Express Scripts 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report56

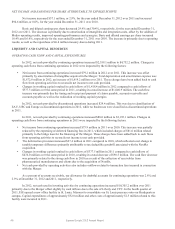

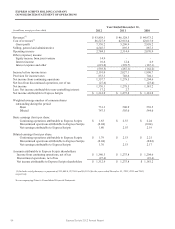

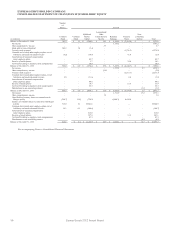

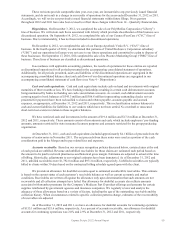

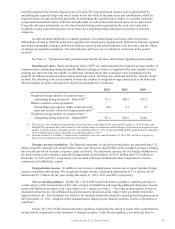

EXPRESS SCRIPTS HOLDING COMPANY

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

Number

of

Shares

Amount

(in millions)

Common

Stock

Common

Stock

Additional

Paid-in

Capital

Accumulated

Other

Comprehensive

Income

Retained

Earnings

Treasury

Stock

Non-

controlling

interest

Total

Balance at December 31, 2009

345.3

$ 3.5

$ 2,260.0

$ 14.1

$ 4,188.6

$ (2,914.4)

$ -

$ 3,551.8

Net income

-

-

-

-

1,181.2

-

-

1,181.2

Other comprehensive income

-

-

-

5.7

-

-

-

5.7

Stock split in form of dividend

345.1

3.4

(3.4)

-

-

-

-

-

Treasury stock acquired

-

-

-

-

-

(1,276.2)

-

(1,276.2)

Common stock issued under employee plans, net of

forfeitures and stock redeemed for taxes

(0.2)

-

(14.5)

-

-

11.9

-

(2.6)

Amortization of unearned compensation

under employee plans

-

-

49.7

-

-

-

-

49.7

Exercise of stock options

-

-

3.7

-

-

34.4

-

38.1

Tax benefit relating to employee stock compensation

-

-

58.9

-

-

-

-

58.9

Balance at December 31, 2010

690.2

$ 6.9

$ 2,354.4

$ 19.8

$ 5,369.8

$ (4,144.3)

$ -

$ 3,606.6

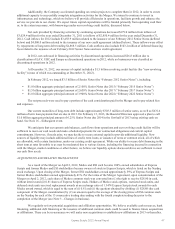

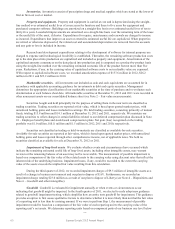

Net income

-

-

-

-

1,275.8

-

2.7

1,278.5

Other comprehensive income

-

-

-

(2.8)

-

-

-

(2.8)

Treasury stock acquired

-

-

-

-

-

(2,515.7)

-

(2,515.7)

Common stock issued under employee plans, net of

-

forfeitures and stock redeemed for taxes

0.5

-

(11.6)

-

-

8.4

-

(3.2)

Amortization of unearned compensation

-

under employee plans

-

-

48.8

-

-

-

-

48.8

Exercise of stock options

-

-

18.3

-

-

17.6

-

35.9

Tax benefit relating to employee stock compensation

-

-

28.3

-

-

-

-

28.3

Distributions to non-controlling interest

-

-

-

-

-

-

(1.1)

(1.1)

Balance at December 31, 2011

690.7

$ 6.9

$ 2,438.2

$ 17.0

$ 6,645.6

$ (6,634.0)

$ 1.6

$ 2,475.3

Net income

-

-

-

-

1,312.9

-

17.2

1,330.1

Other comprehensive income

-

-

-

1.9

-

-

-

1.9

Cancellation of treasury shares in connection with

Merger activity

(204.7)

(2.0)

(728.5)

-

(5,890.3)

6,620.8

-

-

Issuance of common shares in connection with Merger

activity

318.0

3.2

18,841.6

-

-

-

-

18,844.8

Common stock issued under employee plans, net of

forfeitures and stock redeemed for taxes

14.1

0.1

(104.8)

-

-

-

-

(104.7)

Amortization of unearned compensation

under employee plans

-

-

410.0

-

-

-

-

410.0

Exercise of stock options

-

-

387.9

-

-

13.2

-

401.1

Tax benefit relating to employee stock compensation

-

-

45.3

-

-

-

-

45.3

Distributions to non-controlling interest

-

-

(8.1)

(8.1)

Balance at December 31, 2012

818.1

$ 8.2

$ 21,289.7

$ 18.9

$ 2,068.2

$ -

$ 10.7

$ 23,395.7

See accompanying Notes to Consolidated Financial Statements