Energizer 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

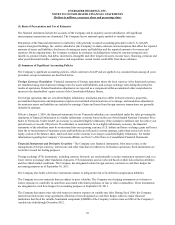

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

are not permitted unless a special exception is made; reserves are established and recorded in cases where the right of return

does exist for a particular sale.

Under certain circumstances, we allow customers to return sun care products that have not been sold by the end of the sun care

season, which is normal practice in the sun care industry. We record sales at the time the title, ownership and risk of loss pass to

the customer. The terms of these sales vary but, in all instances, the following conditions are met: the sales arrangement is

evidenced by purchase orders submitted by customers; the selling price is fixed or determinable; title to the product has

transferred; there is an obligation to pay at a specified date without any additional conditions or actions required by the

Company; and collectability is reasonably assured. Simultaneously with the sale, we reduce sales and cost of sales, and reserve

amounts on our consolidated balance sheet for anticipated returns based upon an estimated return level, in accordance with

GAAP. Customers are required to pay for the sun care product purchased during the season under the required terms. We

generally receive returns of U.S. sun care products from September through January following the summer sun care season. We

estimate the level of sun care returns using a variety of inputs including historical experience, consumption trends during the

sun care season and inventory positions at key retailers as the sun care season progresses. We monitor shipment activity and

inventory levels at key retailers during the season in an effort to identify potential returns issues. This allows the Company to

manage shipment activity to our customers, especially in the latter stages of the sun care season, to reduce the potential for

returned product.

The Company offers a variety of programs, such as consumer coupons and similar consumer rebate programs, primarily to its

retail customers, designed to promote sales of its products. Such programs require periodic payments and allowances based on

estimated results of specific programs and are recorded as a reduction to net sales. The Company accrues, at the time of sale,

the estimated total payments and allowances associated with each transaction. Additionally, the Company offers programs

directly to consumers to promote the sale of its products. Promotions which reduce the ultimate consumer sale prices are

recorded as a reduction of net sales at the time the promotional offer is made, generally using estimated redemption and

participation levels. Taxes we collect on behalf of governmental authorities, which are generally included in the price to the

customer, are also recorded as a reduction of net sales. The Company continually assesses the adequacy of accruals for

customer and consumer promotional program costs not yet paid. To the extent total program payments differ from estimates,

adjustments may be necessary. Historically, these adjustments have not been material.

Advertising and Promotion Costs – The Company advertises and promotes its products through national and regional media

and expenses such activities in the year incurred.

Fair Values of Financial Instruments - Certain financial instruments are required to be recorded at fair value. Changes in

assumptions or estimation methods could affect the fair value estimates; however, we do not believe any such changes would

have a material impact on our financial condition, results of operations or cash flows. Other financial instruments including

cash and cash equivalents and short-term borrowings, including notes payable, are recorded at cost, which approximates fair

value. The fair values of long-term debt and financial instruments are disclosed in Note 15 of the Notes to Consolidated

Financial Statements.

Reclassifications - Certain reclassifications have been made to the prior year financial statements to conform to the current

presentation.

Recently Issued Accounting Pronouncements – Other than as described below, no new accounting pronouncement issued or

effective during the fiscal year has had or is expected to have a material impact on the consolidated financial statements.

On May 12, 2011, the Financial Accounting Standards Board (FASB) issued a new accounting standard update (ASU) to Fair

Value Measurements. The new guidance results in a consistent definition of fair value and common requirements for

measurement of and disclosure about fair value between U.S. GAAP and IFRS. These disclosures will be applied on a

prospective basis beginning on January 1, 2012.

On June 16, 2011, the FASB issued a new ASU to the Presentation of Comprehensive Income. The new guidance eliminated

the current option to report other comprehensive income and its components in the statement of changes in equity. This has no

effect on the Company as we have historically reported comprehensive income on the Statements of Earnings and

Comprehensive Income.

56