Energizer 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

of sales was 11.9% for fiscal 2011, up approximately 100 basis points as compared to fiscal 2010 due primarily to support for

the launch of Schick Hydro. A&P increased $46.8 in fiscal 2010 as compared to fiscal 2009 due to increased spending

including support of the Company's Schick Hydro launch in April 2010.

A&P expense was 11.3% (11.9% excluding the impact of ASR), 10.9% and 10.4% of sales for fiscal 2011, 2010 and 2009,

respectively. A&P expense may vary from year to year with new product launches, the impact of acquisitions, strategic brand

support initiatives, the overall competitive environment, and the state of the global economy.

We expect A&P as a percent of net sales for fiscal 2012 will track closer to historical rates from fiscal 2010 and 2009. We

remain committed to investing in innovation, brand and category development and other growth opportunities.

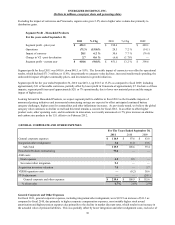

Research and Development

Research and development (R&D) expense was $108.3 in fiscal 2011, $97.1 in fiscal 2010 and $90.5 in fiscal 2009. The

increased expense in fiscal 2011 reflects additional spending in support of the Company’s growth initiatives and the inclusion

of ASR, which added approximately $7. As a percent of sales, R&D expense was approximately 2.3% in all three fiscal years

presented.

Interest, Cost of Debt Early Retirement and Other Financing Expense, net

Interest expense for fiscal 2011 was $121.4, a decrease of $4.0 as compared to fiscal 2010 due primarily to lower average

borrowings. In May, 2011, the Company issued $600.0 principal amount of 4.70% senior notes due May 2021, with interest

paid semi-annually beginning in November 2011. A significant portion of the net proceeds from the issuance of the senior

notes were used for the early redemption of certain private placement notes. This early redemption required a notice period,

which delayed our repayment of the private placement notes. We incurred approximately $3 of duplicate interest expense as a

result of this notice period. Exclusive of this duplicate cost, total interest expense for the full fiscal year in 2011 was down $7.0

compared to fiscal 2010.

As noted previously, the Company utilized a majority of the proceeds from its Senior Note issuance in May 2011 to repay

existing indebtedness including $475 of private placement notes with maturities ranging from 2011 to 2013. The early

retirement of certain of the private placement notes resulted in make-whole payments totaling $19.9, pre-tax, which is reflected

as a separate line item on the attached Statements of Earnings and Comprehensive Income.

Other financing expense, net was $31.0 in fiscal 2011 due primarily to losses on foreign exchange hedging contracts of

approximately $25, which were more than offset by the impact of favorable currencies included in divisional segment profit

results, which were approximately $55, and are detailed later in this discussion.

Interest expense for fiscal 2010 decreased $19.3 as compared to fiscal 2009 due primarily to lower average borrowings. Other

financing expense, net was $26.4 for fiscal 2010 as compared to $21.0 in fiscal 2009. The fiscal 2010 result includes an

exchange loss of $18.3, pre-tax, due primarily to the impact of the devaluation of the Venezuela Bolivar Fuerte. The year-over-

year change in other financing expense, net in fiscal 2010 as compared to fiscal 2009 was favorable, exclusive of the Venezuela

devaluation, as the first quarter of fiscal 2009 included a significant charge related to the strengthening of the U.S. dollar during

the economic crisis. This loss was not repeated in fiscal 2010.

Income Taxes

Income taxes, which include federal, state and foreign taxes, were 35.7%, 25.8% and 33.1% of earnings before income taxes in

fiscal 2011, 2010 and 2009, respectively. Income taxes include the following items which impacted the overall tax rate in the

fiscal years' indicated:

For Fiscal 2011:

• The Household Products restructuring included significant costs incurred in countries with comparatively low

effective tax rates, which has the effect of increasing our overall effective tax rate due to a lower tax benefit associated

with these costs,

• Establishment of an estimated valuation allowance for certain tax loss carryforwards of $4.5 related to costs incurred

from the fiscal 2011 closure of the Swiss plant as part of the Household Products restructuring,

• Tax expense of $6.9 due to the establishment of a valuation allowance for certain foreign tax loss carryforwards,

which are no longer likely to be utilized, based on a recent evaluation,

• Adjustments were recorded to reflect refinement of estimates of tax attributes to amounts in filed returns, settlement of

32