Energizer 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

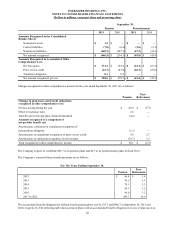

In October 2007, the Company granted RSE awards to certain employees which included approximately 234,800 shares, of

which 210,000 vested and granted an additional 11,000 shares, all of which fully vested. At the same time, the Company

granted RSE awards to senior executives totaling approximately 268,700 shares which vested as follows: 1) 25% of the total

restricted stock equivalents granted, or 67,000 net of forfeitures, vested on the third anniversary of the date of grant; 2) the

remainder of the RSE did not vest because the Company performance target was not achieved.

In October 2008, the Company granted RSE awards to certain employees which included approximately 265,200 shares that in

most cases vest ratably over four years or upon death, disability or change of control. At the same time, the Company granted

RSE awards to senior executives totaling approximately 374,600 which vested as follows: 1) 25% of the total restricted stock

equivalents granted, or 91,900, net of forfeitures, vested on the third anniversary of the date of grant; 2) the remainder of the

RSE did not vest because the Company performance target was not achieved.

In February 2009, the Company granted RSE awards to senior executives totaling approximately 296,000 shares. These awards

were granted in lieu of (i) each executive’s continued participation in the 2009 annual cash bonus program, (ii) his or her right

to receive accruals under the Company’s Supplemental Executive Retirement Plan (an excess pension plan) for calendar year

2009, and (iii) his or her right to receive Company matching accruals under the Company’s Executive Savings Investment Plan

(an excess 401(k) plan) for the 2009 calendar year. Vesting of the equivalents occurred on November 16, 2009, and the number

of shares vested, which was 142,466, was determined based on achievement of individual and Company performance targets

for the period from October 1, 2008 through September 30, 2009. The total award which vested was amortized over the vesting

period.

In October 2009, the Company granted RSE awards to certain employees which included approximately 266,300 shares that in

most cases vest ratably over four years or upon death, disability or change of control. At the same time, the Company granted

two RSE awards to senior executives. One grant includes approximately 145,900 shares and vests on the third anniversary of

the date of grant or upon death, disability or change of control. The second grant includes approximately 339,700 performance

shares which vests on the date that the Company publicly releases its earnings for its 2012 fiscal year contingent upon the

Company’s compound annual growth rate for reported earnings per share (EPS CAGR) for the three year period ending on

September 30, 2012. Under the terms of the performance award, 100% of the grant vests if a three year EPS CAGR of at least

12% is achieved, with smaller percentages vesting if the Company achieves a three year EPS CAGR between 5% and 12%. In

addition, the terms of the performance awards provide that the awards vest upon death, disability and in some instances upon

change of control. The total performance award expected to vest is amortized over the vesting period.

In October 2010, the Company granted RSE awards to certain employees which included approximately 313,300 shares that in

most cases vest ratably over four years or upon death, disability or change of control. At the same time, the Company granted

two RSE awards to key executives. One grant includes approximately 86,700 shares and vests on the third anniversary of the

date of grant or upon death, disability or change of control. The second grant includes approximately 202,300 shares which

vests on the date that the Company publicly releases its earnings for its 2013 fiscal year contingent upon the Company’s EPS

CAGR for the three year period ending on September 30, 2013. Under the terms of the award, 100% of the grant vests if an

EPS CAGR of at least 12% is achieved, with smaller percentages vesting if the Company achieves an EPS CAGR between 5%

and 12%. In addition, the terms of the performance awards provide that the awards vest upon death, disability and in some

instances upon change of control. The total performance award expected to vest will be amortized over the vesting period.

In November 2010, the Company granted two RSE awards to executive officers. One grant includes approximately 47,900

shares and vests on the third anniversary of the date of grant or upon death, disability or change of control. The second grant

includes approximately 111,700 shares which vests on the date that the Company publicly releases its earnings for its 2013

fiscal year contingent upon the Company’s EPS CAGR for the three year period ending on September 30, 2013. Under the

terms of the award, 100% of the grant vests if an EPS CAGR of at least 12% is achieved, with smaller percentages vesting if

the Company achieves an EPS CAGR between 5% and 12%. In addition, the terms of the performance awards provide that the

awards vest upon death, disability and in some instances upon change of control. The total performance award expected to vest

will be amortized over the vesting period.

The Company records estimated expense for the performance based grants based on target achievement for the three year

period for each respective program unless evidence exists that a different ultimate CAGR is likely to occur. Fair value of the

award is determined using the closing share price of the Company's common stock on the date of the grant.

65