Energizer 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

On May 19, 2011, the Company completed the issuance of $600.0 principal amount of 4.70% Senior Notes due May 2021,

with interest paid semi-annually beginning November 2011. The vast majority of the proceeds of the offering were used to

repay existing indebtedness including the early redemption of certain private placement notes. The early retirement of certain

private placement notes resulted in “make whole” payments totaling $19.9 pre-tax, which are reflected as a separate line item

on the Consolidated Statements of Earnings and Comprehensive Income as well as the reconciliation of segment results to total

earnings before income taxes. See Notes 12 and 19 to the Consolidated Financial Statements for further details.

This structure is the basis for the Company’s reportable operating segment information, as included in the tables in Note 19 to

the Consolidated Financial Statements for the fiscal years ended September 30, 2011, 2010 and 2009.

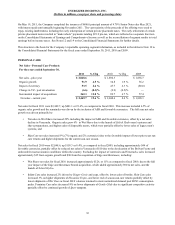

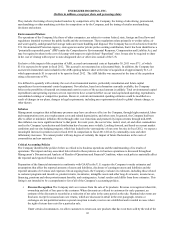

PERSONAL CARE

Net Sales - Personal Care Products

For the years ended September 30,

Net sales - prior year

Organic growth

Impact of currency

Change in VZ - post devaluation

Incremental impact of acquisitions

Net sales - current year

2011

$ 2,048.6

91.9

53.5

(6.6)

262.3

$ 2,449.7

% Chg

4.5 %

2.6 %

(0.3)%

12.8 %

19.6 %

2010

$ 1,890.3

34.8

43.7

(9.9)

89.7

$ 2,048.6

% Chg

1.9 %

2.3 %

(0.5)%

4.7 %

8.4 %

2009

$ 1,856.7

56.2

(80.0)

—

57.4

$ 1,890.3

Net sales for fiscal 2011 were $2,449.7, up $401.1 or 19.6%, as compared to fiscal 2010. This increase included 4.5% of

organic sales growth and the remainder was driven by the inclusion of ASR and favorable currencies. The full year net sales

growth was driven primarily by:

• Net sales in Wet Shave increased 29% including the impact of ASR and favorable currencies, offset by a net sales

decline in Venezuela. Organic sales grew 6% in Wet Shave due to the launch of Schick Hydro men's systems and

shave preparations, and higher sales of disposable razors, which were partially offset by lower sales of legacy men's

systems, and

• Skin Care net sales increased 9% (7% organic and 2% currencies) due to the favorable impact of lower prior year sun

care returns and higher shipments for the current sun care season.

Net sales for fiscal 2010 were $2,048.6, up $158.3 or 8.4%, as compared to fiscal 2009, including approximately $44 of

favorable currencies, partially offset by reduced net sales in Venezuela of $10 due to the devaluation of the Bolivar Fuerte and

unfavorable macroeconomic conditions within the country. Excluding the impact of currencies and Venezuela, sales increased

approximately $35 from organic growth and $90 from the acquisition of Edge and Skintimate, including:

• Wet Shave net sales for fiscal 2010 increased approximately $126, or 11% as compared to fiscal 2009, due to the full

year impact of the Edge and Skintimate brands acquisition, which added approximately $90 to net sales, and the

launch of Schick Hydro.

• Infant Care sales increased 2% driven by Diaper Genie and cups, offset by lower sales of bottles. Skin Care sales

increased 3% on higher shipments of Hawaiian Tropic, and lower end of season sun care returns partially offset by

lower shipments of Wet Ones as fiscal 2010 volumes returned to more normalized demand post H1N1 consumption

peaks. Feminine Care sales decreased 8% on lower shipments of Gentle Glide due to significant competitive activity

partially offset by continued growth of Sport tampons.

34