Energizer 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

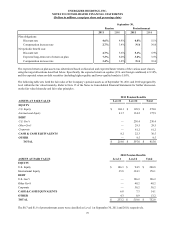

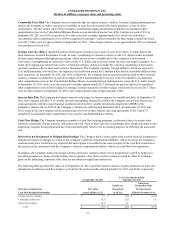

The Company’s total borrowings were $2,368.5 at September 30, 2011, including $503.5 tied to variable interest rates, of

which $300 is hedged via the interest rate swap noted below. The Company maintains total debt facilities of $2,818.5, exclusive

of available borrowings under the receivables securitization program, of which $438.2 remained available as of September 30,

2011, as reduced by $11.8 of outstanding letters of credit.

On May 19, 2011, the Company issued $600.0 principal amount of 4.7% Senior Notes due on May 2021. Interest is payable

semi-annually beginning November 2011.

The net proceeds from the sale of the notes were used for repayment of indebtedness and for general corporate purposes

including fees and expenses related to the debt offering. The indebtedness that was repaid included the following:

• $25.0 Private Placement notes with a fixed interest rate of 3.86%, due June 30, 2011,

• $140.0 Private Placement notes with a fixed interest rate of 6.05%, due June 30, 2011,

• $333.3 for the early redemption of certain Private Placement notes with fixed interest rates ranging from 3.9% to

6.1%, due 2011 to 2013. This included the payment of $310.0 in principal, $19.9 of “make-whole” premiums due to

the early retirement of the debt and $3.4 of accrued interest on the notes at the time of the redemption,

• $82.8 outstanding indebtedness under our $450.0 U.S. revolving credit facility,

• $14.4 outstanding indebtedness under our receivables securitization program, and

• $4.5 in fees and expenses related to the debt offering.

On May 6, 2011, the Company’s $450 U.S. revolving credit facility was renewed for a five year term. This renewal represents

an increase in the amount available under this revolving line of credit as compared to the $275 available under the facility prior

to the renewal. At September 30, 2011, there were no outstanding borrowings under this facility.

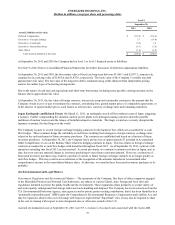

During the second quarter of fiscal 2009, the Company entered into interest rate swap agreements with two major financial

institutions that fixed the variable benchmark component (LIBOR) of the Company’s interest rate on $300 of the Company’s

variable rate debt through December 2012 at an interest rate of 1.9%.

Under the terms of the Company’s credit agreements, the ratio of the Company’s indebtedness to its EBITDA, as defined in the

agreements and detailed below, cannot be greater than 4.00 to 1, and may not remain above 3.50 to 1 for more than four

consecutive quarters. If and so long as the ratio is above 3.50 to 1 for any period, the Company is required to pay additional

interest expense for the period in which the ratio exceeds 3.50 to 1. The interest rate margin and certain fees vary depending on

the indebtedness to EBITDA ratio. Under the Company’s private placement note agreements, the ratio of indebtedness to

EBITDA may not exceed 4.00 to 1. However, if the ratio is above 3.50 to 1, the Company is required to pay an additional 75

basis points in interest for the period in which the ratio exceeds 3.50 to 1. In addition, under the credit agreements, the ratio of

its current year EBIT, as defined in the agreements, to total interest expense must exceed 3.00 to 1. The Company’s ratio of

indebtedness to its proforma EBITDA was 2.92 to 1, and the ratio of its proforma EBIT to total interest expense was 4.33 to 1,

as of September 30, 2011. These ratios were negatively impacted by a significant portion of the pre-tax charges associated with

the Household Products restructuring activities in fiscal 2011 as such charges reduced EBITDA as defined in the agreements.

If the Company fails to comply with the financial covenants referred to above or with other requirements of the credit

agreements or private placement note agreements, the lenders would have the right to accelerate the maturity of the debt.

Acceleration under one of these facilities would trigger cross defaults on other borrowings.

Under the credit agreements, EBITDA is defined as net earnings, as adjusted to add-back interest expense, income taxes,

depreciation and amortization, all of which are determined in accordance with GAAP. In addition, the credit agreement allows

certain non-cash charges such as stock award amortization and asset write-offs or impairments to be “added-back” in

determining EBITDA for purposes of the indebtedness ratio. Severance and other cash charges incurred as a result of

restructuring and realignment activities as well as expenses incurred in acquisition integration activities are included as

reductions in EBITDA for calculation of the indebtedness ratio. In the event of an acquisition, such as ASR in fiscal 2011, the

EBITDA is calculated on a proforma basis to include the trailing twelve-month EBITDA of the acquired company or brands.

Total debt is calculated in accordance with GAAP, but excludes outstanding borrowings under the receivable securitization

program. EBIT is calculated in a fashion identical to EBITDA except that depreciation and amortization are not “added-back”.

Total interest expense is calculated in accordance with GAAP.

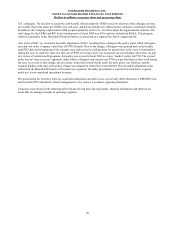

On May 2, 2011, the Company amended and renewed, for a three year term, its existing receivables securitization program.

Borrowings under this program, which may not exceed $200, receive favorable treatment in the Company's debt compliance

covenants. At September 30, 2011, $35.0 was outstanding under this facility.

72