Energizer 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

U.S. colleagues. The decision to accept the cash benefits offered under the VERO was at the election of the colleague and was

irrevocable. Payments under the VERO were cash only, and did not include any enhancement to pension or retirement benefits.

In addition, the Company implemented a RIF program primarily in the U.S., to further adjust the organizational structure. The

total charge for the VERO and RIF in the fourth quarter of fiscal 2009 was $38.6 and was included in SG&A. This program,

which was primarily in the Household Products business is presented as a separate line below segment profit.

Also in fiscal 2009, we recorded a favorable adjustment of $24.1 resulting from a change in the policy under which colleagues

earn and vest in the Company’s paid time off (PTO) benefit. Prior to the change, colleagues were granted and vested in their

total PTO days at the beginning of the calendar year, and received a cash payment for unused days in the event of termination

during the year. As such, the value of a full year of PTO, net of days used, was accrued at any given balance sheet date. As part

of a review of certain benefit programs, this policy was revised in fiscal 2009 to a more “market” policy for PTO. The revised

policy has an “earn as you go” approach, under which colleagues earn current-year PTO on a pro-rata basis as they work during

the year. As a result of this change, any previously earned and vested benefit under the prior policy was forfeited, and the

required liability at the date of the policy change was adjusted to reflect the revised benefit. This favorable adjustment is not

reflected in the Household Products or Personal Care segments, but rather presented as a separate line item below segment

profit as it is not considered operational in nature.

The presentation for inventory write-up, acquisition integration and other costs, cost of early debt retirements, VERO/RIF costs

and favorable PTO adjustment reflects management’s view on how it evaluates segment performance.

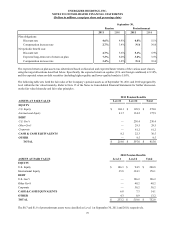

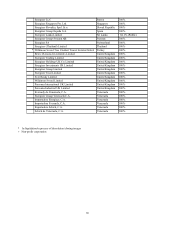

Corporate assets shown in the following table include all cash and cash equivalents, financial instruments and deferred tax

assets that are managed outside of operating segments.

80