Energizer 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

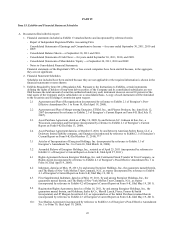

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

Operating Results

Net Sales

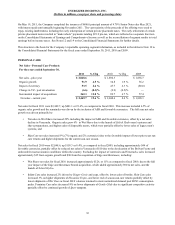

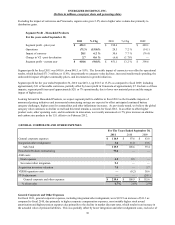

Net Sales - Total Company

For the Years Ended September 30,

Net sales - prior year

Organic change

Impact of currency

Change in VZ - post devaluation

Incremental impact of acquisitions

Net sales - current year

2011

$ 4,248.3

42.0

108.4

(15.3)

262.3

$ 4,645.7

% Chg

1.0 %

2.6 %

(0.4)%

6.2 %

9.4 %

2010

$ 3,999.8

80.7

101.4

(23.3)

89.7

$ 4,248.3

% Chg

2.1 %

2.5 %

(0.6)%

2.2 %

6.2 %

2009

$ 4,331.0

(164.3)

(224.3)

—

57.4

$ 3,999.8

Net sales for fiscal 2011 were $4,645.7, an increase of $397.4, or 9.4%, as compared to fiscal 2010, due primarily to the

inclusion of ASR and the favorable impacts of currencies. On an organic basis, net sales for the fiscal year increased 1% as

higher sales in Personal Care due, in part, to the Schick Hydro launch, higher sales of disposable razors and stronger Skin Care

revenue were offset by declines in Household Products and legacy men's razor systems.

Net sales for fiscal 2010 were $4,248.3, an increase of $248.5, or 6.2%, as compared to fiscal 2009, including the favorable

impact of currencies of approximately $100, and a year-over-year increase of approximately $90 from the full year ownership

of the Edge and Skintimate shave preparation brands. The total year growth was also positively impacted by the Schick Hydro

launch in the third quarter of fiscal 2010. The devaluation and difficult economic conditions in Venezuela resulted in a

reduction in net sales of approximately $23 in fiscal 2010. Net sales for both Personal Care and Household Products grew

approximately 2% on an organic basis in fiscal 2010.

For further discussion regarding net sales in Personal Care and Household Products, please see the section titled “Segment

Results” provided below.

Gross Profit

Gross profit dollars were $2,145.7 in fiscal 2011, an increase of $126.4, or 6.3% as compared to $2,019.3 in fiscal 2010 and

$1,858.6 in fiscal 2009.

Gross Margin as a percent of net sales for fiscal 2011 was 46.2%, down 130 basis points as compared to fiscal 2010. This

decrease was due primarily to the inclusion of value priced ASR products, which reduced gross margin by approximately 130

basis points during the period. In addition, higher commodity costs primarily in batteries, and higher coupon and trade

promotion related to the Schick Hydro launch were offset by favorable currencies and product mix.

Gross margin as a percent of net sales was 47.5% in fiscal 2010 and 46.5% in fiscal 2009. The margin percentage increase in

fiscal 2010 was due primarily to favorable currencies, excluding Venezuela, which added approximately 90 basis points.

Selling, General and Administrative

Selling, general and administrative expenses (SG&A) were $856.1, or 18.4% of net sales as compared to $765.7, or 18.0% of

net sales for fiscal 2010. The dollar increase of $90.4 was due to the inclusion of approximately $49 of expenses related to

ASR, which were not incurred in the prior year, the unfavorable impact of currencies of approximately $19, investments in

growth initiatives of approximately $12 and approximately $10 in higher pension expenses due primarily to the actuarial

impact of lower market discount rates on the value of pension liabilities. ASR expenses in fiscal 2011 included approximately

$13 million of non-recurring transaction/integration expenses. SG&A increased $23.1 in fiscal 2010 as compared to fiscal

2009 due primarily to the impact of annual merit increases and support of growth initiatives.

Advertising and Promotion

For fiscal 2011, advertising and promotion (A&P) was $524.0, an increase of $62.7 as compared to fiscal 2010. A&P as a

percent of net sales for fiscal 2011 was 11.3% as compared 10.9% of net sales in fiscal 2010. Excluding the net sales and A&P

related to ASR, which has a relatively low level of consumer spending in comparison to our other products, A&P as a percent

31