Classmates.com 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Net cash used for investing activities was $258.6 million for the year ended December 31, 2008, compared to net cash provided by

investing activities of $48.5 million for the year ended December 31, 2007. The net increase in cash used for investing activities of

$307.1 million was primarily due to the cash paid for the FTD acquisition and a $5.2 million decrease in net proceeds from maturities and sales

of short-term investments as a result of the liquidation of our short-term investments portfolio to fund the FTD acquisition. Capital expenditures

for the year ended December 31, 2008 were $19.9 million.

Net cash provided by financing activities was $51.8 million for the year ended December 31, 2008, compared to net cash used for financing

activities of $45.6 million for the year ended December 31, 2007. The increase in net cash provided by financing activities was primarily related

to net proceeds from the UOL Credit Agreement and the FTD Credit Agreement of $422.0 million, partially offset by the repayment of FTD

indebtedness of $302.3 million in connection with the closing of the FTD acquisition and payments on the UOL Credit Agreement and FTD

Credit Agreement of $11.4 million. In addition, there was a $4.1 million decrease in the payment of dividends resulting from the decrease in our

quarterly dividend from $0.20 per share of common stock to $0.10 per share of common stock as discussed below. The increase in net cash

provided by financing activities was partially offset by a combined $8.6 million decrease in proceeds from exercises of stock options and

proceeds from our employee stock purchase plan; a $3.2 million increase in repurchases of common stock in connection with shares withheld

upon vesting of restricted stock awards and restricted stock units to pay applicable employee withholding taxes; and a $2.9 million decrease in

excess tax benefits from equity awards. In 2008, prior to the closing of the FTD acquisition, we paid quarterly cash dividends of $0.20 per share

of common stock for a total of $44.4 million. Following the closing of the FTD acquisition, United Online, Inc.'s Board of Directors decreased

our quarterly cash dividend from $0.20 per share of common stock to $0.10 per share of common stock. For the remaining period in 2008, we

paid a quarterly cash dividend of $0.10 per share of common stock for a total of $8.7 million. In 2007, we paid quarterly cash dividends of $0.20

per share of common stock for a total of $57.1 million.

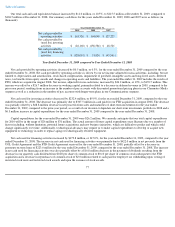

Cash flows from financing activities were also negatively impacted by the withholding of a portion of shares underlying the restricted stock

units, restricted stock awards and stock awards we award to employees. We did not collect the applicable employee withholding taxes upon

vesting of restricted stock units and restricted stock awards and upon the issuance of stock awards from employees. Instead, we automatically

withheld, from the restricted stock units that vested and the stock awards that were issued, the portion of those shares with a fair market value

equal to the amount of the employee withholding taxes due. We then paid the applicable withholding taxes in cash. The net effect of such

withholding adversely impacted our cash flows from financing activities. The amounts remitted in the years ended December 31, 2008 and 2007

were $8.8 million and $5.6 million, respectively, for which we withheld 806,000 shares and 390,000 shares of common stock, respectively, that

were underlying the restricted stock units and restricted stock awards which vested and stock awards that were issued.

80