Classmates.com 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

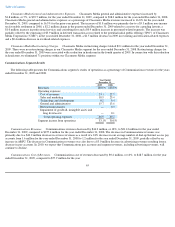

December 31, 2007. Consolidated general and administrative expenses as a percentage of consolidated revenues decreased slightly to 13.8% for

the year ended December 31, 2008, compared to 14.3% for the prior-year period. The increase of $18.9 million was due to $14.1 million of

general and administrative expenses associated with our FTD segment, which are included in consolidated general and administrative expenses

from August 26, 2008 (date of acquisition), and a $7.2 million increase in expenses associated with our Classmates Media segment, partially

offset by a $1.7 million decrease in expenses associated with our Communications segment and a $0.6 million decrease in depreciation. General

and administrative expenses related to our FTD, Classmates Media and Communications segments constituted 16.2%, 43.7% and 40.2%,

respectively, of total segment general and administrative expenses for the year ended December 31, 2008, compared to 0%, 45.6% and 54.4%,

respectively, for the year ended December 31, 2007.

Amortization of Intangible Assets. Consolidated amortization of intangible assets increased by $5.6 million, or 43.9%, to $18.4 million

for the year ended December 31, 2008, compared to $12.8 million for the year ended December 31, 2007. The increase was associated with

increased amortization related to definite-lived intangible assets acquired in connection with our FTD acquisition, partially offset by a decrease

in amortization of intangible assets attributable to the accelerated amortization of intangible assets in earlier years associated with our Classmates

acquisition in November 2004 and, to a lesser extent, a decrease in amortization in the year ended December 31, 2008 compared to the year

ended December 31, 2007 as a result of certain assets from the acquisition of Web hosting assets in April 2004 becoming fully amortized in

March 2007.

Restructuring Charges. Consolidated restructuring charges totaled $0.7 million for the year ended December 31, 2008, compared to

$3.4 million for the year ended December 31, 2007. The restructuring charges for the year ended December 31, 2008 were primarily associated

with the closure of our Orem, Utah facility. In 2007, we eliminated 69 positions and recorded restructuring charges totaling $3.0 million to better

align the Communications segment's cost structure within a mature business for dial-up Internet access services. In addition, we recognized

$0.4 million in restructuring charges in the year ended December 31, 2007 for termination benefits paid to certain employees associated with our

Web hosting and photo sharing businesses.

Impairment of Goodwill, Intangible Assets and Long-Lived Assets. Consolidated impairment charges totaled $176.2 million for the year

ended December 31, 2008, compared to $0 for the year ended December 31, 2007. Impairment charges for the year ended December 31, 2008

were primarily due to a reduction in the fair value of the FTD reporting unit compared to its carrying value and lower fair values in the FTD and

Interflora trademarks and trade names compared to their carrying values.

Interest Income.

Interest income decreased by $2.6 million, or 36.6%, to $4.5 million for the year ended December 31, 2008, compared to

$7.1 million for the year ended December 31, 2007. The decrease in interest income is consistent with the decrease in the investment portfolio

during the year ended December 31, 2008 as a result of the liquidation of investments to partially fund the FTD acquisition and the reduction in

interest rates as a result of the macroeconomic environment.

Interest Expense. Interest expense was $13.2 million for the year ended December 31, 2008, compared to $3,000 for the year ended

December 31, 2007. The increase in interest expense was a result of the indebtedness incurred in connection with the FTD acquisition, which

closed on August 26, 2008.

Other Income (Expense), net. Other expense, net was $48,000 for the year ended December 31, 2008, compared to $0.7 million for the

year ended December 31, 2007. The decrease in other expense, net, was primarily due to interest earned on a non

-income tax dispute settlement,

a $0.3 million net realized gain on sales of our short-term investments recognized in the year ended December 31, 2008 in connection with the

liquidation of our short-term investments portfolio during the year ended

69