Energizer 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

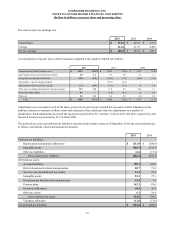

There were no Level 3 pension and other postretirement plan assets at September 30, 2011 and 2010.

Our investment objective for defined benefit retirement plan assets is to satisfy the current and future pension benefit

obligations. The investment philosophy is to achieve this objective through diversification of the retirement plan assets. The

goal is to earn a suitable return with an appropriate level of risk while maintaining adequate liquidity to distribute benefit

payments. The diversified asset allocation includes equity positions, as well as a fixed income allocation. The increased

volatility associated with equities is offset with higher expected returns, while the long duration fixed income positions help

dampen the volatility of the overall portfolio. Risk exposure is controlled by rebalancing the retirement plan assets back to

target allocations, as needed. Investment firms managing retirement plan assets carry out investment policy within their stated

guidelines. Investment performance is monitored against benchmark indices, which reflect the policy and target allocation of

the retirement plan assets.

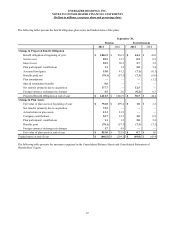

Effective January 1, 2010, the pension benefit earned to date by active participants under the legacy Energizer U.S. pension

plan was frozen and future retirement benefits accrue to active non-ASR participants using a new retirement accumulation

formula. Under this new formula, active non-ASR participants earn a retirement benefit equal to 6% per annum of their

pensionable earnings during a calendar year. In addition, an interest credit is applied to the benefits earned under this revised

formula at a rate equal to a 30 year U.S. Treasury note. Finally, active non-ASR participants that met certain age and service

criteria as of December 31, 2009, receive a transitional benefit in addition to the pension credit of 6% per annum. This

transitional benefit provides an additional pension credit of 2% to 4% per annum of pensionable earnings plus the applicable

interest credit, through 2014. As part of the ASR acquisition in early fiscal 2011, Energizer assumed the legacy benefits under

the two frozen ASR pension plans.

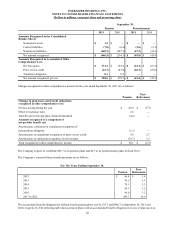

In March 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010

(the Acts) were signed into law in the United States. This legislation extends health care coverage to many uninsured

individuals and expands coverage to those already insured. We have evaluated the effect of the Acts on our U.S. retiree medical

obligation. Under the structure of our U.S. plan, the Company has limited its financial commitment for the benefits provided

under the plan; all costs in excess of the Company's commitment are allocated to the retirees. Any increased costs from the Acts

will also be allocated to the retirees and will not change the Company's financial commitment. As such, we have not added any

additional obligation related to the Acts to the Company's postretirement benefit obligation.

(11) Defined Contribution Plan

The Company sponsors a defined contribution plan, which extends participation eligibility to substantially all U.S. employees,

other than legacy ASR employees. The Company matches 50% of participant’s before-tax contributions up to 6% of eligible

compensation. Prior to January 1, 2010, after-tax contributions not exceeding 1% of participant's compensation were matched

325% by the Company. Amounts charged to expense during fiscal 2011, 2010, and 2009 were $9.2, $8.0, and $8.1,

respectively, and are reflected in SG&A and Cost of products sold in the Consolidated Statements of Earnings. Also included

in the fiscal 2011 expense was $0.9 related to the matching components of two legacy ASR plans. These plans were part of the

ASR acquisition that occurred in early fiscal 2011.

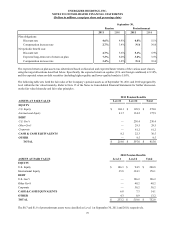

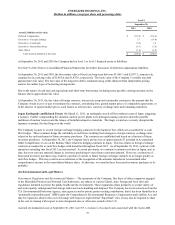

(12) Debt

Notes payable at September 30, 2011 and 2010 consisted of notes payable to financial institutions with original maturities of

less than one year of $56.0 and $24.9, respectively, and had a weighted-average interest rate of 3.1% and 5.7%, respectively.

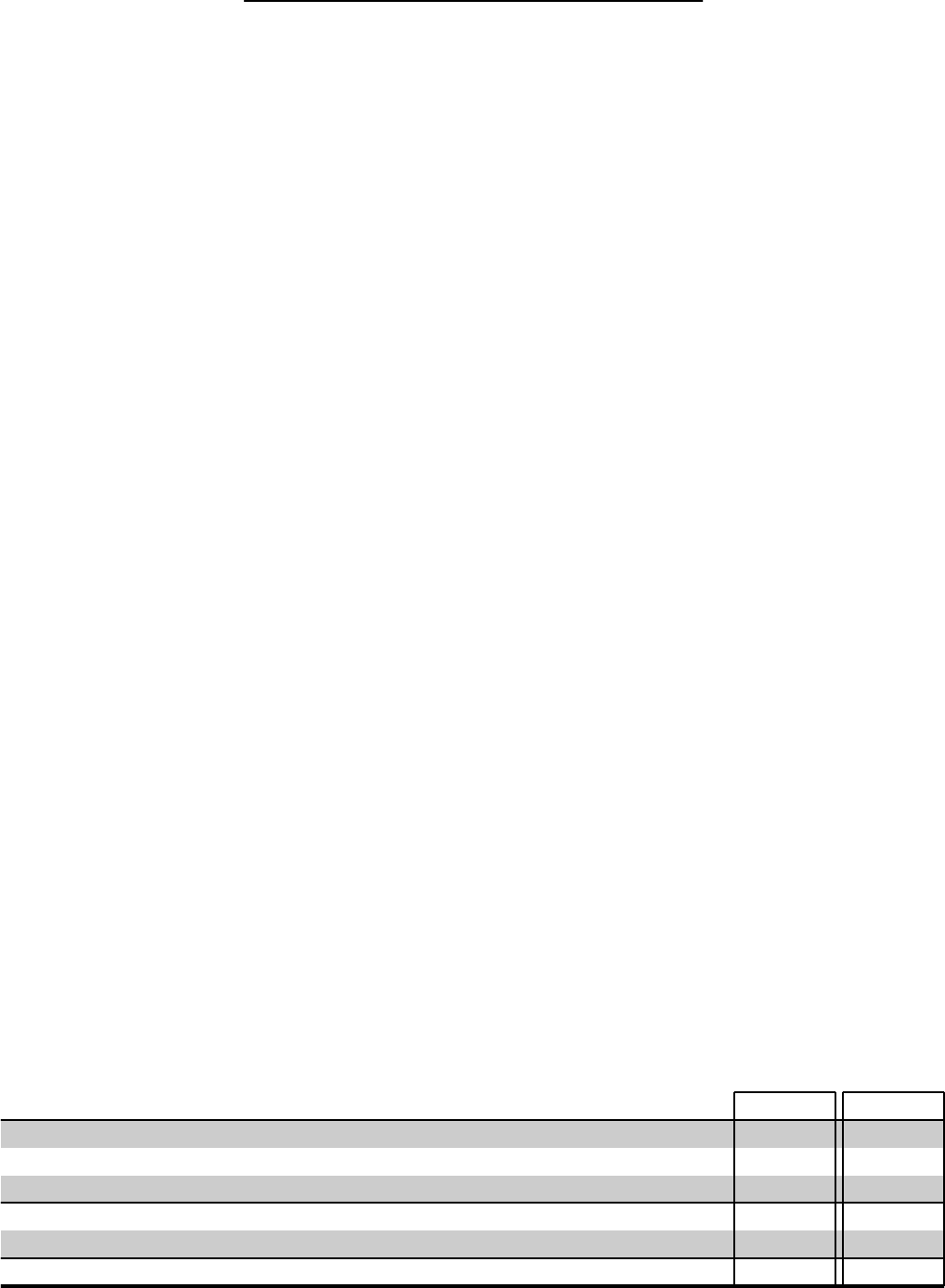

The detail of long-term debt at September 30 for the year indicated is as follows:

Private Placement, fixed interest rates ranging from 4.1% to 6.6%, due 2012 to 2017

Senior Notes, fixed interest rate of 4.7%, due 2021

Term Loan, variable interest at LIBOR + 75 basis points, or 1.0%, due December 2012

Total long-term debt, including current maturities

Less current portion

Total long-term debt

2011

$1,265.0

600.0

447.5

2,312.5

106.0

$2,206.5

2010

$1,835.0

$0.0

453.5

2,288.5

266.0

$2,022.5

71