Classmates.com 2009 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. INCOME TAXES (Continued)

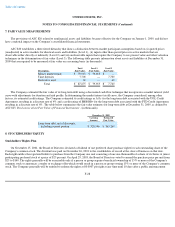

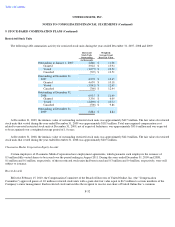

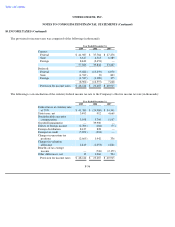

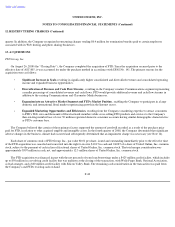

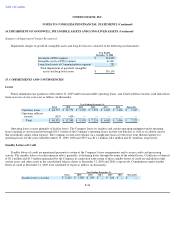

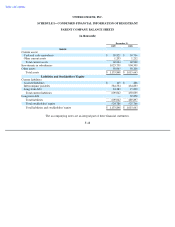

The changes in gross unrecognized tax benefits for the years ended December 31, 2009, 2008 and 2007 were as follows, excluding interest

and penalties (in thousands):

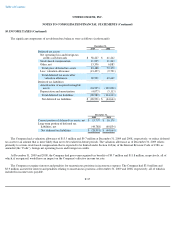

The Company is currently under audit by certain taxing jurisdictions in the U.S. Some audits may conclude in the next twelve months and

any unrecognized tax benefits we have recorded in relation to the audits may differ from actual settlement amounts. It is not possible to estimate

the effect, if any, of any such settlements. The Company anticipates that in the next twelve months, $2.0 million of gross unrecognized tax

benefits will lapse due to the statute of limitations and anticipates no material increase in gross unrecognized tax benefits. The Company files

income tax returns in the U.S., various state and local jurisdictions, the U.K., and in other foreign jurisdictions. With few exceptions, the

Company is not subject to U.S., foreign, state or local examination for years prior to fiscal 2004.

In accordance with ASC 740, at December 31, 2009, the Company had undistributed earnings of foreign subsidiaries of approximately

$3.6 million, for which deferred taxes have not been provided. The Company intends to reinvest these earnings for the foreseeable future. If

these amounts were instead distributed to the U.S. in the form of dividends or otherwise, the Company would be subject to additional U.S.

income taxes.

For the years ended December 31, 2009, 2008 and 2007, income tax benefits (shortfalls), net attributable to equity-based compensation that

were allocated to stockholders' equity amounted to $(3.0) million, $(0.5) million and $4.6 million, respectively.

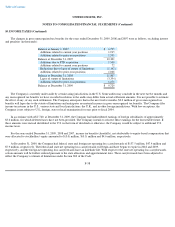

At December 31, 2009, the Company had federal, state and foreign net operating loss carryforwards of $137.5 million, $47.4 million and

$7.9 million, respectively. The federal and state net operating loss carryforwards will begin and have begun to expire in 2018 and 2009,

respectively, and the foreign net operating loss carryforwards have an indefinite life. With respect to the state net operating loss carryforwards,

certain amounts will be further reduced pursuant to the state allocation and apportionment laws. These carryforwards have been adjusted to

reflect the Company's estimate of limitations under Section 382 of the Code.

F-38

Balance at January 1, 2007

$

6,795

Additions related to current year positions

1,915

Additions related to prior

-

year positions

1,591

Balance at December 31, 2007

10,301

Additions due to FTD acquisition

1,508

Additions related to current year positions

72

Reductions due to lapse of statute of limitations

(1,142

)

Additions related to prior

-

year positions

1,068

Balance at December 31, 2008

11,807

Lapse of statute of limitations

(3,354

)

Additions related to prior

-

year positions

1,276

Balance at December 31, 2009

$

9,729