Express Scripts 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

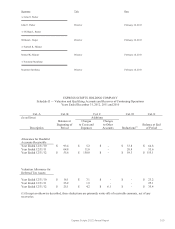

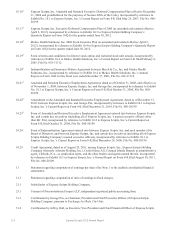

Express Scripts 2012 Annual Report104

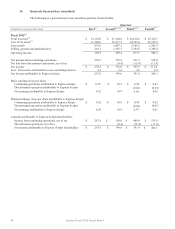

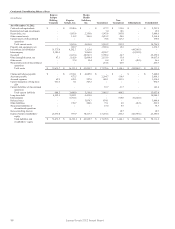

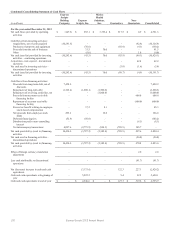

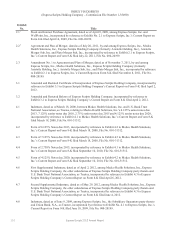

Condensed Consolidating Statement of Cash Flows

(in millions)

Express

Scripts

Holding

Company

Express

Scripts, Inc.

Medco

Health

Solutions,

Inc.

Guarantors

Non-

Guarantors

Consolidated

For the year ended December 31, 2010

Net cash flows provided by operating

activities

$

-

$

1,327.4

$

-

$

773.2

$

16.8

$

2,117.4

Cash flows from investing activities:

Purchases of property and equipment

-

(53.1)

-

(61.3)

(5.5)

(119.9)

Purchase of short-term investments

-

-

-

-

(38.0)

(38.0)

Other

-

17.6

-

(4.3)

(0.5)

12.8

Net cash used in investing activities –

continuing operations

-

(35.5)

-

(65.6)

(44.0)

(145.1)

Net cash used in investing activities –

discontinued operations

-

-

-

-

(0.8)

(0.8)

Net cash used in investing activities

-

(35.5)

-

(65.6)

(44.8)

(145.9)

Cash flows from financing activities:

Repayment of long-term debt

-

(1,340.1)

-

-

-

(1,340.1)

Treasury stock acquired

-

(1,276.2)

-

-

-

(1,276.2)

Excess tax benefit relating to employee

stock-based compensation

-

58.9

-

-

-

58.9

Net proceeds from employee stock

plans

-

35.3

-

-

-

35.3

Deferred financing fees

-

(3.9)

-

-

-

(3.9)

Other

-

3.0

-

-

-

3.0

Net intercompany transactions

-

682.8

-

(708.6)

25.8

-

Net cash (used in) provided by financing

activities

-

(1,840.2)

-

(708.6)

25.8

(2,523.0)

Effect of foreign currency translation

adjustment

-

-

-

-

4.8

4.8

Net (decrease) increase in cash and cash

equivalents

-

(548.3)

-

(1.0)

2.6

(546.7)

Cash and cash equivalents at beginning of

year

-

1,005.0

-

10.0

55.4

1,070.4

Cash and cash equivalents at end of year

$

-

$

456.7

$

-

$

9.0

$

58.0

$

523.7

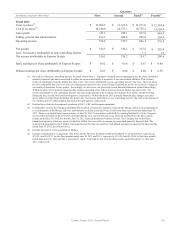

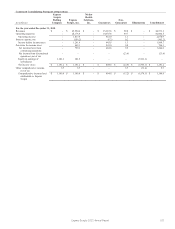

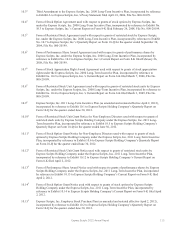

16. Subsequent event

On February 15, 2013, the Board of Directors approved a plan to redeem $1.0 billion aggregate principal

amount of 6.25% Senior Notes due 2014 in the first half of 2013 using existing cash on hand. In connection with

this early redemption, the company expects to pay a premium of approximately $69.0 million.