Energizer 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

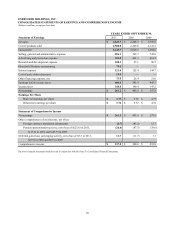

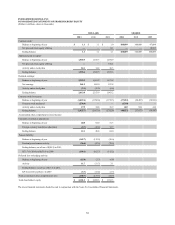

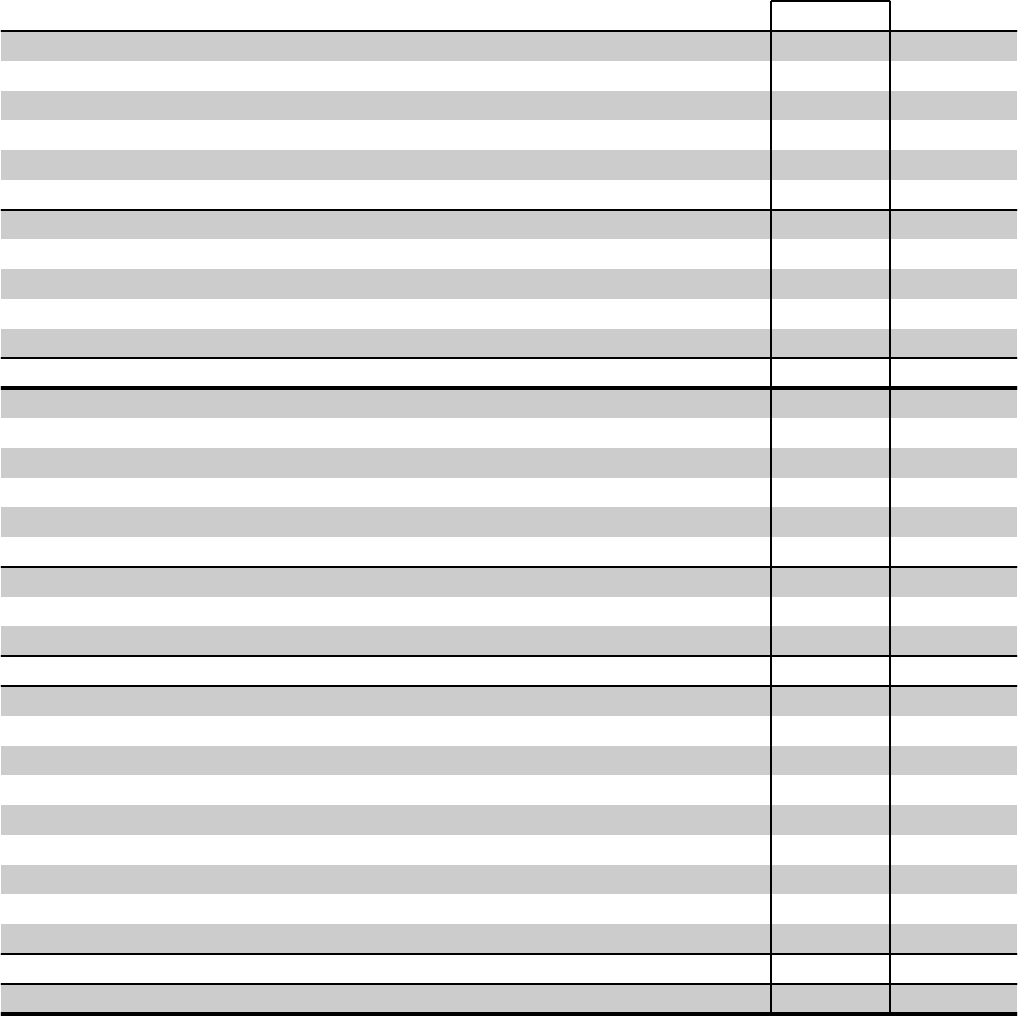

ENERGIZER HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

(Dollars in millions, except par values)

Assets

Current assets

Cash and cash equivalents

Trade receivables, net

Inventories

Other current assets

Total current assets

Property, plant and equipment, net

Goodwill

Other intangible assets, net

Other assets

Total assets

Liabilities and Shareholders' Equity

Current liabilities

Current maturities of long-term debt

Notes payable

Accounts payable

Other current liabilities

Total current liabilities

Long-term debt

Other liabilities

Total liabilities

Shareholders' equity

Preferred stock, $.01 par value, none outstanding

Common stock, $.01 par value, issued 108,008,682 shares at

2011 and 2010

Additional paid-in capital

Retained earnings

Common stock in treasury, at cost, 40,932,950 shares at 2011

37,652,891 shares at 2010

Accumulated other comprehensive loss

Total shareholders' equity

Total liabilities and shareholders' equity

SEPTEMBER 30,

2011

$ 471.2

893.6

653.4

374.4

2,392.6

885.4

1,475.3

1,878.2

31.9

$ 6,663.4

$ 106.0

56.0

289.6

707.7

1,159.3

2,206.5

1,196.3

4,562.1

—

1.1

1,593.6

2,613.0

(1,925.7)

(180.7)

2,101.3

$ 6,663.4

2010

$ 629.7

824.8

666.3

308.7

2,429.5

840.6

1,316.4

1,774.2

27.2

$ 6,387.9

$ 266.0

24.9

271.0

691.6

1,253.5

2,022.5

1,012.3

4,288.3

—

1.1

1,569.5

2,353.9

(1,667.6)

(157.3)

2,099.6

$ 6,387.9

The above financial statements should be read in conjunction with the Notes To Consolidated Financial Statements.

51