Classmates.com 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

2009. From time to time, the Board of Directors has increased the amount authorized for repurchase under this program and has extended the

program. In April 2004, the Board of Directors authorized us to purchase up to an additional $100 million of our common stock under the

program, bringing the total amount authorized under the program to $200 million. In December 2009, the Board of Directors again further

extended the program through December 31, 2010. From August 2001 through December 31, 2009, we had repurchased $139.2 million of our

common stock under the program, leaving $60.8 million of authorization remaining under the program. We have not repurchased any shares of

our common stock under the program since February 2005.

Shares withheld upon the vesting of restricted stock units and restricted stock awards and upon the issuance of stock awards to pay

applicable employee withholding taxes are considered common stock repurchases, but are not counted as purchases against the program. Upon

vesting of restricted stock units or issuance of stock awards, we currently do not collect the applicable employee withholding taxes from

employees. Instead, we automatically withhold, from the restricted stock units that vest and from the stock awards that are issued, the portion of

those shares with a fair market value equal to the amount of the employee withholding taxes due, which is accounted for as a repurchase of

common stock. We then pay the applicable withholding taxes in cash.

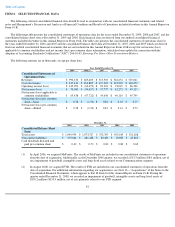

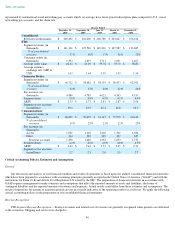

Common stock repurchases during the quarter ended December 31, 2009 were as follows (in thousands, except per share amounts):

40

Period

Total Number of

Shares Purchased

Average Price

Paid per Share

Total Number of

Shares Purchased as

Part of a Publicly

Announced Program

Maximum Approximate

Dollar Value that

May Yet be Purchased

Under the Program

November 2009

199

$

8.15

—

$

60,782