Classmates.com 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

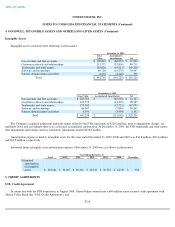

5. CREDIT AGREEMENTS (Continued)

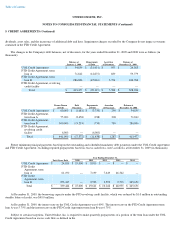

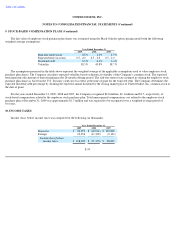

UOL Credit Agreement (commencing in the second quarter of 2009). Subject to certain exceptions, FTD Group, Inc. is required to make annual

prepayments of a portion of the term loans under the FTD Credit Agreement based on excess cash flow as defined in the FTD Credit Agreement

(commencing in the second quarter of 2010). Based on the Company's current projections, under the provisions of the credit facilities, the

Company reasonably expects to make excess cash flow debt prepayments of approximately $11.0 million in the next twelve months.

Accordingly, this amount has been classified as a current liability on the consolidated balance sheet at December 31, 2009. In addition, in 2009,

the Company made voluntary prepayments on the FTD Credit Agreement totaling $57.0 million, eliminating all required payments in 2010.

Under the terms of the FTD Credit Agreement, FTD is significantly restricted from making dividend payments, loans or advances to United

Online, Inc. and its subsidiaries other than to UNOL Intermediate, Inc. and its subsidiaries. These restrictions have resulted in the restricted net

assets (as defined in Rule 4-08(e)(3) of Regulation S-X) of FTD exceeding 25% of the consolidated net assets of the Company. FTD's restricted

net assets at December 31, 2009 and 2008 were $250.5 million and $191.5 million, respectively.

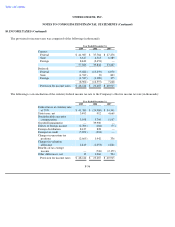

6. DERIVATIVE INSTRUMENTS

Interest Rate Cap

FTD Group, Inc. is required by the FTD Credit Agreement to maintain one or more interest rate swap agreements, interest rate cap

agreements, interest rate collar agreements, or other similar instruments to manage risks associated with interest rate fluctuations and exposures

on its credit facilities with Wells Fargo Bank, National Association. Accordingly, in November 2008, FTD Group, Inc. entered into a three-year

interest rate cap agreement to manage risks associated with interest rate fluctuations on a $150 million notional amount of the FTD Credit

Agreement. This instrument was initially accounted for as a cash flow hedge. In January 2009, FTD Group, Inc. changed the interest rate basis of

the hedged item from LIBOR-based to prime rate-based and, as a result, the cash flow hedge was de-designated and accordingly does not

currently qualify for hedge accounting treatment. The amount of deferred loss on the interest rate cap reclassified from accumulated other

comprehensive loss in the statement of stockholders' equity to interest expense since de-designation of the hedge in the first quarter of 2009 was

immaterial. The interest rate cap does not contain any credit risk-related contingent features as defined by ASC 815, Derivatives and Hedging .

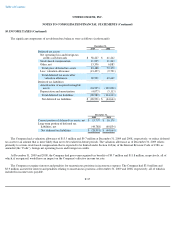

Foreign Exchange Contracts

In 2009, the Company entered into foreign currency forward contracts between the U.S. Dollar and the British Pound. While these contracts

were not designated as hedging instruments for accounting purposes, the Company entered into these derivative contracts to partially offset the

economic effect of fluctuations in the currency exchange rate between the U.S. Dollar and the British Pound. These derivatives were intended to

minimize the impact of foreign currency exchange rates on intercompany dividend payments in British Pounds. At December 31, 2009, there

were no foreign currency forward contracts outstanding. The Company presently anticipates that it may continue to enter into foreign currency

forward or other similar contracts to manage foreign currency exchange rate risks. The foreign currency forward contracts did not contain any

credit risk-related contingent features as defined by ASC 815.

F-27