Classmates.com 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. INCOME TAXES (Continued)

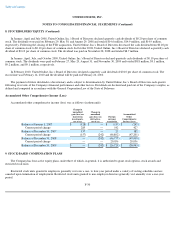

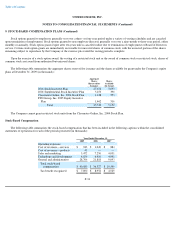

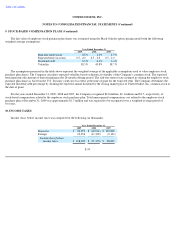

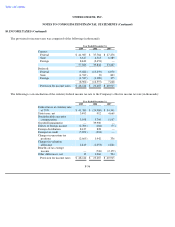

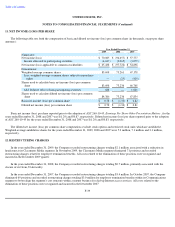

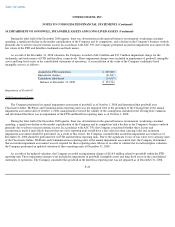

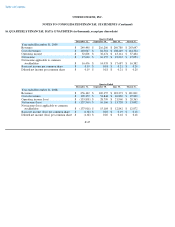

The significant components of net deferred tax balances were as follows (in thousands):

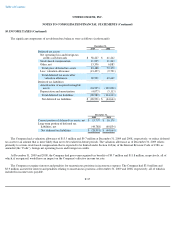

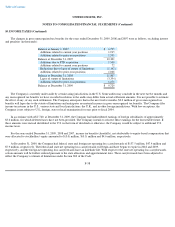

The Company had a valuation allowance of $13.5 million and $9.7 million at December 31, 2009 and 2008, respectively, to reduce deferred

tax assets to an amount that is more likely than not to be realized in future periods. The valuation allowance as of December 31, 2009 relates

primarily to certain stock-based compensation that is expected to be limited under Section 162(m) of the Internal Revenue Code of 1986, as

amended (the "Code"), foreign net operating losses and foreign tax credits.

At December 31, 2009 and 2008, the Company had gross unrecognized tax benefits of $9.7 million and $11.8 million, respectively, all of

which, if recognized, would have an impact on the Company's effective income tax rate.

The Company recognizes interest and penalties for uncertain tax positions in income tax expense. The Company had $3.0 million and

$3.9 million accrued for interest and penalties relating to uncertain tax positions at December 31, 2009 and 2008, respectively, all of which is

included in income taxes payable.

F-37

December 31,

2009

2008

Deferred tax assets:

Net operating loss and foreign tax

credits carryforwards

$

58,227

$

61,242

Stock

-

based compensation

11,905

11,243

Other, net

13,356

6,885

Total gross deferred tax assets

83,488

79,370

Less: valuation allowance

(13,497

)

(9,721

)

Total deferred tax assets after

valuation allowance

69,991

69,649

Deferred tax liabilities:

Amortization of acquired intangible

assets

(94,905

)

(109,200

)

Depreciation and amortization

(4,077

)

(5,113

)

Total deferred tax liabilities

(98,982

)

(114,313

)

Net deferred tax liabilities

$

(28,991

)

$

(44,664

)

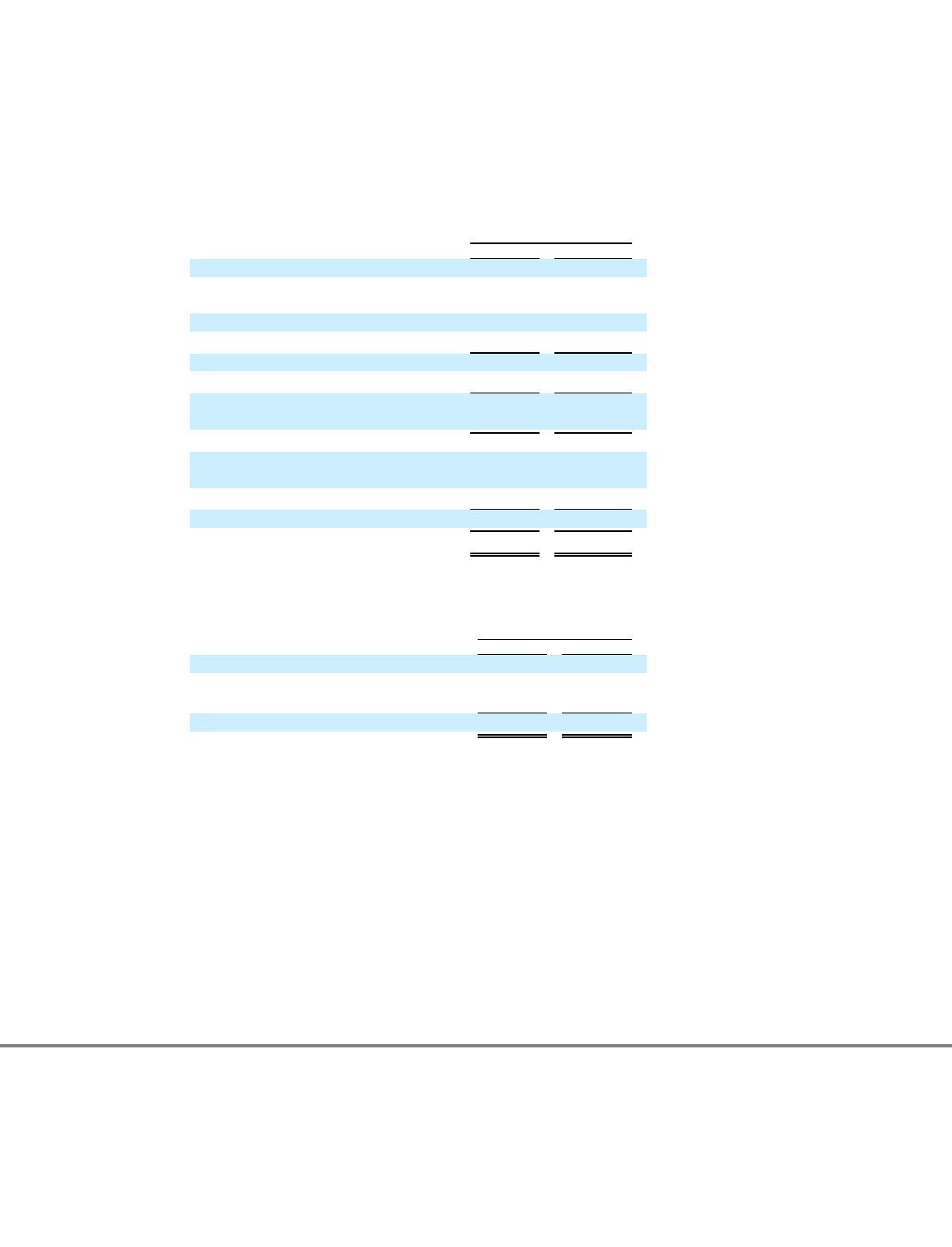

December 31,

2009 2008

Current portion of deferred tax assets, net

$

15,797

$

16,170

Long

-

term portion of deferred tax

liabilities, net

(44,788

)

(60,834

)

Net deferred tax liabilities

$

(28,991

)

$

(44,664

)