Energizer 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

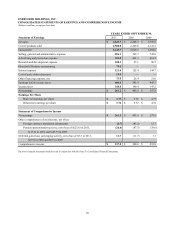

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

environment. Conversely, strengthening of currencies relative to the U.S. dollar and, to a lesser extent, the Euro, can improve

margins. This margin impact coupled with the translation of foreign operating results to the U.S. dollar, our financial reporting

currency, has an impact on reported operating profits. Based on current market conditions, we do not expect currencies to have

a material impact on year over year comparatives in fiscal 2012. However, volatility remains a concern as evidenced by the

significant strengthening of the U.S. dollar in September 2011. So, changes in the value of local currencies in relation to the

U.S. dollar, and, to a lesser extent, the Euro will continue to impact reported sales and segment profitability in the future, and

we cannot predict the direction or magnitude of future changes.

The Company generally views its investments in foreign subsidiaries with a functional currency other than the U.S. dollar as

long-term. As a result, the Company does not generally hedge these net investments. Capital structuring techniques are used to

manage the net investment in foreign currencies, as necessary. Additionally, the Company attempts to limit its U.S. dollar net

monetary liabilities in countries with unstable currencies.

From time to time the Company may employ foreign currency hedging techniques to mitigate potential losses in earnings or

cash flows on foreign currency transactions, which primarily consist of anticipated intercompany purchase transactions and

intercompany borrowings. External purchase transactions and intercompany dividends and service fees with foreign currency

risk may also be hedged. The primary currencies to which the Company’s foreign affiliates are exposed include the U.S. dollar,

the Euro, the Yen, the British pound, the Canadian dollar and the Australian dollar.

The Company uses natural hedging techniques, such as offsetting like foreign currency cash flows and foreign currency

derivatives with durations of generally one year or less, including forward exchange contracts. Certain of the foreign exchange

contracts have been designated and are accounted for as cash flow hedges.

The Company enters into foreign currency derivative contracts to hedge certain existing balance sheet exposures. Any losses on

these contracts would be fully offset by exchange gains on the underlying exposures, thus they are not subject to significant

market risk. The change in fair value of the foreign currency contracts for fiscal 2011 and 2010 resulted in income of $4.5 and

expense of $5.4, respectively, and was recorded in Other financing expense, net on the Consolidated Statements of Earnings

and Comprehensive Income. In addition, the Company has entered into a series of forward currency contracts to hedge the cash

flow uncertainty of forecasted inventory purchases due to short term currency fluctuations. These transactions are accounted for

as cash flow hedges. The Company had an unrealized pre-tax gain on these forward currency contracts accounted for as cash

flow hedges included in Accumulated other comprehensive loss on the Consolidated Balance Sheets of $3.3 and loss of $16.8

at September 30, 2011 and 2010, respectively. Contract maturities for these hedges extend into 2013.

The Company has investments in a Venezuelan affiliate. Venezuela is considered highly inflationary under GAAP since January

1, 2010. In addition, the conversion of local monetary assets to U.S. dollars is restricted by the Venezuelan government. We

continue to monitor this situation, including the impact such restrictions may have on our future business operations. At this

time, we are unable to predict with any degree of certainty how recent and future developments in Venezuela will affect our

Venezuela operations, if at all. At September 30, 2011, the Company had approximately $39 in net monetary assets in

Venezuela. Due to the level of uncertainty in Venezuela, we cannot predict the exchange rate that will ultimately be used to

convert our local currency net monetary assets to U.S. dollars in the future.

Our ability to effectively manage sales and profit levels in Venezuela will be impacted by several factors, including the

Company's ability to mitigate the effect of any potential future devaluation, further actions of the Venezuelan government,

economic conditions in Venezuela, such as inflation and consumer spending, the availability of raw materials, utilities and

energy and the future state of exchange controls in Venezuela, including the availability of U.S. dollars at the official foreign

exchange rate.

On March 11, 2011, an earthquake struck off the northeast coast of Japan, triggering a tsunami. Further compounding the

situation, nuclear power plants were damaged causing concerns about the possible meltdown of nuclear reactors and the release

of harmful radioactive materials. The tragic events have severely disrupted the Japanese economy, the third largest in the

world.

The Company is party to several foreign exchange hedging contracts for the Japanese Yen, which are accounted for as cash

flow hedges. These contracts hedge the variability of cash flows resulting from changes to foreign currency exchange rates

related to the cash settlement of future inventory purchases. The contracts are established and based on a forecast of future

inventory purchases. At September 30, 2011, the Company had a pre-tax loss of approximately $7 included in Accumulated

Other Comprehensive Loss on the Balance Sheet related to hedging contracts in Japan. This loss relates to foreign exchange

contracts accounted for as cash flow hedges with maturities throughout fiscal 2012. As of September 30, 2011, contracts with

40