Express Scripts 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Express Scripts 2012 Annual Report82

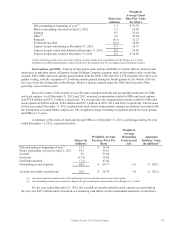

U.S. federal income tax return. These examinations are anticipated to conclude in 2013. The majority of our income

tax contingencies are subject to statutes of limitations that are scheduled to expire in 2017.

We have taken positions in certain taxing jurisdictions for which it is reasonably possible that the total

amounts of unrecognized tax benefits may change within the next twelve months. The possible change could result

from the finalization of the IRS audits as well as various state income tax audits and lapses of statutes of limitation.

Our federal income tax audit uncertainties primarily relate to the timing of deductions while various state income tax

audit uncertainties primarily relate to the attribution of overall taxable income to those states. An estimate of the

range of the reasonably possible change in the next 12 months cannot be made.

As of December 31, 2012, management was evaluating the potential tax benefits related to the disposition

of a business acquired in the Merger. Based on information currently available, our best estimate resulted in no

amounts being recorded at December 31, 2012. However, pending the resolution of certain matters, the deduction

may become realizable in the future.

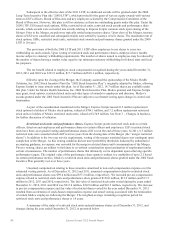

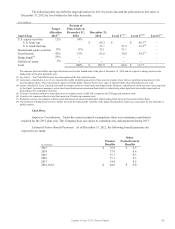

9. Common stock

On May 27, 2011, ESI entered into agreements to repurchase shares of its common stock for an aggregate

purchase price of $1,750.0 million under an Accelerated Share Repurchase (“ASR”) agreement. The ASR agreement

consisted of two agreements, providing for the repurchase of shares of ESI’s common stock worth $1.0 billion and

$750.0 million, respectively. Upon payment of the purchase price on May 27, 2011, ESI received 29.4 million

shares of ESI’s common stock at a price of $59.53 per share. During the third quarter of 2011, we settled the $1.0

billion portion of the ASR agreement and received 1.9 million shares at a final forward price of $53.51 per share.

During the fourth quarter of 2011, we settled $725.0 million of the $750.0 million portion of the ASR agreement and

received 2.1 million shares at a weighted-average final forward price of $50.69.

On April 27, 2012, we settled the remaining portion of the ASR agreement and received 0.1 million

additional shares, resulting in a total of 33.5 million shares received under the agreement.

The ASR agreement was accounted for as an initial treasury stock transaction and a forward stock purchase

contract. The forward stock purchase contract was classified as an equity instrument under applicable accounting

guidance and was deemed to have a fair value of zero at the effective date. The initial repurchase of shares resulted

in an immediate reduction of the outstanding shares used to calculate the weighted-average common shares

outstanding for basic and diluted net income per share on the effective date of the agreements. The remaining

4.0 million shares and 0.1 million shares received for the portions of the ASR agreement that were settled during

2011 and 2012, respectively, reduced weighted-average common shares outstanding for the years ended December

31, 2011 and 2012, respectively.

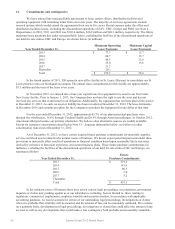

ESI had a stock repurchase program, originally announced on October 25, 1996. Treasury shares were

carried at first in, first out cost. In addition to the shares repurchased through the ASR, ESI repurchased 13.0 million

shares under its existing stock repurchase program during the second quarter of 2011 for $765.7 million.

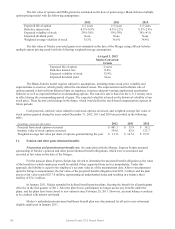

On May 5, 2010, ESI announced a two-for-one stock split for stockholders of record on May 21, 2010

effective June 8, 2010. The split was effected in the form of a dividend by issuance of one additional share of

common stock for each share of common stock outstanding.

Upon consummation of the Merger on April 2, 2012, all ESI shares held in treasury were no longer

outstanding and were cancelled and retired and ceased to exist. Express Scripts eliminated the value of treasury

shares, at cost, immediately prior to the Merger as a reduction to retained earnings and paid-in capital.

The Board of Directors of Express Scripts has not yet adopted a stock repurchase program to allow for the

repurchase of shares of Express Scripts.

As of December 31, 2012, approximately 47.5 million shares of our common stock have been reserved for

employee benefit plans (see Note 10 – Employee benefit plans and stock-based compensation plans).

Preferred Share Purchase Rights. In July 2001, ESI’s Board of Directors adopted a stockholder rights

plan which declared a dividend of one right for each outstanding share of ESI’s common stock. The rights plan

expired on March 15, 2011 and no additional plan has been adopted by the Board of Directors.