Energizer 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10.60

10.61

13

21

23

31.1

31.2

32.1

32.2

101

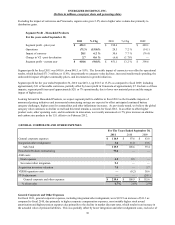

Form of Performance Restricted Stock Equivalent Award Agreement (incorporated by reference to Exhibit

10.2 of Energizer's Current Report on Form 8-K filed October 21, 2011).*

Form of Restricted Stock Equivalent Award Agreement (incorporated by reference to Exhibit 10.3 of

Energizer's Current Report on Form 8-K filed October 21, 2011).*

Portions of the Energizer Holdings, Inc. 2011 Annual Report to Shareholders for the year ended September

30, 2011, incorporated by reference herein.**

Subsidiaries of Registrant.**

Consent of Independent Registered Public Accounting Firm.**

Section 302 Certification of Chief Executive Officer.**

Section 302 Certification of Executive Vice President and Chief Financial Officer.**

Section 1350 Certification of Chief Executive Officer.**

Section 1350 Certification of Executive Vice President and Chief Financial Officer.**

Attached as Exhibit 101 to this Form 10-K are the following documents formatted in eXtensible Business

Reporting Language (XBRL): (i) Consolidated Statements of Earnings and Comprehensive Income for the

years ended September 30, 2009, 2010 and 2011, (ii) Consolidated Balance Sheets at September 30, 2010

and 2011, (iii) Consolidated Statements of Cash Flows for the years ended September 30, 2009, 2010 and

2011, (iv) Consolidated Statements of Shareholders' Equity for the years ended September 30, 2009, 2010

and 2011, and (v) Notes to Consolidated Financial Statements for the year ended September 30, 2011. In

accordance with Rule 406T of Regulation S-T, the XBRL related information in Exhibit 101 to this Annual

Report on Form 10-K shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act,

and shall not be deemed “filed” or part of any registration statement or prospectus for purposes of Section

11 or 12 under the Securities Act of 1933 or the Securities Exchange Act of 1934, or otherwise subject to

liability under those sections, except as shall be expressly set forth by specific reference in such filing. The

financial information contained in the XBRL-related documents is “unaudited” and “unreviewed.”**

*Denotes a management contract or compensatory plan or arrangement.

**Denotes filed herewith.

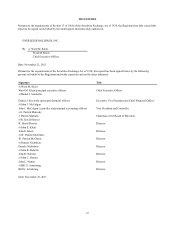

***The Asset Purchase Agreement has been included to provide investors and shareholders with information regarding its

terms. It is not intended to provide any factual, business or operational information about Energizer or ASR. The Asset

Purchase Agreement contains representations and warranties that the parties to the Agreement made solely for the benefit of

each other. The assertions embodied in such representations and warranties are qualified by information contained in

confidential disclosure schedules that ASR provided to Energizer in connection with execution of the Asset Purchase

Agreement. These disclosure schedules contain information that modifies, qualifies and creates exceptions to the

representations and warranties set forth in the Asset Purchase Agreement. Moreover, the representations and warranties in the

Asset Purchase Agreement (i) are subject to materiality standards which may differ from what may be viewed as material by

investors and shareholders, (ii) in certain cases, were used for the purpose of allocating risk among the parties rather than

establishing matters as facts and (iii) were only made as of the date of the Asset Purchase Agreement and are modified in

important part by the underlying disclosure schedules. Accordingly, investors and shareholders should not rely on such

representations and warranties as characterizations of the actual state of facts or circumstances. Moreover, information

concerning the subject matter of such representations and warranties may change after the date of the Asset Purchase

Agreement, which subsequent information may or may not be fully reflected in Energizer's public disclosures. Pursuant to

Item 601 (b) (2) of Regulation S-K schedules have been omitted and will be furnished supplementally to the SEC upon request.

26