Classmates.com 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

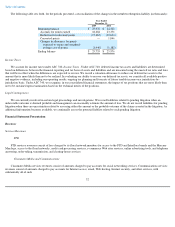

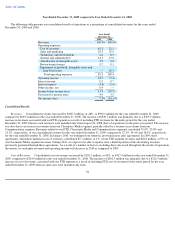

Provision for Income Taxes. For the year ended December 31, 2009, we recorded a tax provision of $48.1 million on pre-tax income of

$118.2 million, resulting in an effective income tax rate of 40.7%. For the year ended December 31, 2008, we recorded a tax provision of

$23.3 million on a pre-tax loss of $71.4 million. The tax provision for the year ended December 31, 2008 reflects the impact of non-deductible

goodwill and impairment charges of $176.2 million. Excluding these charges, the effective income tax rate for the year ended December 31,

2008 would have been 43.5%. The current rate has declined primarily due to the effects of net benefits resulting from statute expirations of

uncertain tax positions offset partially by the limitation of foreign tax credits.

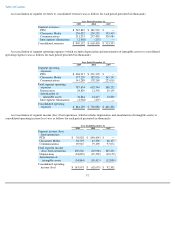

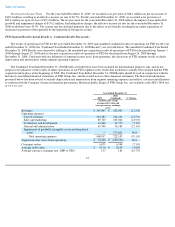

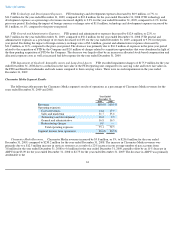

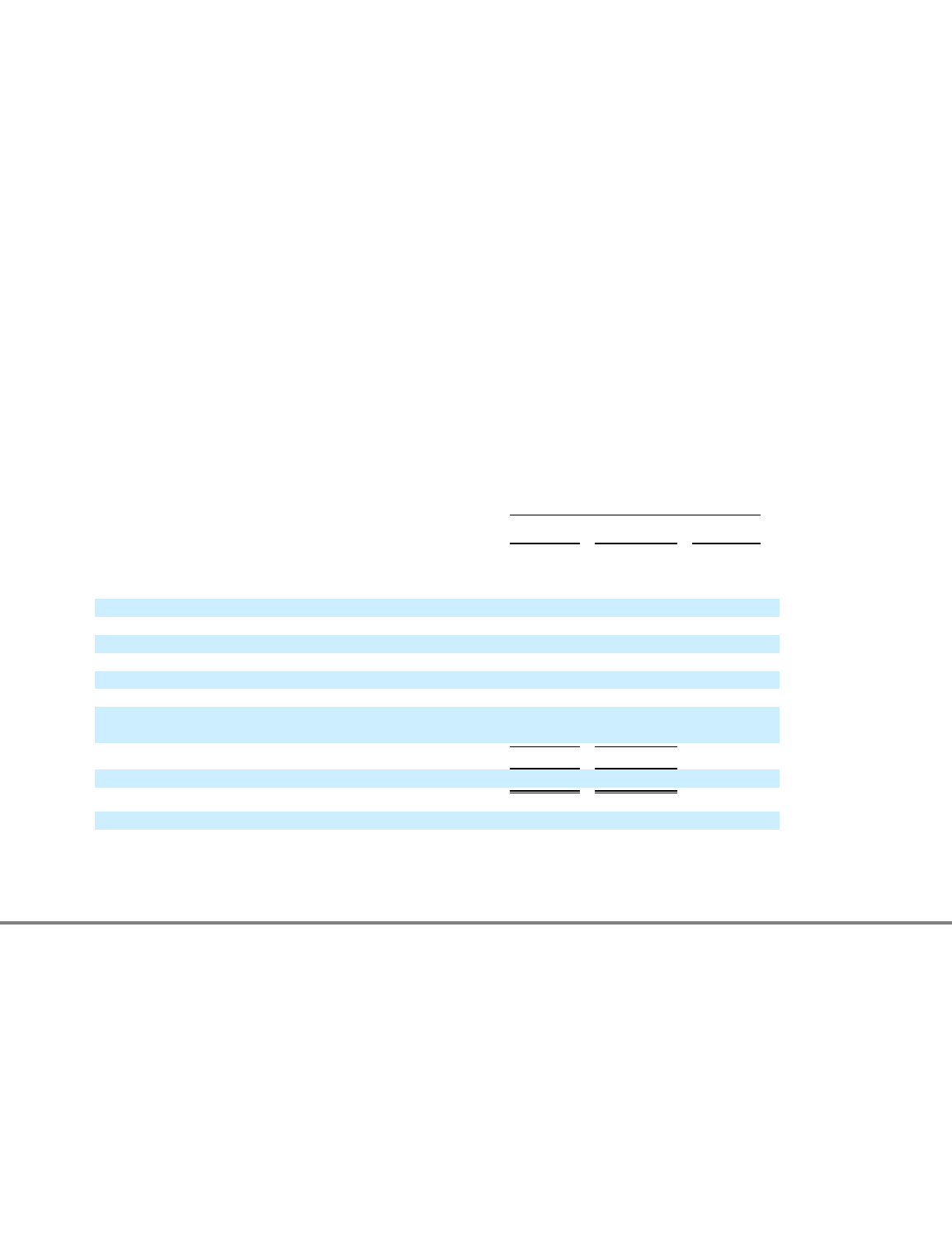

FTD Segment Results (Actual Results vs. Combined Results Discussion)

The results of operations for FTD for the year ended December 31, 2009 and unaudited combined results of operations for FTD for the year

ended December 31, 2008 (the "Combined Year Ended December 31, 2008 Results") are set forth below. The unaudited Combined Year Ended

December 31, 2008 Results were derived by adding (i) the unaudited pre-acquisition results of operations of FTD for the period from January 1,

2008 through August 25, 2008 and (ii) the post-acquisition results of operations of FTD for the period from August 26, 2008 through

December 31, 2008. Consistent with our definition of segment income (loss) from operations, the discussion of FTD segment results excludes

depreciation and amortization within segment operating expenses.

The Combined Year Ended December 31, 2008 Results set forth below have been included for informational purposes only and do not

purport to be indicative of the results of future operations of our FTD segment or the results that would have actually been attained had the FTD

acquisition taken place at the beginning of 2008. The Combined Year Ended December 31, 2008 Results should be read in conjunction with the

historical consolidated financial statements of FTD Group, Inc. and the related notes to those financial statements. The historical information

presented below has been revised to exclude depreciation and amortization from segment operating expenses and reflects certain reclassifications

to conform with the Company's financial statement presentation. Historical public filings of FTD Group, Inc. are available at the SEC's Web site

at www.sec.gov .

61

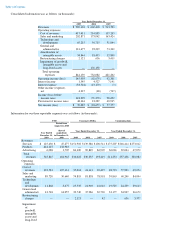

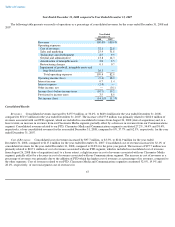

Year Ended December 31,

2009 2008

(Combined) % Change

(in thousands, except

average order value and

average currency exchange

rates)

Revenues

$

545,845

$

622,003

(12.2

)%

Operating expenses:

Cost of revenues

323,581

374,231

(13.5

)%

Sales and marketing

89,720

103,046

(12.9

)%

Technology and development

11,868

12,770

(7.1

)%

General and administrative

43,748

56,189

(22.1

)%

Impairment of goodwill, intangible assets and long-lived

assets

—

175,867

N/A

Total operating expenses

468,917

722,103

(35.1

)%

Segment income (loss) from operations

$

76,928

$

(100,100

)

N/A

Consumer orders

6,071

6,548

(7.3

)%

Average order value

$

59.56

$

62.99

(5.4

)%

Average currency exchange rate: GBP to USD

1.55

1.86

(16.7

)%