Express Scripts 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report36

Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations

OVERVIEW

On July 20, 2011, Express Scripts, Inc. (“ESI”) entered into a definitive merger agreement (the “Merger

Agreement”) with Medco Health Solutions, Inc. (“Medco”), which was amended by Amendment No. 1 thereto on

November 7, 2011 The transactions contemplated by the Merger Agreement (the “Merger”) were consummated on April 2,

2012. For financial reporting and accounting purposes, ESI was the acquirer of Medco. The consolidated financial

statements reflect the results of operations and financial position of ESI for the years ended December 31, 2011 and 2010

and for the period beginning January 1, 2012 through April 1, 2012. References to amounts for periods after the closing of

the Merger on April 2, 2012 relate to Express Scripts.

As the largest full-service pharmacy benefit management (“PBM”) company, we provide healthcare management

and administration services on behalf of our clients, which include managed care organizations, health insurers, third-party

administrators, employers, union-sponsored benefit plans, workers’ compensation plans and government health programs.

We report segments on the basis of services offered and have determined we have two reportable segments: PBM and

Other Business Operations. During the second quarter of 2012, we reorganized our segments to better reflect our structure

following the Merger. Our other international retail network pharmacy management business (which has been substantially

shut down as of December 31, 2012) was reorganized from our PBM segment into our Other Business Operations. During

the third quarter of 2011 we reorganized our FreedomFP line of business from our Other Business Operations segment into

our PBM segment. Our integrated PBM services include network claims processing, home delivery services, patient care

and direct specialty home delivery to patients, benefit plan design consultation, drug utilization review, formulary

management, drug data analysis services, distribution of injectable drugs to patient homes and physician offices, bio-

pharma services, fertility services to providers and patients and fulfillment of prescriptions to low-income patients through

manufacturer-sponsored patient assistance programs.

Through our Other Business Operations segment, we provide services including distribution of pharmaceuticals

and medical supplies to providers and clinics and scientific evidence to guide the safe, effective, and affordable use of

medicines.

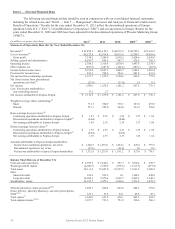

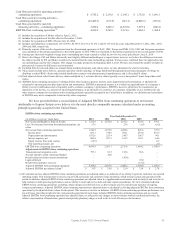

Revenue generated by our segments can be classified as either tangible product revenue or service revenue. We

earn tangible product revenue from the sale of prescription drugs by retail pharmacies in our retail pharmacy networks and

from dispensing prescription drugs from our home delivery and specialty pharmacies. Service revenue includes

administrative fees associated with the administration of retail pharmacy networks contracted by certain clients, medication

counseling services and certain specialty distribution services. Tangible product revenue generated by our PBM and Other

Business Operations segments represented 99.0% of revenues for the year ended December 31, 2012 as compared to 99.4%

for both of the years ended December 31, 2011 and 2010.

MERGER TRANSACTION

As a result of the Merger on April 2, 2012, Medco and ESI each became wholly owned subsidiaries of Express

Scripts and former Medco and ESI stockholders became owners of stock in Express Scripts, which is listed for trading on

the Nasdaq stock exchange. Upon closing of the Merger, former ESI stockholders owned approximately 59% of Express

Scripts and former Medco stock holders owned approximately 41%.

RECENT DEVELOPMENTS

As previously noted in ESI’s Annual Report on Form 10-K for the year ended December 31, 2011, the contract

with Walgreen Co. (“Walgreens”) expired on December 31, 2011. Prior to expiration of the contract with Walgreens, ESI

provided a full array of tools and resources to help members efficiently transfer prescriptions to other conveniently located

pharmacies. As announced on July 19, 2012, Express Scripts and Walgreens reached a multi-year pharmacy network

agreement with rates and terms under which Walgreens participates in the broadest Express Scripts retail pharmacy network

available to new and existing clients, as of September 15, 2012. Express Scripts helped to provide a smooth transition for

those plan sponsors who include Walgreens’ pharmacies in their network.

EXECUTIVE SUMMARY AND TREND FACTORS AFFECTING THE BUSINESS

Our results in 2012 compared to prior periods continue to be driven by the addition of Medco to our book of

business on April 2, 2012. The Merger impacted all components of our financial statements, including our revenues,

expenses and profits, the consolidated balance sheet and claims volumes. Our results reflect the ability to successfully