Energizer 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

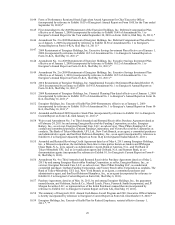

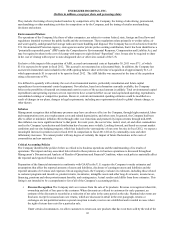

Segment Profit - Personal Care Products

For the years ended September 30,

Segment profit - prior year

Operations

Impact of currency

Change in VZ - post devaluation

Incremental impact of acquisitions

Segment profit - current year

2011

$ 366.6

(11.9)

26.9

(1.2)

28.0

$ 408.4

% Chg

(3.2)%

7.3 %

(0.3)%

7.6 %

11.4 %

2010

$ 341.1

(25.1)

24.9

3.2

22.5

$ 366.6

% Chg

(7.3)%

7.3 %

0.9 %

6.6 %

7.5 %

2009

$ 322.5

33.8

(20.0)

—

4.8

$ 341.1

Segment profit for fiscal 2011 was $408.4, up $41.8, or 11.4%, due to the favorable impacts of the inclusion of ASR and

currencies. This was partially offset by lower operational results of approximately $12, or 3%, due to increased A&P in support

of the Schick Hydro launch partially offset by higher margin from the organic sales growth noted above.

Segment profit for fiscal 2010 was $366.6, up $25.5, or 7.5%, as compared to fiscal 2009, due to the favorable impact of

currencies of approximately $25, exclusive of Venezuela. Excluding the impact of favorable currencies, segment profit was

essentially flat as higher gross margin from the increased sales noted above was offset by higher A&P and overhead spending

due, in part, to the support of the April 2010 Schick Hydro launch in North America and the full year impact of spending behind

Edge and Skintimate. Overall, the Venezuela devaluation and related deterioration in economic conditions in the country did not

have a material impact on year-over-year segment profit.

Looking forward in Personal Care and inclusive of a full year of ASR results, we expect segment profit growth in fiscal 2012

will be primarily driven by mid-single digit organic sales growth. We plan to continue to invest in trial generating activities,

brand equity and growth opportunities across all of our Personal Care categories to grow our sales and continue to enhance the

long term health of the business.

Finally, as noted in our discussion of the ASR acquisition, ASR manufactures and sells industrial and specialty blades. This is a

relatively small product line, with annualized sales of less than $50 and comparatively lower operating margins. We are

evaluating the potential sale of this business, as it is not strategic and does not integrate well into our existing Wet Shave

product line. We estimate that the carrying value of the assets that may be sold was approximately $30 at September 30, 2011.

On November 7, 2011, which is our first fiscal quarter of 2012, the Board of Directors delegated authority to pursue and

approve a potential sale of the industrial blade assets to senior management. The review of this potential action remains on-

going and we can provide no assurance that a sale will be completed.

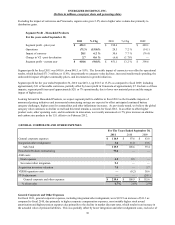

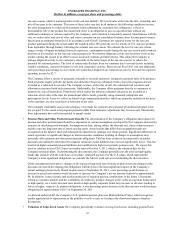

HOUSEHOLD PRODUCTS

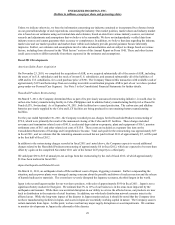

Net Sales - Household Products

For the years ended September 30,

Net sales - prior year

Organic Change

Impact of currency

Change in VZ - post devaluation

Net sales - current year

2011

$ 2,199.7

(49.9)

54.9

(8.7)

$ 2,196.0

% Chg

(2.3)%

2.5 %

(0.4)%

(0.2)%

2010

$ 2,109.5

45.9

57.7

(13.4)

$ 2,199.7

% Chg

2.2 %

2.7 %

(0.6)%

4.3 %

2009

$ 2,474.3

(220.5)

(144.3)

—

$ 2,109.5

For fiscal 2011, net sales were $2,196.0, essentially flat as compared to $2,199.7 for fiscal 2010. Organic sales declined 2.3%

as compared to fiscal 2010 due to continued negative category value trends and increased retailer trade spending, primarily in

the U.S. and Western Europe. We estimate that the dollar value of the battery category in global measured markets declined

in the low single digits in fiscal 2011. This decline in organic sales on a year over year basis was offset by favorable

currencies.

For fiscal 2010, net sales were $2,199.7, up $90.2 or 4.3%, including approximately $58 of favorable currencies. The currency

gains were partially offset by reduced net sales in Venezuela of approximately $13 due to the reasons noted previously.

35