Energizer 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

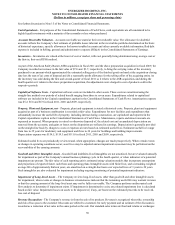

On September 15, 2011, the FASB issued a new ASU to Testing Goodwill for Impairment. The new guidance provides an

option to perform a "qualitative" assessment to determine whether further impairment testing is necessary. This guidance will

be applied on a prospective basis beginning on January 1, 2012.

(3) American Safety Razor acquisition

On November 23, 2010, we completed the acquisition of ASR, as we acquired substantially all of the assets of ASR, including

the assets of its U.S. subsidiaries and the stock of its non-U.S. subsidiaries, and assumed substantially all of the liabilities of

ASR and its U.S. subsidiaries, for a cash purchase price of $301. The Company financed this transaction with available cash of

approximately $129 and borrowings from our existing receivable securitization program. ASR is part of our Personal Care

Segment. ASR provides an important strategic fit and opportunity for the Personal Care business as it competes in the value

segment of the wet shave category. The Company’s legacy Wet Shave product line focuses on branded wet shave products.

ASR, founded in 1875, is a leading global manufacturer of private label/value wet shaving razors and blades, and industrial and

specialty blades.

As of September 30, 2011, the purchase price allocation for the ASR acquisition is complete. We have determined the fair

values of assets acquired and liabilities assumed for purposes of allocating the purchase price, in accordance with accounting

guidance for business combinations. For purposes of the allocation, the Company has estimated a fair value adjustment for

inventory based on the estimated selling price of the finished goods acquired at the closing date less the sum of (a) costs of

disposal and (b) a reasonable profit allowance for the selling effort of the acquiring entity. The fair value adjustment for the

acquired equipment was established using a cost and market approach. The fair values of the identifiable intangible assets were

estimated using various valuation methods including discounted cash flows using both an income and cost approach. In

accordance with fair value measurement guidance, the Company determined that the non-financial assets and liabilities

summarized below are derived from significant unobservable inputs (“Level 3 inputs”).

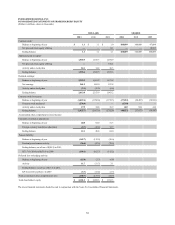

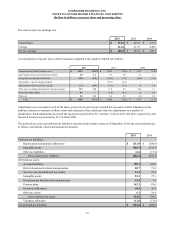

At September 30, 2011, the allocation of the purchase price is as follows:

Cash

Trade receivables, net

Inventories

Identifiable intangible assets

Goodwill

Other assets

Property, plant and equipment, net

Accounts payable and other liabilities

Income taxes payable

Pension/Other Postretirement Benefits

Net assets acquired

$ 33.9

52.4

45.8

122.3

161.9

51.9

117.1

(101.2)

(60.5)

(122.6)

$ 301.0

The purchased identifiable intangible assets are as follows:

Customer Relationships

Technology and patents

Tradenames / Brands

Total

Total

$ 94.4

20.4

7.5

$ 122.3

Estimated Life

20 years

7 years

15 years

For tax purposes, Goodwill will be amortized over 15 years.

Proforma revenue and operating results for ASR are not included as they are not considered material to the Consolidated

Financial Statements.

57