Comcast 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

growing number of companies that provide a broad range of communications products and services and entertainment, news and

information content to consumers. Additionally, there continue to be new companies with significant financial resources that

potentially may compete on a larger scale with our cable services, as well as with our cable and broadcast networks and filmed

entertainment businesses.

Competition for the cable services we offer consists primarily of direct broadcast satellite (“DBS”)

providers, which have a national

footprint and compete in all our service areas, and phone companies, which overlap approximately 45% of our service areas and

are continuing to expand their fiber-

based networks. We also compete with other providers of traditional cable services. All of these

companies typically offer features, pricing and packaging for services comparable to our cable services.

Each of NBCUniversal’

s businesses also face substantial and increasing competition from providers of similar types of content, as

well as from other forms of entertainment and recreational activities. NBCUniversal also must compete to obtain talent,

programming and other resources required in operating its businesses.

Technological changes are further intensifying and complicating the competitive landscape for all of our businesses by challenging

existing business models and affecting consumer behavior. Newer services and devices that enable online digital distribution of

movies, television shows, and other cable and broadcast video programming continue to gain consumer acceptance and evolve,

including some services that charge a nominal or no fee for such programming. These services and devices may potentially

negatively affect demand for our video services, as well as demand for our cable network, broadcast television and filmed

entertainment content, as the number of entertainment choices available to consumers increases and as video programming is

more reliably delivered over the Internet and more easily viewed via the Internet on televisions. Wireless services and devices also

continue to evolve allowing consumers to access information, entertainment and communication services, which could negatively

impact demand for our cable services, including for our voice services as people substitute mobile phones for landline phones. In

addition, delayed viewing and advertising skipping have become more common as the penetration of DVRs and similar products

has increased and as content has become increasingly available via video-on-

demand services and Internet sources, which may

have a negative impact on our advertising revenue.

In our Cable Communications segment, we believe that adding more content and delivering it on an increasing variety of platforms

will assist in attracting and retaining customers for our cable services. We are also developing and launching new technology

initiatives, such as our X1 platform, and deploying new wireless gateway devices, to further enhance our video and high-

speed

Internet services. In our NBCUniversal segments, to compete for consumers of our content and for customers at our theme parks,

we have invested, and will continue to invest, substantial amounts in acquiring content and producing original content for our cable

networks and broadcast television networks, including the acquisition of sports rights, and will continue to invest in our film

productions and in the development of new theme park attractions. See “Business — Competition” for additional information.

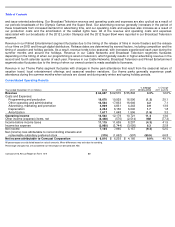

Seasonality and Cyclicality

Each of our businesses is subject to seasonal and cyclical variations. In our Cable Communications segment, our results are

impacted by the seasonal nature of customers receiving our cable services in college and vacation markets. This generally results

in a reduction in net customer additions in the second calendar quarter and increased net customer additions in the third and fourth

calendar quarters of each year.

Revenue in our Cable Communications, Cable Networks and Broadcast Television segments is subject to cyclical advertising

patterns and changes in viewership levels. Our U.S. advertising revenue is generally higher in the second and fourth calendar

quarters of each year, due in part to increases in consumer advertising in the spring and in the period leading up to and including

the holiday season. U.S. advertising revenue is also cyclical, benefiting in even-

numbered years from advertising related to

candidates running for political office

49

Comcast 2013 Annual Report on Form 10

-

K