Express Scripts 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report88

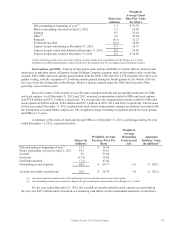

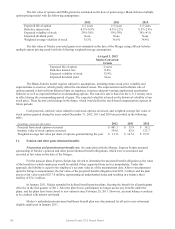

Actuarial assumptions. The Company has elected an accounting policy that measures the pension plan’s

benefit obligation as if participants were to separate immediately. As a result, a discount rate is not used to value the

pension benefit obligation. Also, since both the pension and other postretirement benefit plans are frozen, a rate of

compensation increase is not applicable.

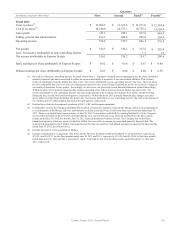

Other

Postretirement

Benefits

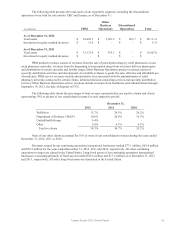

Weighted-average assumptions used to determine

benefit obligations at fiscal year-end:

Discount rate

2.48%

Weighted-average assumptions used to determine

net cost for the fiscal year ended:

Discount rate

3.30%

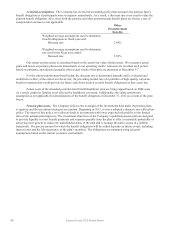

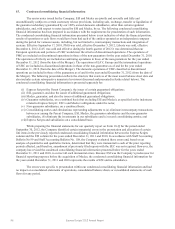

Our return on plan assets is calculated based on the actual fair value of plan assets. We recognize actual

gains and losses on pension plan assets immediately in our operating results. Amounts are recorded each period

based on estimates, and adjusted annually when actual results of the plan are measured at December 31st.

For the other postretirement benefit plan, the discount rate is determined annually and is evaluated and

modified to reflect, at the end of our fiscal year, the prevailing market rate of a portfolio of high-quality corporate

bond investments that would provide the future cash flows needed to settle benefit obligations as they come due.

Future costs of the amended postretirement benefit healthcare plan are being capped based on 2004 costs.

As a result, employer liability is not affected by healthcare cost trend. Additionally, the salary growth rate

assumption is not applicable for determination of the benefit obligation at December 31, 2012 as a result of the plan

freeze.

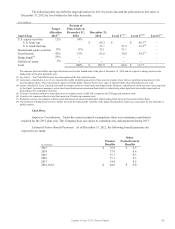

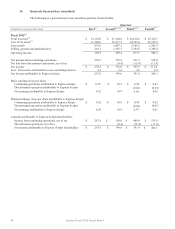

Pension plan assets. The Company believes the oversight of the investments held under its pension plans

is rigorous and the investment strategies are prudent. Beginning in 2013, we have adopted a dynamic asset allocation

policy. The intent of this policy is to allocate funds to investments with lower expected risk profiles as the funded

ratio of the pension plan improves. The investment objectives of the Company’s qualified pension plan are designed

to provide liquidity to meet benefit payments and expenses payable from the plan to offer a reasonable probability of

achieving asset growth to reduce the underfunded status of the plan and to manage the plan’s assets in a liability

framework. The precise amount for which the benefit obligations will be settled depends on future events, including

interest rates and the life expectancy of the plan’s members. The obligations are estimated using actuarial

assumptions based on the current economic environment.