Classmates.com 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

statements. The historical information presented below has been revised to exclude depreciation and amortization and reflects certain

reclassifications to conform with the Company's financial statement presentation. Historical public filings of FTD Group, Inc. are available at the

SEC's Web site at www.sec.gov .

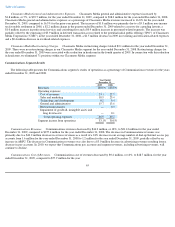

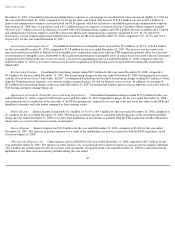

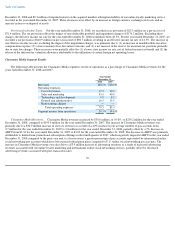

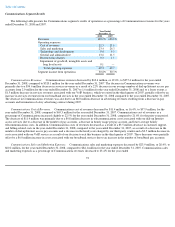

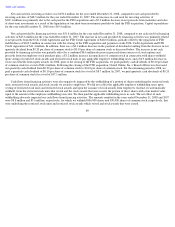

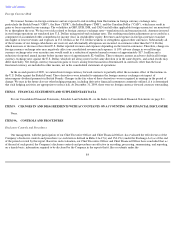

The following table presents the FTD segment's expenses and results as a percentage of FTD revenues for each period presented:

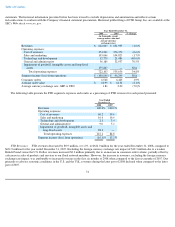

FTD Revenues. FTD revenues decreased by $9.9 million, or 1.6%, to $622.0 million for the year ended December 31, 2008, compared to

$631.9 million for the year ended December 31, 2007. Excluding the foreign currency exchange rate impact of $12.3 million due to a weaker

British Pound versus the U.S. Dollar, revenues increased $2.3 million primarily due to an increase in consumer order volume, partially offset by

a decrease in sales of products and services to our floral network members. However, the increase in revenues, excluding the foreign currency

exchange rate impact, was attributable to increased revenues in the first six months of 2008 when compared to the first six months of 2007. Due

primarily to adverse economic conditions in the U.S. and the U.K., revenues during the latter part of 2008 declined when compared to the latter

part of 2007.

74

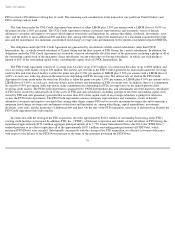

Year Ended December 31,

2008

2007

% Change

(in thousands, except

average order value and

average currency

exchange rates)

Revenues

$

622,003

$

631,935

(1.6

)%

Operating expenses:

Cost of revenues

374,231

376,370

(0.6

)%

Sales and marketing

103,046

104,823

(1.7

)%

Technology and development

12,770

21,486

(40.6

)%

General and administrative

56,189

32,957

70.5

%

Impairment of goodwill, intangible assets and long

-

lived

assets

175,867

—

N/A

Total operating expenses

722,103

535,636

34.8

%

Segment income (loss) from operations

$

(100,100

)

$

96,299

N/A

Consumer orders

6,548

6,423

1.9

%

Average order value

$

62.99

$

64.32

(2.1

)%

Average currency exchange rate: GBP to USD

1.86

2.00

(7.0

)%

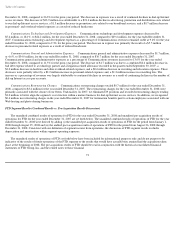

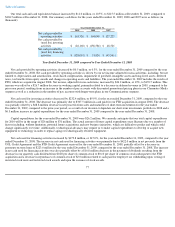

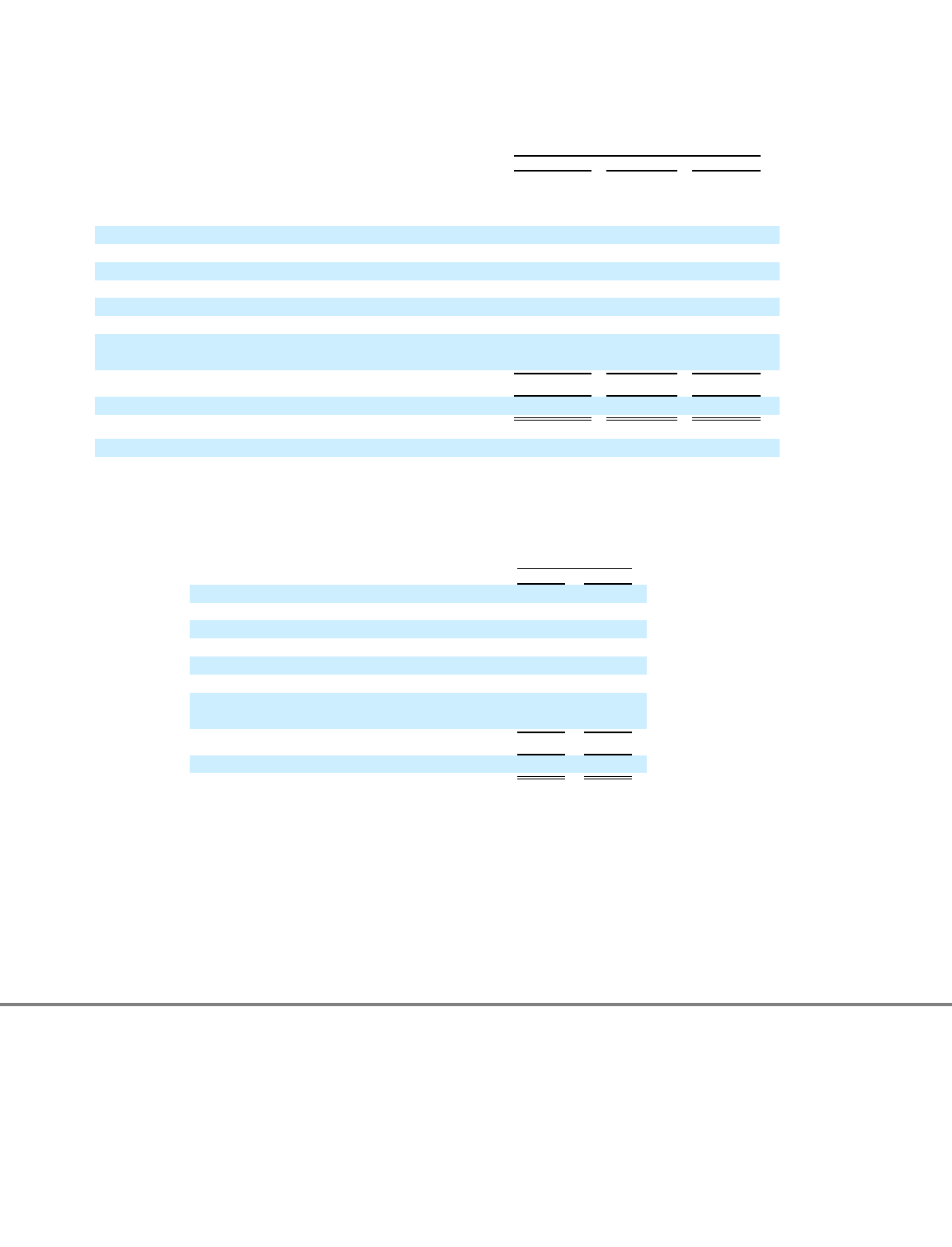

Year Ended

December 31,

2008

2007

Revenues

100.0

%

100.0

%

Operating expenses:

Cost of revenues

60.2

59.6

Sales and marketing

16.6

16.6

Technology and development

2.1

3.4

General and administrative

9.0

5.2

Impairment of goodwill, intangible assets and

long

-

lived assets

28.3

—

Total operating expenses

116.1

84.8

Segment income (loss) from operations

(16.1

)%

15.2

%