Energizer 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

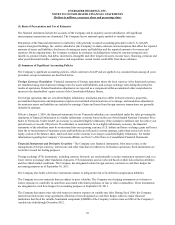

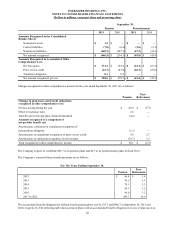

in Venezuela.

Effective January 1, 2010 and continuing through fiscal 2011, the financial statements for our Venezuela subsidiary are

consolidated under the rules governing the translation of financial information in a highly inflationary economy based on the

use of the blended National Consumer Price Index in Venezuela. Under GAAP, an economy is considered highly inflationary if

the cumulative inflation rate for a three year period meets or exceeds 100 percent. If a subsidiary is considered to be in a highly

inflationary economy, the financial statements of the subsidiary must be re-measured into our reporting currency (U.S. dollar)

and future exchange gains and losses from the re-measurement of monetary assets and liabilities are reflected in current

earnings, rather than exclusively in the equity section of the balance sheet, until such time as the economy is no longer

considered highly inflationary. At September 30, 2011, the U.S. dollar value of monetary assets, net of monetary liabilities,

which would be subject to an earnings impact from translation rate movements for our Venezuela affiliate under highly

inflationary accounting was approximately $39.

On January 8, 2010, the Venezuelan government announced its intention to devalue the Bolivar Fuerte relative to the U.S.

dollar. The revised official exchange rate for imported goods considered non-essential moved to an exchange rate of 4.30 to 1

U.S. dollar, which was twice the previous official rate prior to the devaluation. As noted above, the Company determined, prior

to this official devaluation, that exchange rates available in the then existing parallel rate market were the appropriate rates to

use for the translation of our Venezuela affiliates' financial statements, so this official devaluation action did not result in any

further devaluation charges.

In May 2010, the Venezuela government introduced additional exchange controls over securities transactions in the previously

mentioned parallel rate market. It established the Central Bank of Venezuela as the only legal intermediary through which

parallel rate market transactions can be executed and established government control over the parallel exchange rate, which was

set at approximately 5.60 to 1 U.S. dollar at September 30, 2011. At the same time, it significantly reduced the notional amount

of transactions that run through this Central Bank controlled, parallel rate market mechanism.

Since foreign exchange is no longer available in the historical parallel rate market, the Company is now using the exchange rate

available in the Central Bank-controlled parallel rate market as the translation rate for our Venezuela affiliates' financial

statements for the purposes of consolidation, rather than the official exchange rate, as this is the rate at which the Company is

obtaining U.S. dollars for the settlement of invoices on new imports. Due to the level of uncertainty in Venezuela, we cannot

predict the exchange rate that will ultimately be used to convert our local currency monetary assets to U.S. dollars in the future.

As a result, further charges reflecting a less favorable exchange rate outcome are possible.

Our ability to effectively manage sales and profit levels in Venezuela will be impacted by several factors, including the

Company's ability to mitigate the effect of any potential future devaluation, further actions of the Venezuelan government,

economic conditions in Venezuela, such as inflation and consumer spending, the availability of raw materials, utilities and

energy and the future state of exchange controls in Venezuela including the availability of U.S. dollars at the official foreign

exchange rate or the Central Bank-controlled parallel rate.

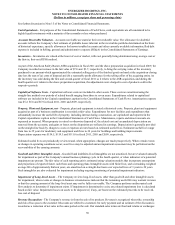

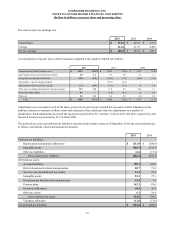

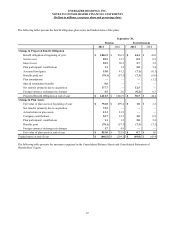

(6) Goodwill and Intangible Assets

Goodwill and intangible assets deemed to have an indefinite life are not amortized, but reviewed annually for impairment of

value or when indicators of a potential impairment are present. The Company monitors changing business conditions, which

may indicate that the remaining useful life of goodwill and other intangible assets may warrant revision or carrying amounts

may require adjustment. As part of our business planning cycle, we performed our annual impairment test in the fourth quarter

of fiscal 2011, 2010 and 2009. During fiscal 2011, we consolidated the Playtex and Wet Shave strategic business units, which

were both part of our Personal Care reporting segment, to form a single business unit. During our annual impairment testing in

fiscal 2011, we tested goodwill for impairment for both Wet Shave and Playtex individually and in the aggregate, in addition to

testing the goodwill associated with the Energizer reporting unit in our Household Products segment. There were no

indications of impairment of goodwill noted during this testing. Going forward, we will test goodwill for impairment for two

reporting units, the combined Personal Care reporting unit and the Energizer reporting unit.

In addition, we completed impairment testing on indefinite-lived intangible assets other than goodwill, which are trademarks/

brand names used in our various product categories. No impairment was indicated as a result of this testing. However, the

recorded values of such intangible assets from more recent acquisitions, such as the Playtex acquisition, are often more

susceptible to an impairment risk, if operating results or macroeconomic conditions deteriorate. Playtex indefinite-lived

intangible assets, exclusive of goodwill, represent more than 75% of total indefinite-lived intangible assets, exclusive of

59