Energizer 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

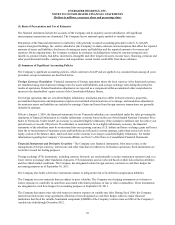

underlying product life cycles, operating plans and the macroeconomic environment. Our estimates of the useful lives

of determinable-lived intangible assets are primarily based on the same factors. The costs of determinable-lived

intangible assets are amortized to expense over the estimated useful life. The value of indefinite-lived intangible assets

and residual goodwill is not amortized, but is tested at least annually for impairment.

However, future changes in the judgments, assumptions and estimates that are used in our impairment testing

including discount and tax rates or future cash flow projections, could result in significantly different estimates of the

fair values in the future. A reduction in the estimated fair values could result in impairment charges that could

materially affect our financial statements in any given year. The recorded value of goodwill and intangible assets from

recently acquired businesses are derived from more recent business operating plans and macroeconomic

environmental conditions and therefore are more susceptible to an adverse change that could require an impairment

charge.

During fiscal 2011, we consolidated the Playtex and Wet Shave strategic business units, which were both part of our

Personal Care reporting segment, to form a single business unit. During our annual impairment testing in fiscal 2011,

we tested goodwill for impairment for both Wet Shave and Playtex individually and in the aggregate, in addition to

testing the goodwill associated with the Energizer reporting unit in our Household Products segment. There were no

indications of impairment of goodwill noted during this testing. Going forward, we will test goodwill for impairment

for two reporting units, the combined Personal Care reporting unit and the Energizer reporting unit.

In addition, we completed impairment testing on indefinite-lived intangible assets other than goodwill, which are

trademarks/brand names used in our various businesses. No impairment was indicated as a result of this testing.

However, the recorded values of such intangible assets from more recent acquisitions, such as the Playtex acquisition,

are often more susceptible to an impairment risk, if operating results or macroeconomic conditions deteriorate.

Playtex indefinite-lived intangible assets, exclusive of goodwill, represent more than 75% of total indefinite-lived

intangible assets, exclusive of goodwill. We utilized a discounted cash flow model using an excess earnings valuation

technique to test the Playtex trademarks for impairment. Key assumptions included a discount rate of 9% and a

terminal growth rate of 3%. While no impairment was indicated during this testing, the indicated fair value for two

trademarks, Playtex and Wet Ones, were relatively close to the carrying value at 114% of the carrying value

(approximately $650) for the Playtex trademark and 107% of the carrying value (approximately $200) for the Wet

Ones trademark.

Recently Issued Accounting Standards

See discussion in Note 2 to the Consolidated Financial Statements related to recently issued accounting standards.

Forward-Looking Statements

This document contains both historical and forward-looking statements. Forward-looking statements are not based on historical

facts but instead reflect our expectations, estimates or projections concerning future results or events, including, without

limitation, statements regarding future earnings, investment or spending initiatives, cost savings related to our restructuring

project, the impact of certain price increases, anticipated advertising and promotional spending, the estimated impact of foreign

currency movements, raw material and commodity costs, category value and future volume, sales and growth in some of our

businesses. These statements generally can be identified by the use of forward-looking words or phrases such as “believe,”

“expect,” “anticipate,” “may,” “could,” “intend,” “belief,” “estimate,” “plan,” “likely,” “will,” “should” or other similar words

or phrases. These statements are not guarantees of performance and are inherently subject to known and unknown risks,

uncertainties and assumptions that are difficult to predict and could cause our actual results, performance or achievements to

differ materially from those expressed in or indicated by those statements. We cannot assure you that any of our expectations,

estimates or projections will be achieved.

The forward-looking statements included in this document are only made as of the date of this document and we disclaim any

obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. Numerous factors

could cause our actual results and events to differ materially from those expressed or implied by forward-looking statements,

including, without limitation:

• Energizer's ability to improve operations and realize cost savings;

• Energizer's ability to timely implement strategic initiatives in a manner that will positively impact our financial condition

and results of operation;

45