Energizer 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

There were no material tax loss carryforwards that expired in fiscal 2011. Future expirations of tax loss carryforwards and tax

credits, if not utilized, are not material from 2012 through 2015, and thereafter or no expiration, $22.5. The valuation allowance

is attributed to tax loss carryforwards and tax credits outside the U.S.

We regularly repatriate a portion of current year earnings from select non U.S. subsidiaries. Generally, these non-U.S.

subsidiaries are in tax jurisdictions with effective tax rates that do not result in materially higher U.S. tax provisions related to

the repatriated earnings. No provision is made for additional taxes on undistributed earnings of foreign affiliates that are

intended and planned to be indefinitely invested in the affiliate. We intend to, and have plans to, reinvest these earnings

indefinitely in our foreign subsidiaries to fund local operations, fund pension and other post retirement obligations and fund

capital projects. At September 30, 2011, approximately $980 of foreign subsidiary retained earnings was considered

indefinitely invested in those businesses. U.S. income taxes have not been provided for such earnings. It is not practicable to

determine the amount of unrecognized deferred tax liabilities associated with such earnings.

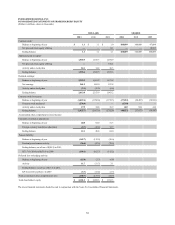

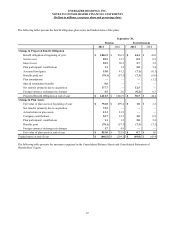

Unrecognized tax benefits activity for the years ended September 30, 2011 and 2010 are summarized below:

Unrecognized tax benefits, beginning of year

Additions based on current year tax positions and acquisitions

Reductions for prior year tax positions

Settlements with taxing authorities/statute expirations

Unrecognized tax benefits, end of year

2011

$ 48.7

8.1

(0.7)

(14.9)

41.2

2010

$ 46.9

5.0

(1.4)

(1.8)

48.7

Included in the unrecognized tax benefits noted above are $35.5 of uncertain tax positions that would affect the Company’s

effective tax rate, if recognized. The Company does not expect any significant increases or decreases to their unrecognized tax

benefits within twelve months of this reporting date. In the Consolidated Balance Sheets, unrecognized tax benefits are

classified as Other liabilities (non-current) to the extent that payment is not anticipated within one year.

The Company classifies accrued interest and penalties related to unrecognized tax benefits in the income tax provision. The

Company accrued approximately $7.6 of interest and $2.8 of penalties at September 30, 2011 and $7.0 of interest and $0.7 of

penalties at September 30, 2010. Interest was computed on the difference between the tax position recognized in accordance

with GAAP and the amount previously taken or expected to be taken in the Company’s tax returns.

The Company files income tax returns in the U.S. federal jurisdiction, various cities and states, and more than 50 foreign

jurisdictions where the Company has operations. U.S. federal income tax returns for tax years ended September 30, 2005 and

after remain subject to examination by the Internal Revenue Service. With few exceptions, the Company is no longer subject to

state and local income tax examinations for years before September 30, 2003. The status of international income tax

examinations varies by jurisdiction. The Company does not anticipate any material adjustments to its financial statements

resulting from tax examinations currently in progress.

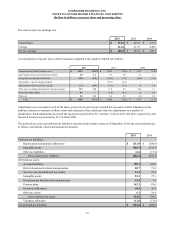

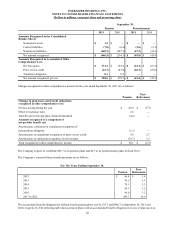

(8) Earnings Per Share

For each period presented below, basic earnings per share is based on the average number of shares outstanding during the

period. Diluted earnings per share is based on the average number of shares used for the basic earnings per share calculation,

adjusted for the dilutive effect of stock options and restricted stock equivalents.

62