Energizer 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

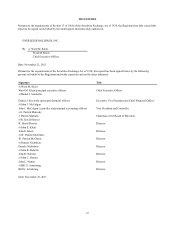

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

Excluding the impact of currencies and Venezuela, organic sales grew 2.2% due to higher sales volume due primarily to

distribution gains.

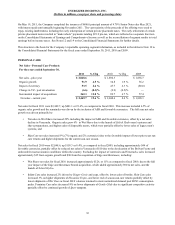

Segment Profit - Household Products

For the years ended September 30,

Segment profit - prior year

Operations

Impact of currency

Change in VZ - post devaluation

Segment profit - current year

2011

$ 451.1

(71.3)

28.1

2.7

$ 410.6

% Chg

(15.8)%

6.2 %

0.6 %

(9.0)%

2010

$ 398.6

28.5

30.6

(6.6)

$ 451.1

% Chg

7.2 %

7.7 %

(1.7)%

13.2 %

2009

$ 489.1

(14.1)

(76.4)

—

$ 398.6

Segment profit for fiscal 2011 was $410.6, down $40.5, or 9.0%. The favorable impact of currencies was offset by operational

results, which declined $71.3 million, or 15.8%, due primarily to category value declines, increased retailer trade spending, the

unfavorable impact of higher commodity prices, and investments in growth initiatives.

Segment profit for the year ended September 30, 2010 was $451.1, up $52.5 or 13.2% as compared to fiscal 2009, including

approximately $31 of favorable currencies, partially offset by lower profit in Venezuela of approximately $7. Exclusive of these

impacts, segment profit increased approximately $29, or 7% operationally, due to lower raw material prices and the margin

impact of higher sales.

Looking forward in Household Products, we expect segment profit to stabilize in fiscal 2012 as the favorable impacts of

announced pricing initiatives and incremental restructuring savings are expected to offset anticipated continued battery

category challenges, higher costs for commodities and other inflationary increases. As previously noted, we believe the global

category value continues to decline overall and this trend remains a concern for fiscal 2012. In an effort to offset higher

product costs, other operating costs, and investments in innovation, we recently announced a 6.7% price increase on alkaline

and carbon zinc products in the U.S. effective in February 2012.

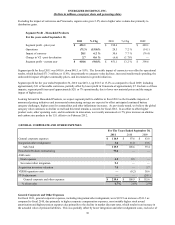

GENERAL CORPORATE AND OTHER EXPENSES

General corporate expenses

Integration/other realignment

Sub-Total

Household Products restructuring

ASR costs:

Deal expenses

Severance/other integration

Acquisition inventory valuation

VERO/separation costs

PTO adjustment

General corporate and other expenses

% of net sales

For The Years Ended September 30,

2011

$ 116.9

3.0

119.9

79.0

4.2

9.3

7.0

—

—

$ 219.4

4.7%

2010

$ 97.6

11.0

108.6

—

0.5

—

—

(0.2)

—

$ 108.9

2.6%

2009

$ 83.8

13.6

97.4

—

—

—

3.7

38.6

(24.1)

$ 115.6

2.9%

General Corporate and Other Expenses

For fiscal 2011, general corporate expenses, including integration/other realignment, were $119.9 an increase of $11.3 as

compared to fiscal 2010, due primarily to higher corporate compensation expenses, most notably higher stock award

amortization and higher pension expenses due primarily to the decline in market discount rates, which results in an increase in

the actuarial value of pension liabilities. This was partially offset by lower integration and other realignment costs, exclusive of

36