Energizer 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

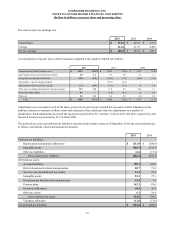

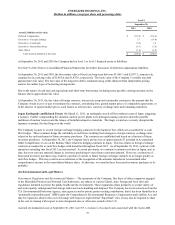

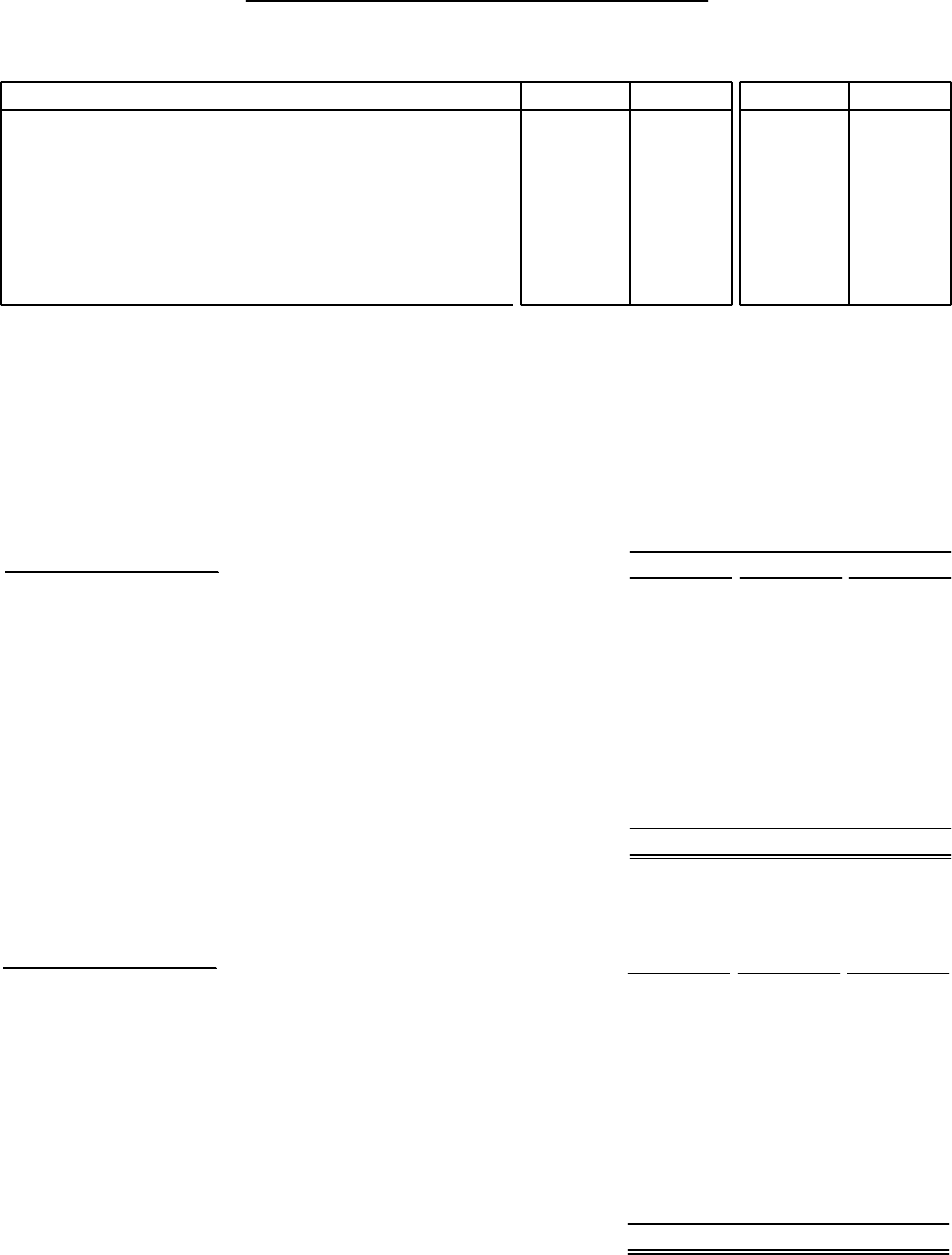

Plan obligations:

Discount rate

Compensation increase rate

Net periodic benefit cost:

Discount rate

Expected long-term rate of return on plan

Compensation increase rate

September 30,

Pension

2011

4.6%

2.7%

4.7%

7.3%

3.4%

2010

4.8%

3.4%

5.6%

8.0%

3.8%

Postretirement

2011

4.8%

N/A

5.1%

3.2%

N/A

2010

5.1%

N/A

5.9%

3.5%

N/A

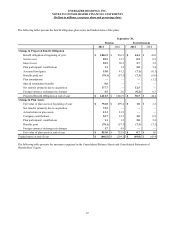

The expected return on plan assets was determined based on historical and expected future returns of the various asset classes,

using the target allocations described below. Specifically, the expected return on equities (U.S. and foreign combined) is 9.38%,

and the expected return on debt securities (including higher-quality and lower-quality bonds) is 5.05%.

The following table sets forth the fair value of the Company’s pension assets as of September 30, 2011 and 2010 segregated by

level within the fair value hierarchy. Refer to Note 15 of the Notes to Consolidated Financial Statements for further discussion

on the fair value hierarchy and fair value principles.

ASSETS AT FAIR VALUE

EQUITY

U.S. Equity

International Equity

DEBT

U.S. Gov't

Other Gov't

Corporate

CASH & CASH EQUIVALENTS

OTHER

TOTAL

2011 Pension Benefits

Level 1

$ 168.1

41.7

—

—

—

8.2

—

$ 218.0

Level 2

$ 109.9

134.2

230.4

29.5

61.2

22.3

9.5

$ 597.0

Total

$ 278.0

175.9

230.4

29.5

61.2

30.5

9.5

$ 815.0

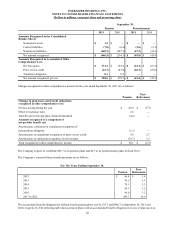

ASSETS AT FAIR VALUE

EQUITY

U.S. Equity

International Equity

DEBT

U.S. Gov't

Other Gov't

Corporate

CASH & CASH EQUIVALENTS

OTHER

TOTAL

2010 Pension Benefits

Level 1

$ 186.3

35.8

—

—

—

6.8

4.3

$ 233.2

Level 2

$ 94.5

134.3

196.2

48.2

30.2

7.3

8.9

$ 519.6

Total

$ 280.8

170.1

196.2

48.2

30.2

14.1

13.2

$ 752.8

The $0.7 and $1.0 of postretirement assets were classified as Level 1 at September 30, 2011 and 2010, respectively.

70