Express Scripts 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 81

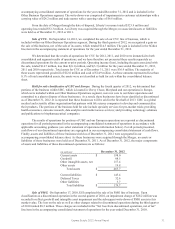

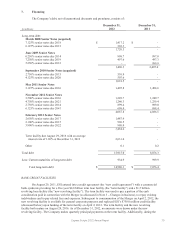

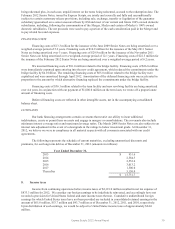

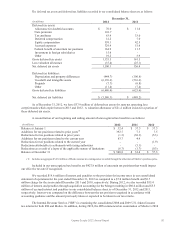

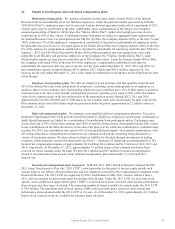

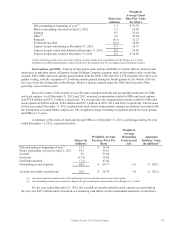

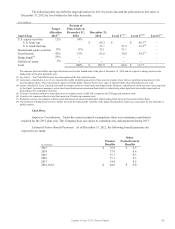

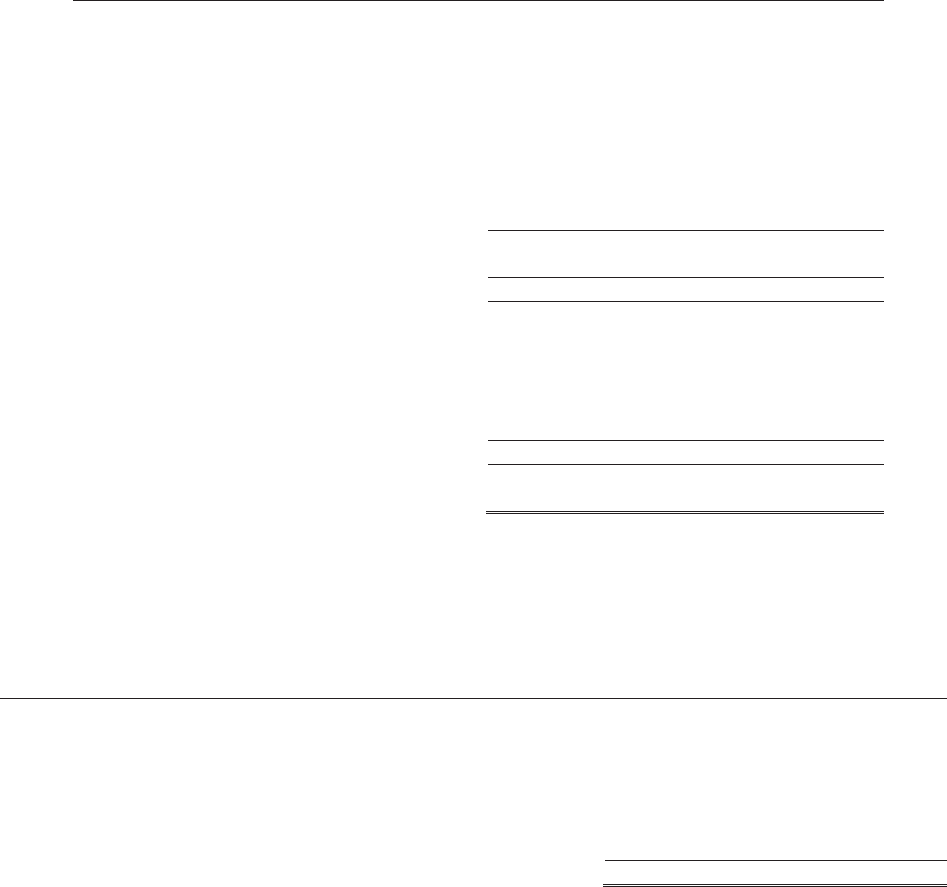

The deferred tax assets and deferred tax liabilities recorded in our consolidated balance sheet are as follows:

December 31,

(in millions)

2012

2011

Deferred tax assets:

Allowance for doubtful accounts

$ 70.0

$ 11.6

Note premium

101.7

-

Tax attributes

63.4

33.0

Deferred compensation

12.2

7.0

Equity compensation

359.1

42.9

Accrued expenses

329.4

51.6

Federal benefit of uncertain tax positions

164.9

11.5

Investment in foreign subsidiaries

15.6

-

Other

19.2

3.9

Gross deferred tax assets

1,135.5

161.5

Less valuation allowance

(35.4)

(25.1)

Net deferred tax assets

1,100.1

136.4

Deferred tax liabilities:

Depreciation and property differences

(444.7)

(100.8)

Goodwill and intangible assets

(6,176.6)

(516.6)

Prepaids

(7.7)

(0.8)

Other

(11.4)

(7.4)

Gross deferred tax liabilities

(6,640.4)

(625.6)

Net deferred tax liabilities

$ (5,540.3)

$ (489.2)

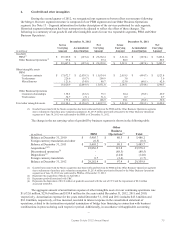

As of December 31, 2012, we have $37.9 million of deferred tax assets for state net operating loss

carryforwards which expire between 2013 and 2032. A valuation allowance of $21.2 million exists for a portion of

these deferred tax assets.

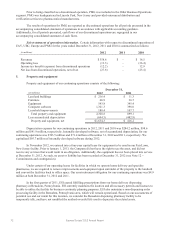

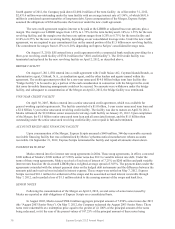

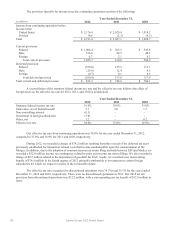

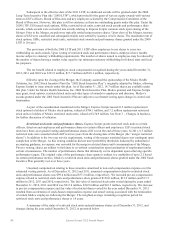

A reconciliation of our beginning and ending amount of unrecognized tax benefits is as follows:

(in millions)

2012

2011

2010

Balance at January 1

$ 32.4

$ 57.3

$ 57.3

Additions for tax positions related to prior years(1)

392.7

7.3

7.5

Reductions for tax positions related to prior years

(1.3)

(30.3)

(5.3)

Additions for tax positions related to the current year

83.7

4.9

-

Reductions for tax positions related to the current year

-

-

(1.9)

Reductions attributable to settlements with taxing authorities

-

(5.1)

-

Reductions as a result of a lapse of the applicable statute of limitations

(6.7)

(1.7)

(0.3)

Balance at December 31

$ 500.8

$ 32.4

$ 57.3

(1) Includes an aggregate $343.4 million of Medco income tax contingencies recorded through the allocation of Medco’s purchase price.

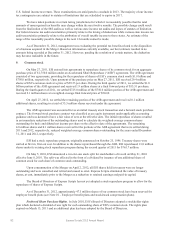

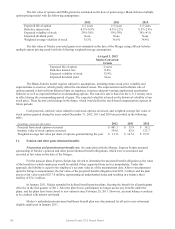

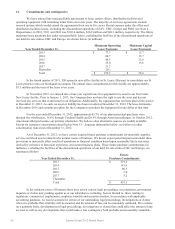

Included in our unrecognized tax benefits are $427.8 million of uncertain tax positions that would impact

our effective tax rate if recognized.

We recorded $19.6 million of interest and penalties to the provision for income taxes in our consolidated

statement of operations for the year ended December 31, 2012 as compared to a $7.0 million benefit and $3.7

million charge for the years ended December 2011 and 2010, respectively. During 2012, we also recorded $55.4

million of interest and penalties through acquisition accounting for the Merger resulting in $80.6 million and $5.5

million of accrued interest and penalties in our consolidated balance sheet as of December 31, 2012 and 2011,

respectively. Interest was computed on the difference between the tax position recognized in accordance with

accounting guidance and the amount previously taken or expected to be taken in our tax returns.

The Internal Revenue Service ("IRS") is examining the consolidated 2008 and 2009 U.S. federal income

tax returns for both ESI and Medco. In addition, during 2012, the IRS commenced an examination of Medco’s 2010