Express Scripts 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 85

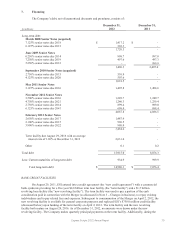

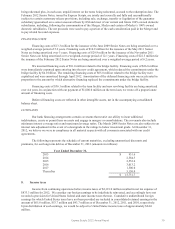

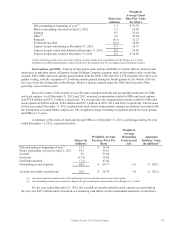

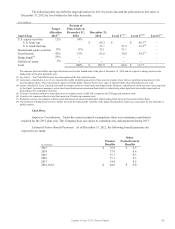

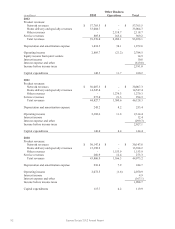

Shares (in

millions)

Weighted-

Average Grant

Date Fair Value

Per Share

ESI outstanding at beginning of year(1)

1.3

$ 41.92

Medco outstanding converted at April 2, 2012

7.2

56.49

Granted

0.3

53.03

Other(2)

0.2

52.04

Released

(4.1)

52.25

Forfeited/Cancelled

(0.2)

54.49

Express Scripts outstanding at December 31, 2012

4.7

54.57

Express Scripts vested and deferred at December 31, 2012

0.2

56.49

Express Scripts non-vested at December 31, 2012

4.5

$ 54.50

(1) All outstanding awards were converted to Express Scripts awards upon consummation of the Merger at a 1:1 ratio.

(2) Represents additional performance shares issued above the original value for exceeding certain performance metrics.

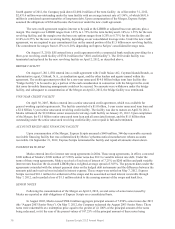

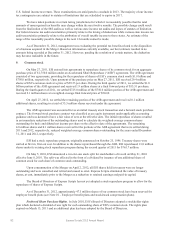

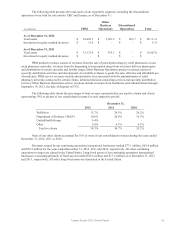

Stock options and SSRs. Express Scripts grants stock options and SSRs to certain officers, directors and

employees to purchase shares of Express Scripts Holding Company common stock at fair market value on the date

of grant. ESI’s SSRs and stock options granted under both the 2000 LTIP and 2011 LTIP generally have three-year

graded vesting, with the exception of 1.0 million awards granted during the fourth quarter of 2011which cliff vest

two years from the closing date of the Merger. Medco’s options granted under the 2002 Stock Incentive Plan

generally vest over three years.

Due to the nature of the awards, we use the same valuation methods and accounting treatments for SSRs

and stock options. As of December 31, 2012 and 2011, unearned compensation related to SSRs and stock options

was $74.4 million and $32.1 million, respectively. We recorded pre-tax compensation expense related to SSRs and

stock options of $220.0 million, $34.6 million and $32.1 million in 2012, 2011 and 2010, respectively. The increase

for the year ended December 31, 2012 resulted from stock-based compensation expense acceleration associated with

the termination of certain Medco employees. The weighted-average remaining recognition period for stock options

and SSRs is 1.6 years.

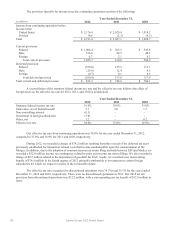

A summary of the status of stock options and SSRs as of December 31, 2012, and changes during the year

ended December 31, 2012, is presented below.

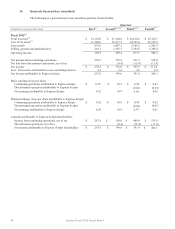

Shares (in

millions)

Weighted-Average

Exercise Price Per

Share

Weighted-

Average

Remaining

Contractual

Life

Aggregate

Intrinsic Value

(in millions)

(1)

ESI outstanding at beginning of year(2)

13.7

$ 34.54

Medco outstanding converted at April 2, 2012

41.5

38.61

Granted

3.6

53.06

Exercised

(13.5)

30.82

Forfeited/cancelled

(1.1)

47.60

Outstanding at end of period

44.2

$ 40.71

6.1

$ 592.5

Awards exercisable at period end

30.2

$ 36.79

5.6

$ 522.0

(1) Amount by which the market value of the underlying stock exceeds the exercise price of the option.

(2) All outstanding awards were converted to Express Scripts awards upon consummation of the Merger at a 1:1 ratio.

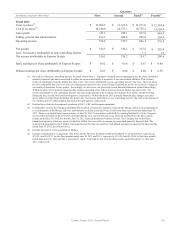

For the year ended December 31, 2012, the windfall tax benefit related to stock options exercised during

the year was $45.3 million and is classified as a financing cash inflow on the consolidated statement of cash flows.