Express Scripts 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Express Scripts 2012 Annual Report 59

58

These revisions provide comparable data year-over-year, are immaterial to any previously issued financial

statements, and do not result in a change in our results of operations for the years ended December 31, 2012 or 2011.

Accordingly, we will revise our previously issued financial statements within future filings. Prior quarters

throughout 2012 and 2011 have also been revised to reflect these changes within Note 14 – Quarterly financial data.

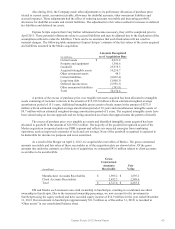

Dispositions. On December 3, 2012, we completed the sale of our PolyMedica Corporation (“Liberty”)

line of business. We will retain cash flows associated with Liberty which preclude classification of this business as a

discontinued operation. On September 14, 2012, we completed the sale of our ConnectYourCare (“CYC”) line of

business. Due to immateriality, it has not been included in discontinued operations.

On December 4, 2012, we completed the sale of our Europa Apotheek Venlo B.V. (“EAV”) line of

business. In the fourth quarter of 2012, we determined that portions of United BioSource Corporation subsidiary

(“UBC”) and our operations in Europe were not core to our future operations and committed to a plan to dispose of

these businesses. On September 17, 2010, ESI completed the sale of its Phoenix Marketing Group (“PMG”) line of

business. These lines of business are classified as discontinued operations.

In accordance with applicable accounting guidance, the results of operations for these entities are reported

as discontinued operations for all periods presented in the accompanying consolidated statement of operations.

Additionally, for all periods presented, assets and liabilities of the discontinued operations are segregated in the

accompanying consolidated balance sheet and cash flows of our discontinued operations are segregated in our

accompanying consolidated statement of cash flows (see Note 4 – Dispositions).

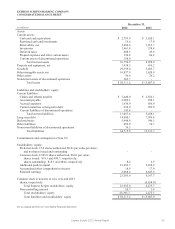

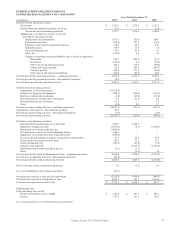

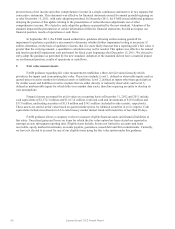

Cash and cash equivalents. Cash and cash equivalents include cash on hand and investments with original

maturities of three months or less. We have banking relationships resulting in certain cash disbursement accounts

being maintained by banks not holding our cash concentration accounts. As a result, cash disbursement accounts

carrying negative book balances of $545.3 million and $506.8 million (representing outstanding checks not yet

presented for payment) have been reclassified to claims and rebates payable, accounts payable and accrued

expenses, as appropriate, at December 31, 2012 and 2011, respectively. This reclassification restores balances to

cash and current liabilities for liabilities to our vendors which have not been settled. No overdraft or unsecured

short-term loan exists in relation to these negative balances.

We have restricted cash and investments in the amount of $19.6 million and $17.8 million at December 31,

2012 and 2011, respectively. These amounts consist of investments and cash, which include employers’ pre-funding

amounts, amounts restricted for state insurance licensure purposes and amounts restricted for the group purchasing

organization.

At December 31, 2011, cash and cash equivalents included approximately $4.1 billion of proceeds from the

issuance of senior notes in November 2011. The net proceeds from these notes were used as a portion of the cash

consideration paid in the Merger and to pay related fees and expenses.

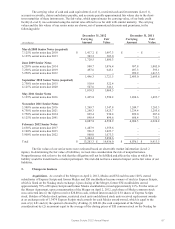

Accounts receivable. Based on our revenue recognition policies discussed below, certain claims at the end

of each period are unbilled. Revenue and unbilled receivables for those claims are estimated each period based on

the amount to be paid to network pharmacies and historical gross margin. Estimates are adjusted to actual at the time

of billing. Historically, adjustments to our original estimates have been immaterial. As of December 31, 2012 and

2011, unbilled receivables were $1,792.0 million and $971.0 million, respectively. Unbilled receivables are typically

billed to clients within 30 days based on the contractual billing schedule agreed upon with the client.

We provide an allowance for doubtful accounts equal to estimated uncollectible receivables. This estimate

is based on the current status of each customer’s receivable balance as well as current economic and market

conditions. Receivables are written off against the allowance only upon determination that such amounts are not

recoverable and all collection attempts have failed. Our allowance for doubtful accounts also reflects amounts

associated with member premiums for the Company’s Medicare Part D product offerings and amounts for certain

supplies reimbursed by government agencies and insurance companies. We regularly review and analyze the

adequacy of these allowances based on a variety of factors, including the age of the outstanding receivable and the

collection history. When circumstances related to specific collection patterns change, estimates of the recoverability

of receivables are adjusted.

As of December 31, 2012 and 2011, we have an allowance for doubtful accounts for continuing operations

of $155.1 million and $55.6 million, respectively. As a percent of accounts receivable, our allowance for doubtful

accounts for continuing operations was 2.8% and 2.9% at December 31, 2012 and 2011, respectively.