, net

1.2

-

0.2

Effective tax rate

38.0%

37.0%

36.9%

Our effective tax rate from continuing operations was 38.0% for the year ended December 31, 2012,

compared to 37.0% and 36.9% for 2011 and 2010, respectively.

During 2012, we recorded a charge of $14.2 million resulting from the reversal of the deferred tax asset

previously established for transaction-related costs that became nondeductible upon the consummation of the

Merger. In addition, due to the adoption of common income tax return filing methods between ESI and Medco, we

recorded a $52.0 million income tax contingency related to prior year income tax return filings. We also recorded a

charge of $0.5 million related to the impairment of goodwill for EAV. Lastly, we recorded a net nonrecurring

benefit of $74.9 million in the fourth quarter of 2012 primarily attributable to investments in certain foreign

subsidiaries for which we expect to realize in the foreseeable future.

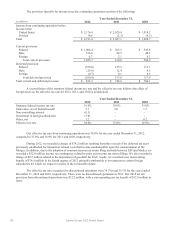

The effective tax rate recognized in discontinued operations was (79.5%) and 35.5% for the years ended

December 31, 2012 and 2010, respectively. There were no discontinued operations in 2011. Our 2012 net tax

provision from discontinued operations was $12.2 million, with a corresponding net tax benefit of $12.9 million in

2010.