Classmates.com 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

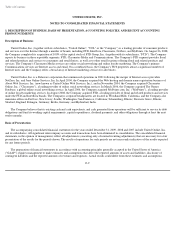

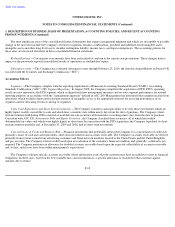

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

the receivable to the amount that is expected to be collected. These specific allowances are re-

evaluated and adjusted as additional information is

received that impacts the amount of the allowance. Also, an allowance is established for all customers based on the aging of the receivables. If

circumstances change (i.e., higher than expected defaults or an unexpected material adverse change in a customer's ability to meet its financial

obligations), the estimates of the recoverability of amounts due to the Company are adjusted.

At December 31, 2009 and 2008, the Company's cash and cash equivalents were maintained primarily with major financial institutions and

brokerage firms in the United States and the United Kingdom. Deposits with these institutions and firms generally exceed the amount of

insurance provided on such deposits.

Property and Equipment —Property and equipment are stated at historical cost less accumulated depreciation and amortization.

Depreciation is computed using the straight-line method over the estimated useful lives of the assets, which is generally two to three years for

computer software and equipment, three to seven years for furniture and fixtures, twenty-five to forty years for buildings, and five to forty years

for building improvements. Leasehold improvements, which are included in furniture and fixtures, are amortized using the straight-line method

over the shorter of the lease term or up to ten years. Upon the sale or retirement of property or equipment, the cost and related accumulated

depreciation or amortization is removed from the Company's consolidated financial statements with the resulting gain or loss reflected in the

Company's results of operations. Repairs and maintenance costs are expensed as incurred.

Derivative Instruments —The Company accounts for derivative instruments in accordance with ASC 815, Derivatives and Hedging . The

Company maintains an interest rate cap associated with interest rate fluctuations on certain of its credit facilities, however, the interest rate cap

does not currently qualify for hedge accounting treatment. In addition, the Company periodically uses foreign exchange contracts to partially

offset the economic effect of fluctuations in currency exchange rates.

Derivatives are recognized on the balance sheet at fair value. Changes in the fair value of derivatives that qualify as cash flow hedges are

recorded in accumulated other comprehensive income (loss) and are subsequently reclassified into earnings when the underlying transactions

occur. Cash flows from hedging activities are classified in the consolidated statements of cash flows under the same category as the cash flows

from the hedged item.

The Company formally assesses, at inception and on an ongoing basis, whether the derivatives that are used in hedging transactions are

highly effective in offsetting changes in the cash flows of hedged items. If it is determined that a derivative is not highly effective as a hedge, or

that it ceased to be a highly effective hedge or if a forecasted hedge is no longer probable to occur, gains or losses on the derivative are reported

in earnings.

Fair Value of Financial Instruments —In accordance with ASC 820, Fair Value Measurements and Disclosures , the Company maximizes

the use of observable inputs and minimizes the use of unobservable inputs when developing fair value measurements. When available, the

Company uses quoted market prices to measure fair value. If market prices are not available, fair value measurement is based upon models that

use primarily market-based or independently-sourced market parameters. If market observable inputs for model-based valuation techniques are

not available, the Company will be

F-11