Classmates.com 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. INCOME TAXES (Continued)

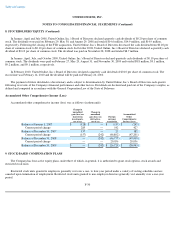

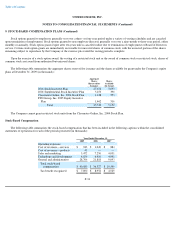

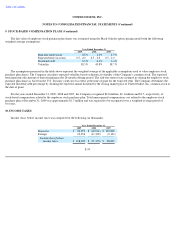

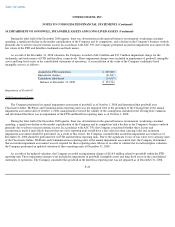

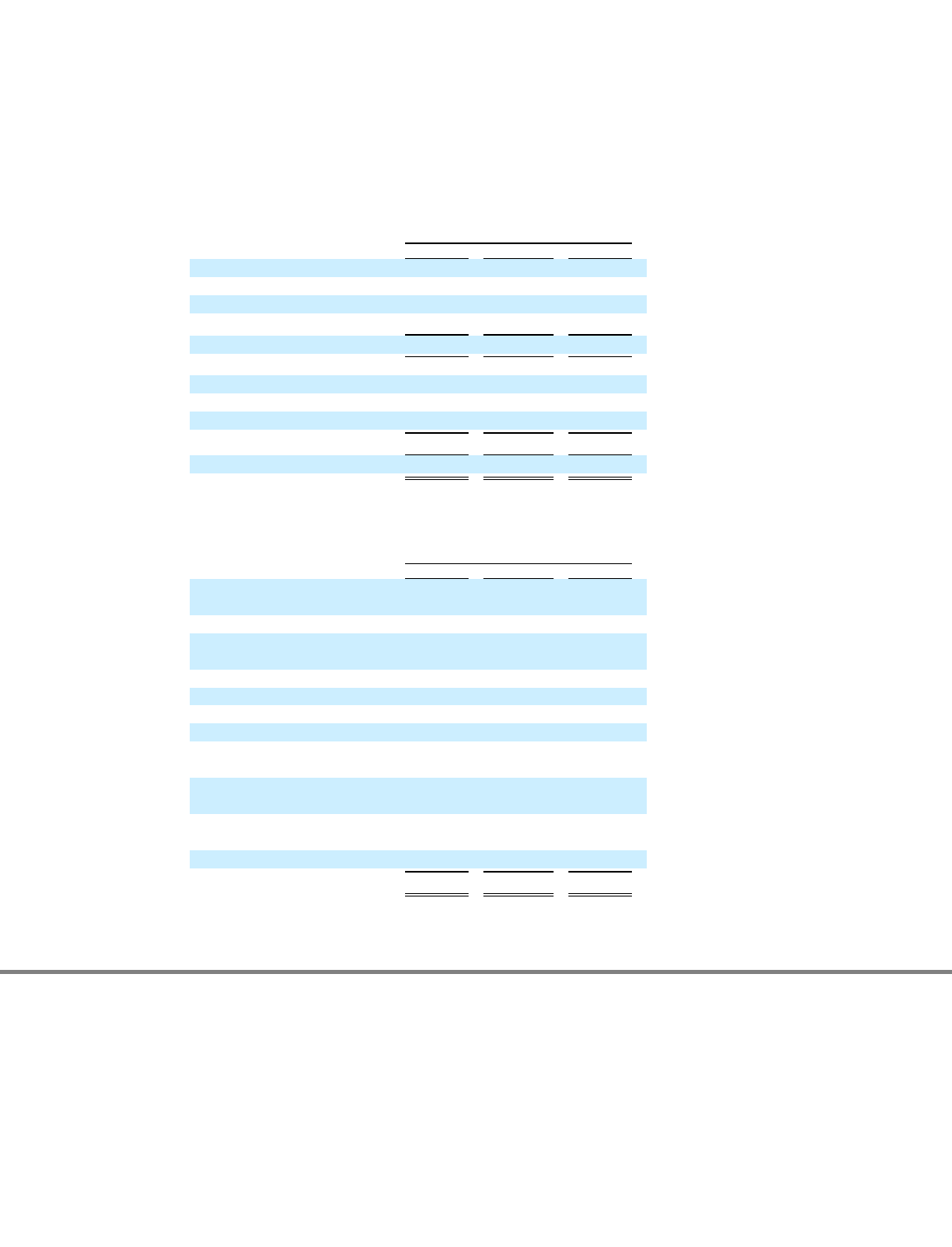

The provision for income taxes was comprised of the following (in thousands):

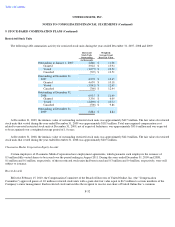

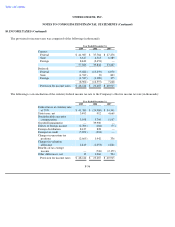

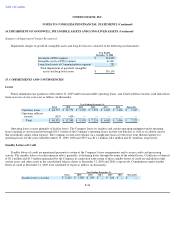

The following is a reconciliation of the statutory federal income tax rate to the Company's effective income tax rate (in thousands):

F-36

Year Ended December 31,

2009

2008

2007

Current:

Federal

$

41,987

$

37,784

$

27,278

State

6,617

4,513

6,389

Foreign

8,442

(2,453

)

—

57,046

39,844

33,667

Deferred:

Federal

(5,822

)

(15,359

)

6,070

State

(1,533

)

(9

)

803

Foreign

(1,547

)

(1,189

)

375

(8,902

)

(16,557

)

7,248

Provision for income taxes

$

48,144

$

23,287

$

40,915

Year Ended December 31,

2009

2008

2007

Federal taxes at statutory rate

of 35%

$

41,380

$

(24,980

)

$

34,541

State taxes, net

3,493

912

4,660

Nondeductible executive

compensation

3,958

5,796

1,107

Goodwill impairment

—

39,900

—

Effects of foreign income

(2,706

)

(104

)

(75

)

Foreign distribution

8,127

828

—

Foreign tax credit

(5,871

)

(294

)

—

Changes in uncertain tax

positions

(2,669

)

1,942

336

Changes in valuation

allowance

2,419

(1,053

)

1,821

Benefits of tax exempt

income

—

(

726

)

(2,179

)

Other differences, net

13

1,066

704

Provision for income taxes

$

48,144

$

23,287

$

40,915