Energizer 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ese investments had a signicant impact on our 2011 results, but we

believe they make us a stronger competitor in increasingly challenging markets,

which should deliver benets going forward and lead to a return to meaningful

earnings growth.

e Global Launch of Schick Hydro® A major focus of our Year of Investment

was the continuing roll-out of Schick Hydro, a new shaving system with

technological innovations that are redening the wet shave category. Our

distribution build was our fastest ever, with the April 2010 debut of Hydro in

the United States closely followed by launches in Japan in August 2010 and in

major Western European markets in October 2010.

e magnitude of the investment in the Hydro launch is reected in our

spending on advertising and promotion, which was 11.3 percent of net sales

(11.9 percent excluding ASR) as compared to 10.3 percent of net sales in 2009.

Consumers who try Hydro generate repeat rates that are the strongest we have

ever experienced in the wet shave market. And the positive reception to Hydro

is driving market share gains for Schick wet shave products. In the U.S., Schick’s

value market share of men’s systems has increased nearly ve share points, and

our total manual shave value market share has increased 1.5 points since the

Hydro launch.* Schick Hydro is more than a product, it is a growth platform we

expect to leverage with product add-ons, just as we did with Quattro® following

its introduction in 2003.

We continue to roll out Hydro in new markets, with recent launches in

Austria, Switzerland and Spain. By scal-year end, we had launched Hydro for

men in all of our major markets.

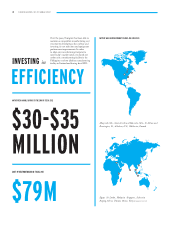

Restructuring Our Battery Operations e restructuring of our battery

manufacturing operations included closing an alkaline production facility in

Switzerland and a carbon zinc product facility in the Philippines, and reducing

production capacity in other locations. Total restructuring costs for the

scal year were $79 million, most of which was related to manufacturing

capacity rationalization.

e restructuring improves our positioning in a market with declining

unit sales and intensifying competition. It is expected to generate annual

savings estimated at $30 to $35 million by the end of scal 2012, improve our

productivity and capacity utilization, and create a simpler business model.

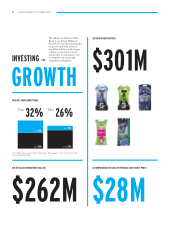

e ASR Acquisition Our acquisition of ASR for a cash price of $301 million

broadened our wet shave product portfolio, enhancing our ability to deliver total

category solutions to our retail customers; expanded our manufacturing capacity;

and provided greater scale. With approximately half of ASR sales outside the

United States, we see opportunities to accelerate growth in developing markets.

We are pleased with ASR’s results since its acquisition in November 2010.

ASR is the third-largest manufacturer and distributor of wet shave products

and a leading supplier of private-label razors and blades, with a majority share of

the private label segment.

ENERGIZER HOLDINGS, INC. 2011 ANNUAL REPORT 3

SHAVE PREP

Edge® and Skintimate® continue

to be the U.S. market share leaders

in shave prep. e addition of

Hydro Gel to the shave prep

portfolio has been largely

incremental to the business,

helping grow our total U.S. dollar

share of the shave prep category.

FEMININE CARE

Playtex® Sport® grew tampon

share behind sales growth on

larger pack sizes and the launch of

Super Plus absorbency tampons.

*52-weeks ending October 29, 2011, versus 52-week ending April 3, 2010. Source: Nielsen Scantrack, Total U.S. FDMx.

References to market shares represent U.S. dollar

share for 52 weeks as reported by Nielsen FDMx.