Classmates.com 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

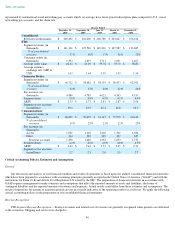

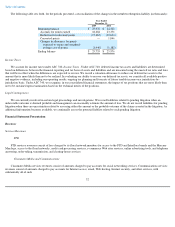

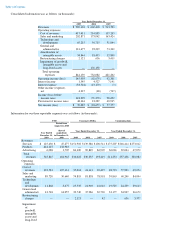

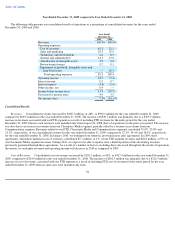

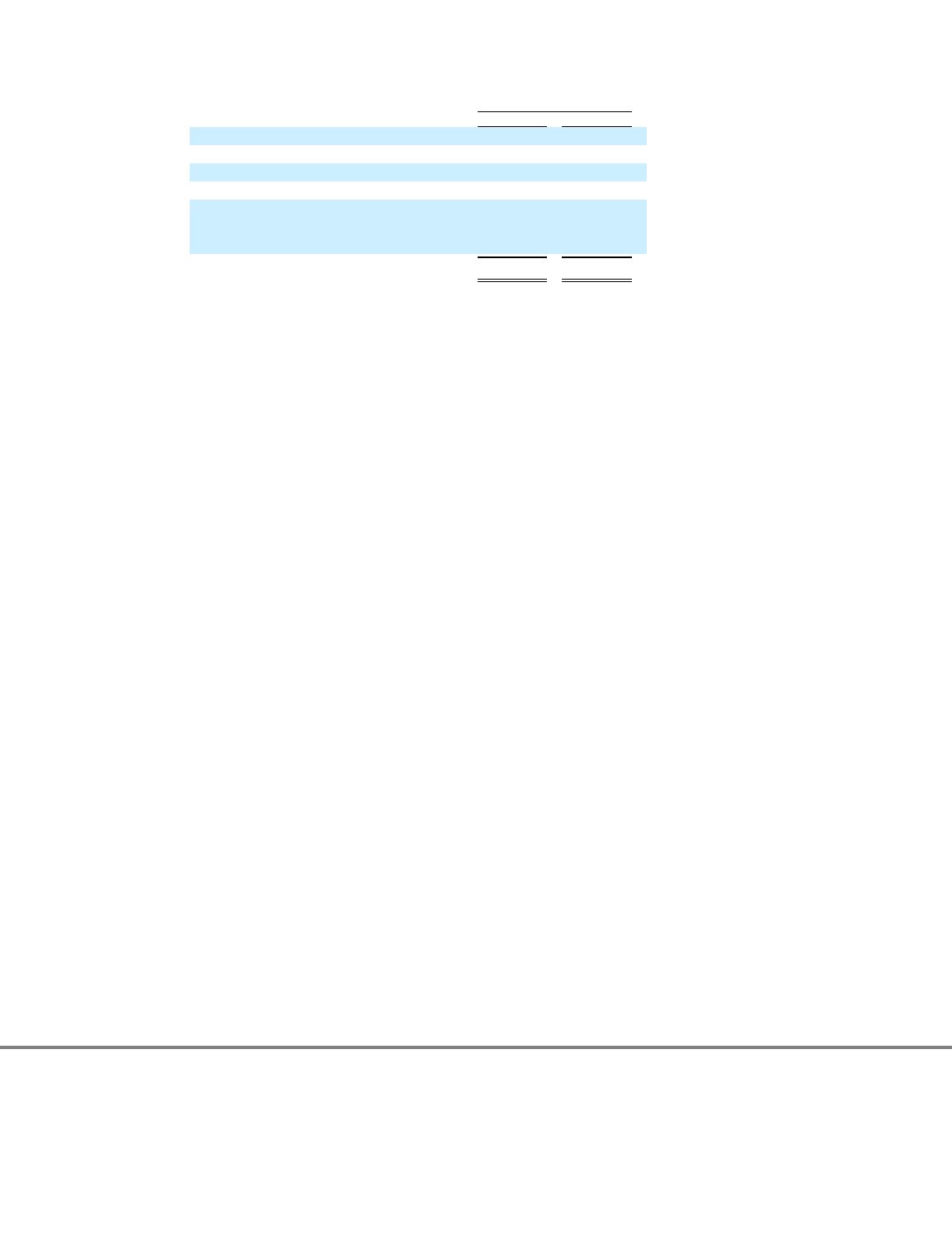

The following table sets forth, for the periods presented, a reconciliation of the changes in the member redemption liability (in thousands):

Income Taxes

We account for income taxes under ASC 740, Income Taxes . Under ASC 740, deferred income tax assets and liabilities are determined

based on differences between the financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws

that will be in effect when the differences are expected to reverse. We record a valuation allowance to reduce our deferred tax assets to the

amount that is more likely than not to be realized. In evaluating our ability to recover our deferred tax assets, we consider all available positive

and negative evidence, including our operating results, ongoing tax planning and forecasts of future taxable income on a jurisdiction-by-

jurisdiction basis. Under ASC 740, we recognize, in our consolidated financial statements, the impact of tax positions that are more likely than

not to be sustained upon examination based on the technical merits of the positions.

Legal Contingencies

We are currently involved in certain legal proceedings and investigations. We record liabilities related to pending litigation when an

unfavorable outcome is deemed probable and management can reasonably estimate the amount of loss. We do not record liabilities for pending

litigation when there are uncertainties related to assessing either the amount or the probable outcome of the claims asserted in the litigation. As

additional information becomes available, we continually assess the potential liability related to such pending litigation.

Financial Statement Presentation

Revenues

Services Revenues

FTD

FTD services revenues consist of fees charged to its floral network members for access to the FTD and Interflora brands and the Mercury

Man logo, access to the floral networks, credit card processing services, e-commerce Web sites services, online advertising tools, and telephone

answering, order-taking, transmission, and clearing-house services.

Classmates Media and Communications

Classmates Media services revenues consist of amounts charged to pay accounts for social networking services. Communications services

revenues consist of amounts charged to pay accounts for Internet access, email, Web hosting, Internet security, and other services, with

substantially all of such

52

Year Ended

December 31,

2009 2008

Beginning balance

$

25,976

$

24,560

Accruals for points earned

18,684

23,356

Reduction for redeemed points

(17,465

)

(22,604

)

Converted points

—

1,846

Changes in allowance for points

expected to expire and weighted-

average cost of points

(1,440

)

(1,182

)

Ending balance

$

25,755

$

25,976