Classmates.com 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

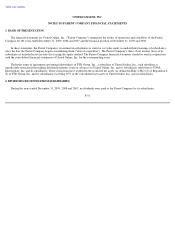

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

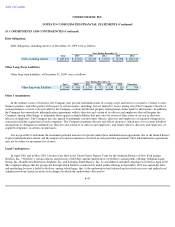

13. ACQUISITIONS (Continued)

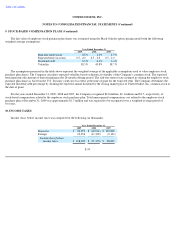

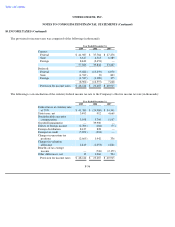

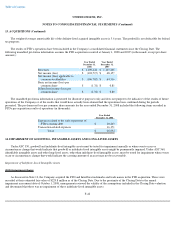

The weighted-average amortizable life of the definite-

lived acquired intangible assets is 5.6 years. The goodwill is not deductible for federal

tax purposes.

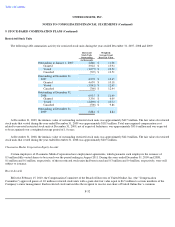

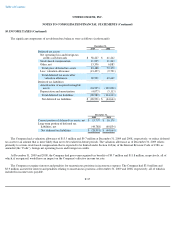

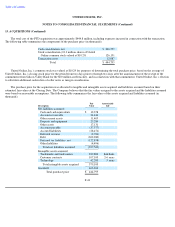

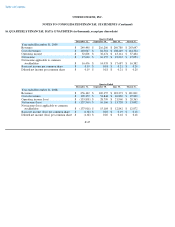

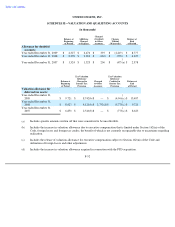

The results of FTD's operations have been included in the Company's consolidated financial statements since the Closing Date. The

following unaudited pro forma information assumes the FTD acquisition occurred at January 1, 2008 and 2007 (in thousands, except per share

amounts):

The unaudited pro forma information is presented for illustrative purposes only and does not purport to be indicative of the results of future

operations of the Company or of the results that would have actually been attained had the operations been combined during the periods

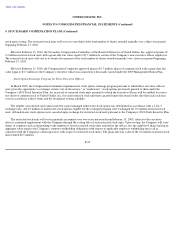

presented. The pro forma net loss per common share amounts for the year ended December 31, 2008 included the following items recorded in

FTD's pre-acquisition results of operations (in thousands):

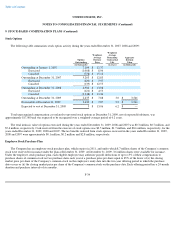

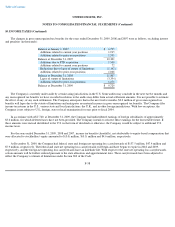

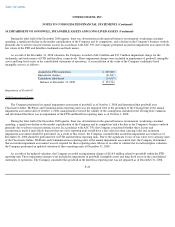

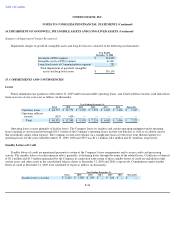

14. IMPAIRMENT OF GOODWILL, INTANGIBLE ASSETS AND LONG-LIVED ASSETS

Under ASC 350, goodwill and indefinite-lived intangible assets must be tested for impairment annually or when events occur or

circumstances change that would indicate that goodwill or indefinite-lived intangible assets might be permanently impaired. Under ASC 360,

identifiable intangible assets and other long-lived assets, other than indefinite-lived intangible assets, must be tested for impairment when events

occur or circumstances change that would indicate the carrying amount of an asset may not be recoverable.

Impairment of Indefinite

-Lived Intangible Assets

2008 Impairment Charge

As discussed in Note 13, the Company acquired the FTD and Interflora trademarks and trade names in the FTD acquisition. These were

recorded at their estimated fair value of $229.8 million as of the Closing Date. Due to the proximity of the Closing Date to the annual

impairment assessment date of October 1, 2008, management reviewed the validity of the assumptions included in the Closing Date valuation

and determined that there was no impairment of these indefinite-lived intangible assets.

F-42

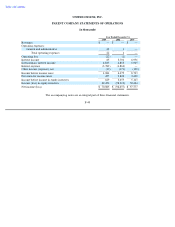

Year Ended

December 31,

2008

Year Ended

December 31,

2007

Revenues

$

1,109,441

$

1,145,438

Net income (loss)

$

(103,717

)

$

68,157

Net income (loss) applicable to

common stockholders

$

(106,782

)

$

64,316

Basic net income (loss) per

common share

$

(1.31

)

$

0.81

Diluted net income (loss) per

common share

$

(1.31

)

$

0.80

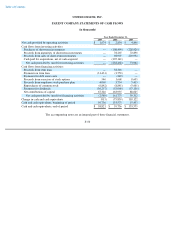

Year Ended

December 31, 2008

Expenses related to the early repayment of

FTD's existing debt

$

10,463

Transaction

-

related expenses

16,171

Total

$

26,634