Classmates.com 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

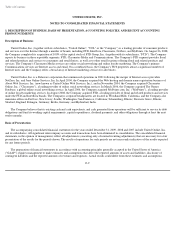

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

The most significant areas of the consolidated financial statements that require management judgment and which are susceptible to possible

change in the near term include the Company's revenue recognition, business combinations, goodwill and indefinite-lived intangible assets,

intangible assets and other long-lived assets, member redemption liability, income taxes, and legal contingencies. The accounting policies for

these areas are discussed elsewhere in these consolidated financial statements.

Reclassifications —Certain prior-year amounts have been reclassified to conform to the current year presentation. These changes had no

impact on the previously reported consolidated results of operations or stockholders' equity.

Subsequent events —The Company has evaluated subsequent events through February 23, 2010, the date this Annual Report on Form 10-K

was filed with the Securities and Exchange Commission ("SEC").

Accounting Policies

Segments —The Company complies with the reporting requirements of Financial Accounting Standards Board ("FASB") Accounting

Standards Codification ("ASC") 280, Segment Reporting . In August 2008, the Company completed the acquisition of FTD. FTD's operating

results are now reported as the FTD segment, which is aligned with how management measures and reviews segment performance for internal

reporting purposes in accordance with the "management approach" defined in ASC 280. Management has determined that segment income from

operations, which excludes depreciation and amortization of intangible assets, is the appropriate measure for assessing performance of its

segments and for allocating resources among its segments.

Cash, Cash Equivalents and Short-Term Investments —The Company considers cash equivalents to be only those investments which are

highly liquid, readily convertible to cash and which have a maturity date within ninety days from the date of purchase. The Company's short-

term investments held during 2008 consisted of available-for-sale securities with maturities exceeding ninety days from the date of purchase.

Consistent with ASC 320, Investments-Debt and Equity Securities , the Company classified these securities, all of which had readily

determinable fair values and which were highly liquid, as short-term. In connection with the FTD acquisition, the Company liquidated its short-

term investments portfolio and, at December 31, 2009 and 2008, had no short-term investments.

Concentrations of Credit and Business Risk —Financial instruments that potentially subject the Company to a concentration of credit risk

primarily consist of cash and cash equivalents, short-term investments and accounts receivable. The Company's accounts receivable are derived

primarily from revenue earned from advertising customers and floral network members located in the United States and the United Kingdom,

and pay accounts. The Company extends credit based upon an evaluation of the customer's financial condition and, generally, collateral is not

required. The Company maintains an allowance for doubtful accounts receivable based upon the expected collectibility of accounts receivable

and, to date, such losses have been within management's expectations.

The Company evaluates specific accounts receivable where information exists that the customer may have an inability to meet its financial

obligations. In these cases, based on the best available facts and circumstances, a specific allowance is recorded for that customer against

amounts due to reduce

F-10