Energizer 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

tax audits and other tax adjustments. These fiscal 2011 adjustments decreased the income tax provision by $1.7, and

• A tax benefit of $2.6 was recorded in fiscal 2011 associated with the write-up and subsequent sale of inventory

acquired in the ASR acquisition.

For Fiscal 2010:

• A $23.5 tax benefit related to the favorable impact of a foreign tax credit;

• Adjustments were recorded to reflect refinement of estimates of tax attributes to amounts in filed returns, settlement of

tax audits and other tax adjustments. The fiscal 2010 adjustment decreased the income tax provision by $6.1, and

• A $4.1 tax benefit was recorded in fiscal 2010 reflecting the local tax benefit of the Venezuela devaluation charge.

For Fiscal 2009:

• Adjustments were recorded to reflect refinement of estimates of tax attributes to amounts in filed returns, settlement of

tax audits and other tax adjustments. This adjustment increased the tax provision by $1.5 in fiscal 2009, and

• A tax benefit of $1.4 was recorded in fiscal 2009 associated with the write-up and subsequent sale of inventory

acquired in the Edge/Skintimate shave preparation acquisition.

The Company's effective tax rate is highly sensitive to the mix of countries, from which earnings or losses are derived.

Declines in earnings in lower tax rate countries, earnings increases in higher tax rate countries, repatriation of foreign earnings

or operating losses in the future could increase future tax rates. Additionally, adjustments to prior year tax provision estimates

could increase or decrease future tax provisions.

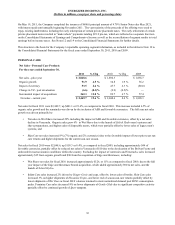

Segment Results

Operations for the Company are managed via two segments - Personal Care (Wet Shave, Skin Care, Feminine Care and Infant

Care) and Household Products (Battery and Lighting Products). On November 23, 2010, which is in the first fiscal quarter of

2011, we completed the acquisition of ASR, which is a leading global manufacturer of private label/value wet shaving razors

and blades, and industrial and specialty blades and is part of the Company’s Personal Care segment. Segment performance is

evaluated based on segment operating profit, exclusive of general corporate expenses, share-based compensation costs, costs

associated with most restructuring, integration or business realignment activities, including the Household Products

restructuring activities in fiscal 2011 and amortization of intangible assets. Financial items, such as interest income and

expense, are managed on a global basis at the corporate level.

The Company’s operating model includes a combination of stand-alone and combined business functions between the Personal

Care and Household Products businesses, varying by country and region of the world. Shared functions include product

warehousing and distribution, various transaction processing functions, and in some countries, a combined sales force and

management. Such allocations do not represent the costs of such services if performed on a stand-alone basis. The Company

applies a fully allocated cost basis, in which shared business functions are allocated between the businesses.

The reduction in gross profit associated with the write-up and subsequent sale of the inventory acquired in the ASR acquisition

in November 2010, which was $7.0 for fiscal 2011, and the Edge and Skintimate shave preparation acquisition in June 2009,

which was $3.7 for fiscal 2009, as well as the related expenses and integration costs for each of the acquisitions are not

reflected in the Personal Care segment, but rather presented below segment profit, as they are non-recurring items directly

associated with the acquisition. Such presentation reflects how management evaluates segment performance.

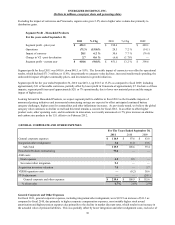

In fiscal 2011, the Company recorded expense of $1.8 related to the devaluation of its net monetary assets in Venezuela as a

result of accounting for the translation of this affiliate under the accounting rules governing a highly inflationary economy.

These results reflect an exchange rate of 5.6 Venezuelan Bolivar Fuerte to one U.S. dollar. In the prior fiscal year, the Company

recorded a pre-tax loss of $18.3 due primarily to the devaluation of our Venezuela affiliates' U.S. dollar based intercompany

payable as a result of the devaluation of the exchange rate between the U.S. dollar and the Venezuelan Bolivar Fuerte. These

impacts, which are included in other financing on the Consolidated Statements of Earnings and Comprehensive Income, are not

considered in the evaluation of segment profit. However, normal operating results in Venezuela, such as sales, gross profit and

operating expenses, have been negatively impacted on a net basis in fiscal 2011 as compared to fiscal 2010 by translating at

less favorable exchange rates, primarily in the first fiscal quarter of 2011, and by the impact of unfavorable economic

conditions in the country. These operating results remain part of the reported segment totals. The segment impacts of the

Venezuela devaluation and the unfavorable economic impact on operating results are shown separately in the tables provided in

the division discussions. See Note 5 to the Consolidated Financial Statements for further details.

33