Express Scripts 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 71

ill &

$ 3.7 $ 11.5)

$ 3.7 $ 11.5)

$ 0.5 $ 23.0)

14.3 -

$ 14.8 $ 23.0)

$ 18.5 $ 34.5)

accompanying consolidated statement of operations for the year ended December 31, 2012 and is included in the

Other Business Operations segment. The write-down was comprised of impairments to customer relationships with a

carrying value of $24.2 million and trade names with a carrying value of $6.6 million.

From the date of Merger through the date of disposal, Liberty’s revenue totaled $323.9 million and

operating loss totaled $32.3 million. As Liberty was acquired through the Merger, no associated assets or liabilities

were held as of December 31, 2012 or 2011.

Sale of CYC. On September 14, 2012, we completed the sale of our CYC line of business, which is

included within our Other Business Operations segment. During the third quarter of 2012, we recognized a gain on

the sale of this business, net of the sale of its assets, which totaled $14.3 million. The gain is included in the SG&A

line item in the accompanying statement of operations for the year ended December 31, 2012.

We determined that the results of operations for CYC for 2012, 2011, and 2010 were immaterial to both

consolidated and segment results of operations, and we have therefore not presented these results separately as

discontinued operations for the current or prior periods. Operating income (loss), including the gain associated with

the sale, totaled $14.7 million, less than $(0.1) million, and $(3.3) million for the years ended December 31, 2012,

2011 and 2010 respectively. Total assets for CYC as of December 31, 2011 were $36.9 million. The majority of

these assets represented goodwill of $12.0 million and cash of $14.9 million. As these amounts represented less than

0.1% of total consolidated assets, the assets were not classified as held for sale within the consolidated balance

sheet.

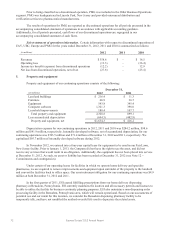

Held for sale classification of UBC and Europe. During the fourth quarter of 2012, we determined that

portions of the business within UBC, which is located in Chevy Chase, Maryland and our operations in Europe,

which were included within our Other Business Operations segment, were not core to our future operations and

committed to a plan to dispose of these businesses. As a result, these businesses have been classified as discontinued

as of December 31, 2012. It is expected that these businesses will be sold in the first half of 2013. UBC is a global

medical and scientific affairs organization that partners with life science companies to develop and commercialize

their products. The portions of the business held for sale include specialty services for pre-market trials; providing

health economics, outcome research, data analytics and market access services; and providing technology solutions

and publications to biopharmaceutical companies.

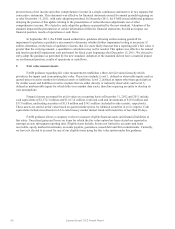

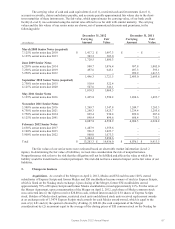

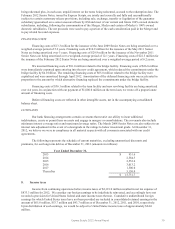

The results of operations for portions of UBC and our European operations are reported as discontinued

operations for all periods presented in the accompanying consolidated statement of operations in accordance with

applicable accounting guidance (see select statement of operations information below). For all periods presented,

cash flows of our discontinued operations are segregated in our accompanying consolidated statement of cash flows.

Finally, assets and liabilities of these businesses held as of December 31, 2012 were segregated in our

accompanying consolidated balance sheet. As these businesses were acquired through the Merger, no assets or

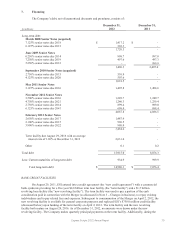

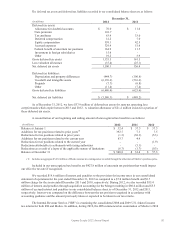

liabilities of these businesses were held as of December 31, 2011. As of December 31, 2012, the major components

of assets and liabilities of these discontinued operations are as follows:

(in millions)

December 31, 2012

Current assets

$

198.0

Goodwill

88.5

Other intangible assets, net

157.4

Other assets

19.8

Total assets

$

463.7

Current liabilities

$

143.4

Deferred Taxes

32.6

Other liabilities

3.7

Total liabilities

$

179.7

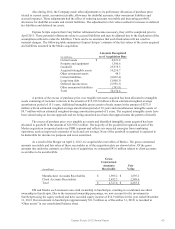

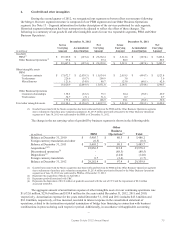

Sale of PMG. On September 17, 2010, ESI completed the sale of its PMG line of business. Upon

classification as a discontinued operation in the second quarter of 2010, an impairment charge of $28.2 million was

recorded to reflect goodwill and intangible asset impairment and the subsequent write-down of PMG assets to fair

market value. The loss on the sale as well as other charges related to discontinued operations during the third quarter

of 2010 totaled $8.3 million. These charges are included in the “Net loss from discontinued operations, net of tax”

line item in the accompanying consolidated statement of operations for the year ended December 31, 2010.