Energizer 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

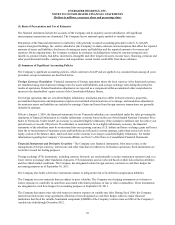

(4) Household Products Restructuring

The Company continually reviews its Personal Care and Household Products business models to identify potential

improvements and cost savings. On November 1, 2010, which was the first quarter of fiscal 2011, the Board of Directors (the

Board) authorized a Household Products program designed to accelerate investments in both geographic and product growth

opportunities, streamline our worldwide manufacturing operations and improve the efficiency of our administrative operations.

The Board authorized a broad restructuring plan and delegated authority to management to determine the final plan with

respect to the initiatives.

On March 7, 2011, the Company determined that, as part of its previously announced restructuring initiative, it would close its

carbon zinc battery manufacturing facility in Cebu, Philippines and its alkaline battery manufacturing facility in La Chaux De

Fonds (LCF), Switzerland. The carbon zinc and alkaline batteries previously supplied by the Cebu and LCF facilities are now

produced in our remaining battery manufacturing facilities.

At September 30, 2011, the Company recorded pre-tax charges for the Household Products restructuring of $79.0, which were

primarily the result of the announced closing of the Cebu and LCF facilities. These charges included severance and termination

related costs of $41.8, accelerated depreciation on property, plant and equipment of $16.1, pension settlement costs of $6.1 and

other related exit costs of $15.0. These costs are included as a separate line item on the Consolidated Statements of Earnings

and Comprehensive Income.

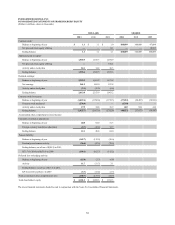

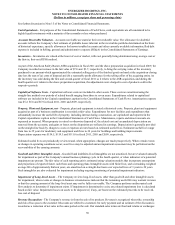

The following table summarizes the Household Products restructuring activities in fiscal 2011 and the remaining accrual

balance at September 30, 2011.

Fiscal 2011

Asset write-downs

Severance & Termination Related Costs

Pension Settlement Cost

Other Related Exit Costs/CTA

Total

Charges to

Income

$ 16.1

41.8

6.1

15.0

$ 79.0

Other/

CTA

$—

2.3

—

(0.8)

$ 1.5

Utilized

Cash

$—

(38.4)

(6.1)

(12.8)

$(57.3)

Non-Cash

$(16.1)

—

—

—

$(16.1)

Ending

Balance

$—

5.7

—

1.4

7.1

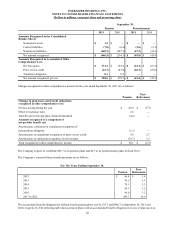

The Company estimates that total pre-tax charges of approximately $80 to $85 will be incurred as a result of the Household

Products restructuring initiative, inclusive of the $79.0 recorded as of September 30, 2011. These charges are expected to be

offset by a gain on the completed November 2011 sale of the former LCF property to a third party. We anticipate $30 to $35 of

annual pre-tax savings from the restructuring by the end of fiscal 2012, of which $11 were realized in fiscal 2011.

(5) Venezuela

For fiscal 2011, the Company recorded pre-tax expense of $1.8 related to the change in the carrying value of the net monetary

assets of its Venezuelan affiliate under highly inflationary accounting. This charge was included in other financing expense, net

on the Consolidated Statements of Earnings and Comprehensive Income.

At December 31, 2009, which is the end of our first fiscal quarter of 2010, the Company determined that the exchange rate

available in the parallel rate market was the appropriate rate to use for the translation of our Venezuela affiliates' financial

statements for the purpose of consolidation based on the facts and circumstances of our business, including the fact that, at the

time, the parallel rate market was the then current method used to settle U.S. dollar invoices for newly imported product. As a

result, the Company recorded a pre-tax loss, net of the impact of certain settlements and adjustments, primarily as a result of

devaluing its U.S. dollar based intercompany payable of approximately $18 in fiscal 2010, which was included in other

financing expense, net on the Consolidated Statements of Earnings and Comprehensive Income. The pre-tax loss reflects the

higher local currency expected to be required to settle this U.S. dollar based obligation due to the use of the parallel market rate

at that time, which was substantially unfavorable to the then official exchange rate. This U.S. dollar intercompany payable was

an obligation of our Venezuela affiliate to other Energizer affiliates for costs associated with the importing of goods for resale

58