Energizer 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

The counterparties to long-term committed borrowings consist of a number of major financial institutions. The Company

continually monitors positions with, and credit ratings of, counterparties both internally and by using outside ratings agencies.

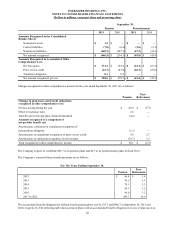

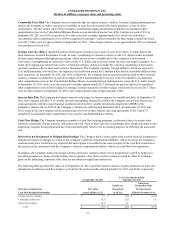

Aggregate maturities of long-term debt, including current maturities, at September 30, 2011 are as follows for the fiscal years’

noted: $106.0 in 2012, $566.5 in 2013, $140.0 in 2014, $230.0 in 2015, $210.0 in 2016 and $1,060.0 thereafter. At this time,

the Company intends to repay only scheduled debt maturities over the course of the next fiscal year with the intent to preserve

committed liquidity.

(13) Preferred Stock

The Company’s Articles of Incorporation authorize the Company to issue up to 10 million shares of $0.01 par value of

preferred stock. During the three years ended September 30, 2011, there were no shares of preferred stock outstanding.

(14) Shareholders’ Equity

At September 30, 2011, there were 300 million shares of ENR stock authorized, of which approximately 1.3 million shares

were reserved for issuance under the 2000 Incentive Stock Plan and 1.7 million shares were reserved for issuance under the

2009 Incentive Stock Plan.

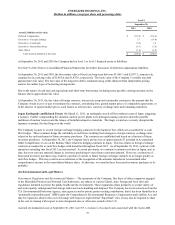

Beginning in September 2000, the Company’s Board of Directors has approved a series of resolutions authorizing the

repurchase of shares of ENR common stock, with no commitments by the Company to repurchase such shares. On July 24,

2006, the Board of Directors approved the repurchase of up to an additional 10 million shares. In fiscal 2011, the Company

repurchased 3.7 million shares of Energizer common stock, exclusive of a small number of shares related to the net settlement

of certain stock awards for tax withholding purposes, for a total cost of approximately $276. Since the end of fiscal 2011 and

through November 20, the Company repurchased an additional 0.8 million shares of its common stock at a total cost of

approximately $56. All of the shares were purchased in the open market under the Company's current authorization from its

Board of Directors. The Company has approximately 3.4 million shares remaining on the above noted Board authorization to

repurchase its common stock in the future. Future purchases may be made from time to time on the open market or through

privately negotiated transactions, subject to corporate objectives and the discretion of management.

(15) Financial Instruments and Risk Management

The market risk inherent in the Company’s financial instruments and positions represents the potential loss arising from adverse

changes in currency rates, commodity prices, interest rates and the Company’s stock price. Company policy allows derivatives

to be used only for identifiable exposures and, therefore, the Company does not enter into hedges for trading purposes where

the sole objective is to generate profits.

Concentration of Credit Risk The counterparties to derivative contracts consist of a number of major financial institutions and

are generally institutions with which the Company maintains lines of credit. The Company does not enter into derivative

contracts through brokers nor does it trade derivative contracts on any other exchange or over-the-counter markets. Risk of

currency positions and mark-to-market valuation of positions are strictly monitored at all times.

The Company continually monitors positions with, and credit ratings of, counterparties both internally and by using outside

rating agencies. The Company has implemented policies that limit the amount of agreements it enters into with any one party.

While nonperformance by these counterparties exposes the Company to potential credit losses, such losses are not anticipated.

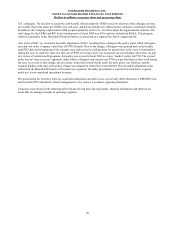

The Company sells to a large number of customers primarily in the retail trade, including those in mass merchandising,

drugstore, supermarket and other channels of distribution throughout the world. Wal-Mart Stores, Inc. and its subsidiaries

accounted for 19.5%, 20.1% and 21.4% of total net sales in fiscal 2011, 2010 and 2009, respectively, primarily in North

America. The Company performs ongoing evaluations of its customers' financial condition and creditworthiness, but does not

generally require collateral. The Company’s largest customer had obligations to the Company with a carrying value of $118.8 at

September 30, 2011. While the competitiveness of the retail industry presents an inherent uncertainty, the Company does not

believe a significant risk of loss from a concentration of credit risk exists with respect to accounts receivable.

In the ordinary course of business, the Company enters into contractual arrangements (derivatives) to reduce its exposure to

foreign currency, interest rate and commodity price risks. The section below outlines the types of derivatives that existed at

September 30, 2011 and 2010 as well as the Company’s objectives and strategies for holding these derivative instruments.

73